- On-chain knowledge exhibits that BTC might witness excessive liquidations between the $42,000 and $46,000 worth marks.

- BTC’s worth has fallen by virtually 10% post-ETF approval.

- There was a decline in BTC demand since 12 January.

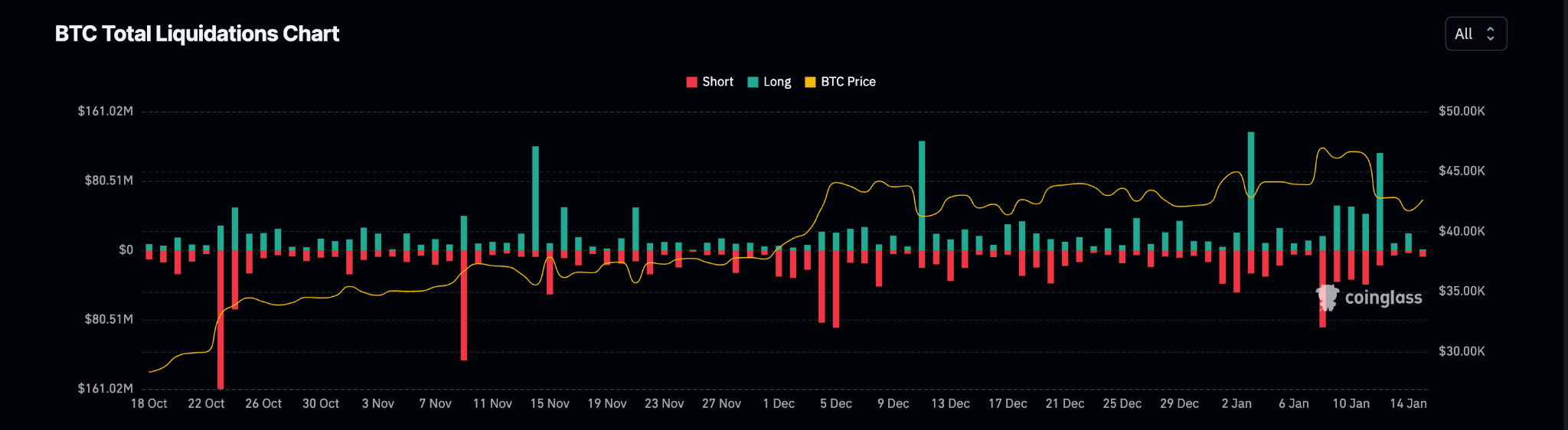

Bitcoin liquidation heatmap assessed on a 3-day chart revealed that the coin’s market is liable to excessive liquidations between the $42,000 and $46,000 worth ranges.

Liquidations happen when merchants’ leveraged positions are compelled to shut as a result of the value of BTC strikes in opposition to them.

Based on knowledge from Coinglass, the BTC market recorded a excessive lengthy liquidation of $112 million on 12 January, marking its second-highest lengthy liquidation quantity because the yr started.

This coincided with the 7% worth decline recorded on the identical day, in keeping with knowledge from CoinMarketCap.

What’s Subsequent for BTC?

At press time, the main crypto asset exchanged arms at $42,658. Whereas many anticipated a surge above $50,000 post-ETF approval, BTC’s worth has plummeted by virtually 10% since then.

