Over 650,000 models of staked Ethereum, valued at roughly $1.6 billion, have been redeemed final week—the most important quantity of redemption for the reason that Shanghai Improve was accomplished final yr.

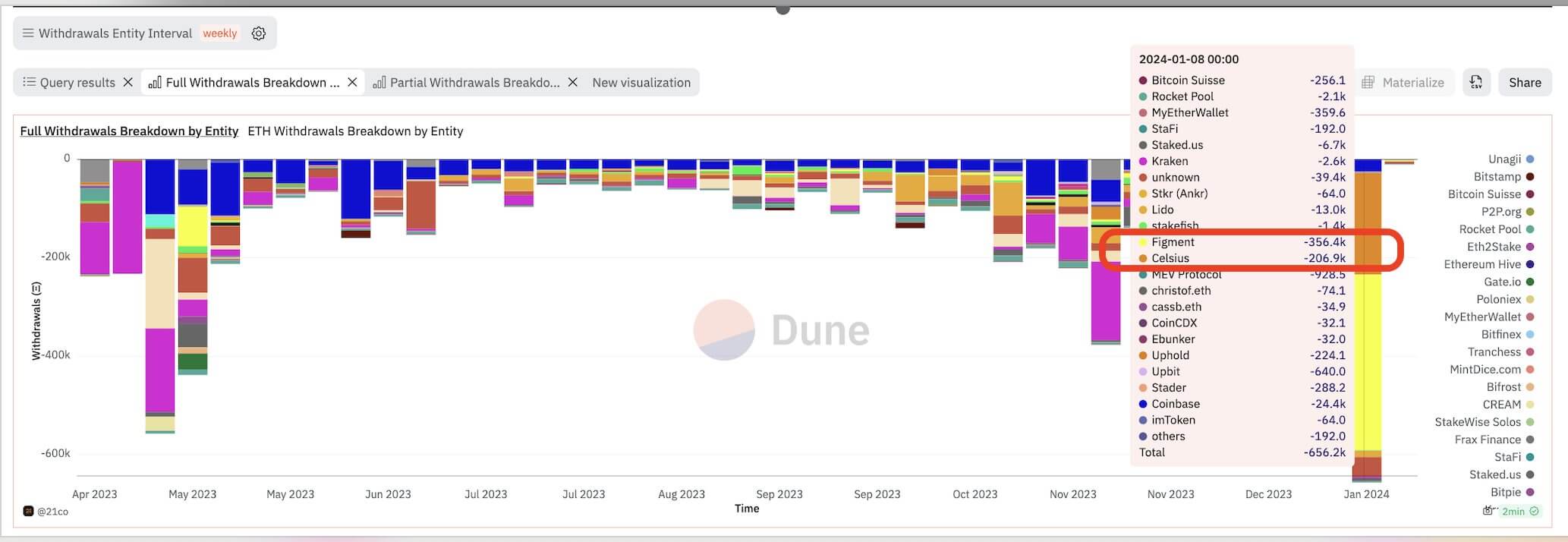

A Dune Analytics dashboard shared by Tom Wan, an analyst at 21 Shares, confirmed that the bankrupt crypto lender Celsius and staking service supplier Figment have been the first contributors to this substantial redemption surge. Collectively, they orchestrated withdrawals totaling 563,300 staked ETH, constituting a powerful 85% of the whole redemptions in the course of the reporting interval.

starcrypto highlighted these companies’ position in pushing Ethereum’s validator exits to a report excessive of over 16,000 validators on Jan. 5. On the time, the 2 companies made up roughly 75% of the whole withdrawals within the queue as they deliberate to take away greater than 550,000 staked Ethereum.

Celsius beforehand revealed plans to unstake 206,300 ETH, price round $470 million, as a part of efforts for its chapter course of. The failed lender mentioned the withdrawals can be used to facilitate the distribution of belongings to its collectors.

Alternatively, Figment was additionally making substantial withdrawals of over 350,000 staked ETH on its purchasers’ behalf.

Following these substantial withdrawals, the whole quantity of staked Ethereum now sits at 28.9 million, based on Nansen’s Ethereum Shanghai (Shapella) Improve dashboard.

ETH’s worth unaffected

The staked Ethereum withdrawal exercise didn’t negatively affect ETH’s worth efficiency in the course of the previous week, because the digital asset’s worth rose by round 12% to a peak of $2700, its highest worth since Might 2022.

Recommendations that the U.S. Securities and Change Fee might approve a spot Ethereum exchange-traded fund (ETF) following comparable approvals granted to Bitcoin ETFs have contributed to this upward worth motion.

Larry Fink, the CEO of asset administration agency BlackRock, additional fueled the optimism when he mentioned he noticed “worth in having an Ethereum ETF” throughout an interview with CNBC.

Information from Polymarket reveals that round 55% of bets on the platform anticipate an Ethereum ETF approval by the top of Might.