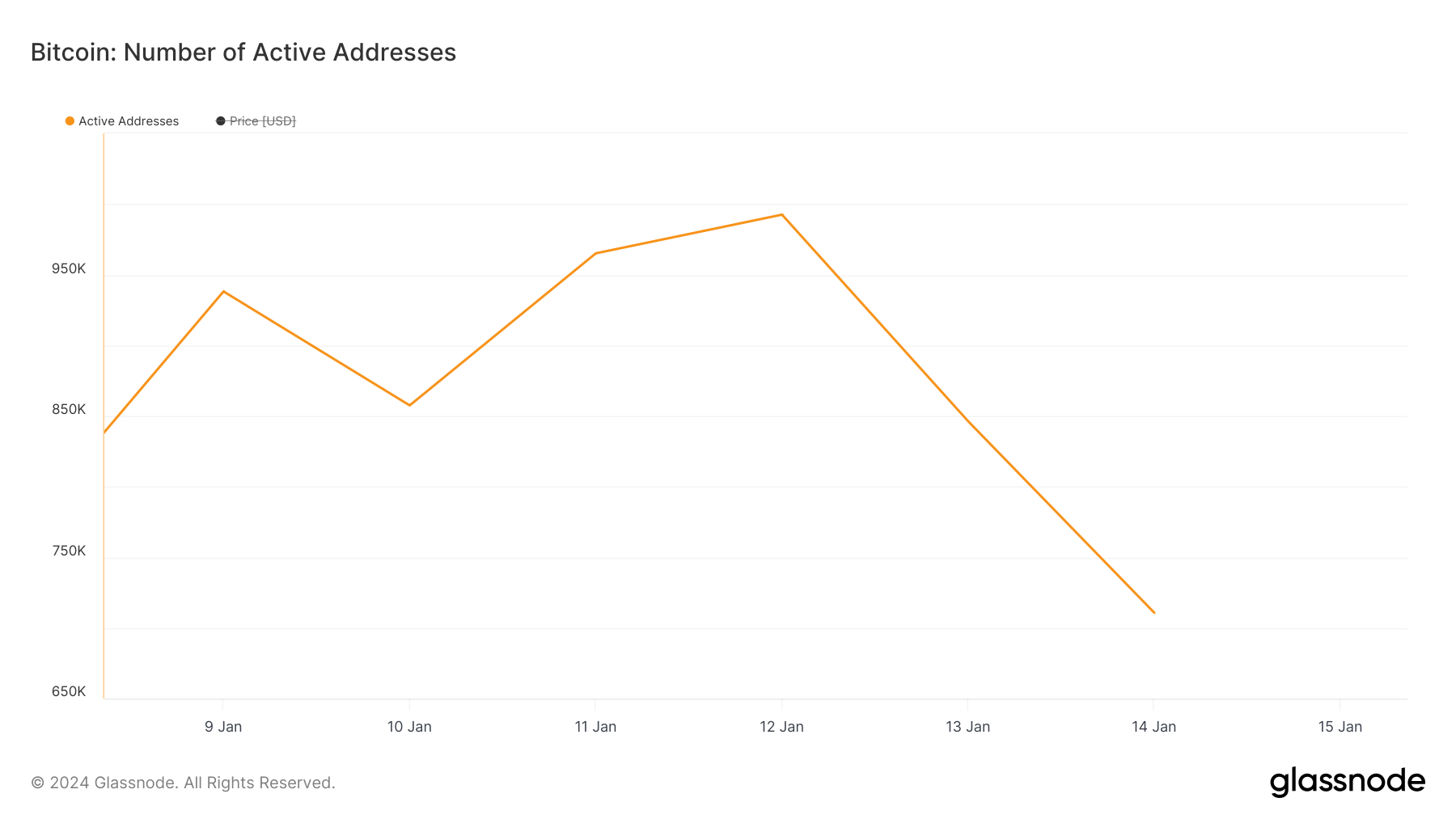

Each day demand for BTC peaked on 12 January and has since dwindled. On-chain knowledge retrieved from Glassnode confirmed that the each day rely of distinctive addresses concerned in BTC transactions recorded a excessive of 992,491 on 12 January and has since fallen by 28%.

As of 14 January, solely 710,706 distinctive addresses have been energetic on the BTC community both as a sender or receiver.

A take a look at BTC’s worth actions on a each day chart revealed that the autumn in demand for the coin coincided with a bearish crossover of its MACD line with its pattern line. On 12 January, the MACD line crossed beneath the pattern line to sign the re-entry of the bears into the market.

Signifying an increase in coin sell-offs, BTC’s Relative Energy Index (RSI) rested beneath the middle line at press time. The momentum indicator returned a worth of 46.66, suggesting that promoting stress exceeded coin accumulation.

Additional, since 12 January, market volatility has surged. The hole between the higher and decrease bands of BTC’s Bollinger Bands (BB) indicator has since widened progressively.

When an asset sees a rise within the hole between the higher and decrease bands of its BB indicator, it exhibits that its worth is liable to extreme fluctuations.

Disclaimer: The data introduced on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any type. Coin Version just isn’t liable for any losses incurred because of the utilization of content material, merchandise, or providers talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.