Analyzing the value of cryptocurrencies on Coinbase, particularly in contrast with different international exchanges, is important for understanding its impression on international market developments. Though the U.S. market might not at all times lead when it comes to buying and selling quantity or liquidity, the pricing on Coinbase usually units a development that resonates throughout the worldwide cryptocurrency market, underscoring the significance of monitoring and analyzing its worth actions.

Coinbase’s predominantly retail investor base makes it a really helpful gauge of retail sentiment within the U.S. Being a regulated trade within the U.S., Coinbase’s pricing can also be considerably influenced by regulatory developments, which is why worth volatility on the trade could be a proxy for political or regulatory occasions within the nation.

The time period ‘premium’ refers back to the worth distinction of an asset throughout totally different markets or exchanges. For cryptocurrencies, a premium on Coinbase implies that the value of a cryptocurrency, on this case Bitcoin, is greater on Coinbase in comparison with one other trade resembling Binance. This premium or premium hole is quantified by subtracting the value of Bitcoin on one other trade from the value on Coinbase. A extra comparative method includes calculating the proportion distinction or the premium index, which offers a clearer view of the premium in relation to the market.

The actions of the premium are crucial in understanding market situations. An growing premium on Coinbase can counsel a surge in shopping for exercise on the platform, probably as a consequence of an inflow of retail traders, or it may very well be indicative of decrease liquidity on Coinbase in comparison with different exchanges. Geographic elements, resembling regulatory information or fiat foreign money fluctuations affecting Coinbase’s predominantly U.S. consumer base, may additionally contribute to an elevated premium. Conversely, a lowering premium might signify a rise in promote orders on Coinbase, doubtlessly by retail traders, or an enchancment in liquidity or aggressive pricing from different exchanges. It may additionally point out market arbitrage, the place merchants purchase on different exchanges and promote on Coinbase, thus narrowing the value hole.

Analyzing these premium actions might help gauge market sentiment and conduct. For instance, a constant premium may counsel sturdy retail confidence amongst Coinbase customers, whereas a diminishing premium may mirror a bearish sentiment or a shift towards promoting. These actions are sometimes interpreted as main indicators of market developments and arbitrage alternatives.

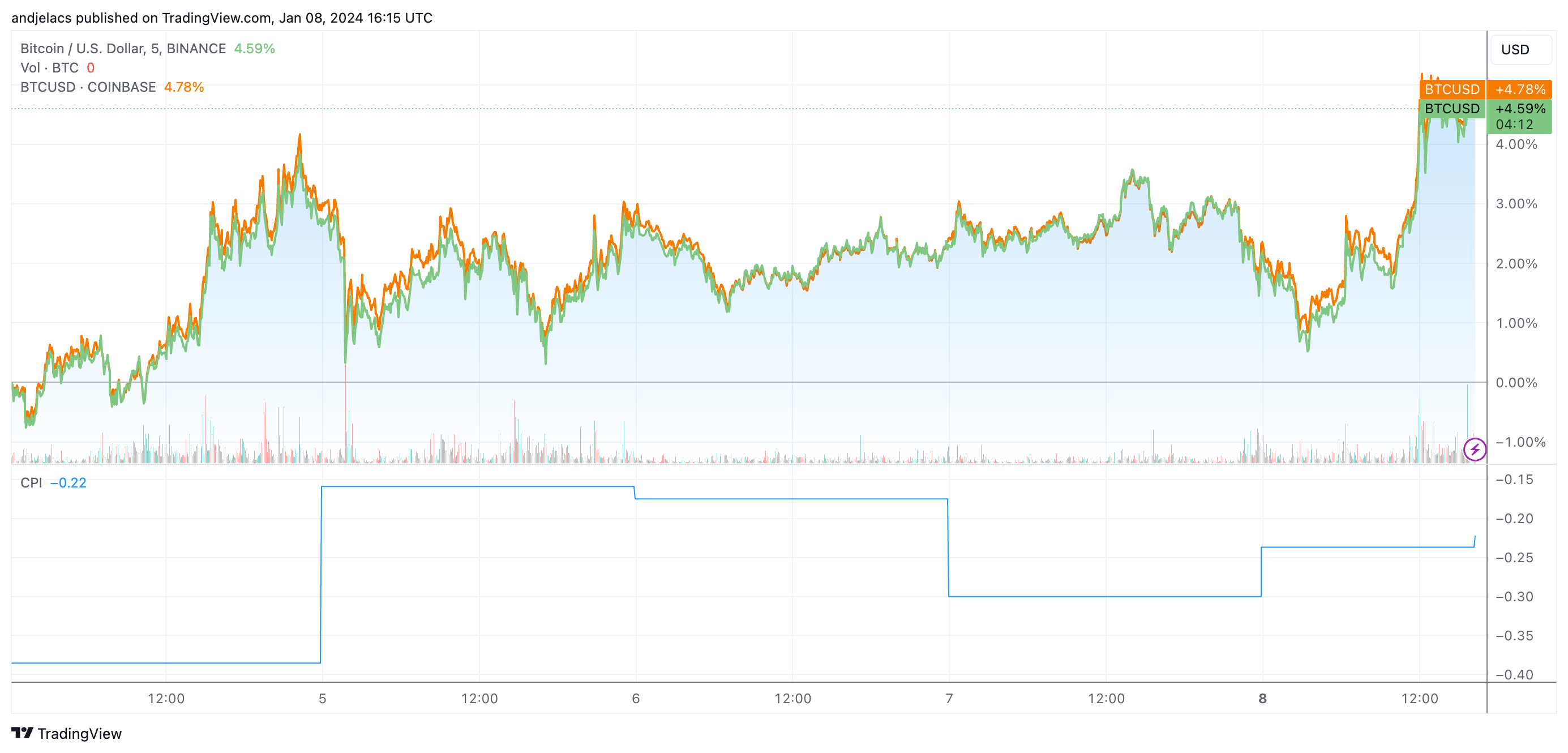

Analyzing Bitcoin’s worth motion on Coinbase and Binance reveals that BTC/USD posted a 5-day enhance of 4.78% on Coinbase and 4.59% on Binance on Jan. 8. The marginally greater enhance on Coinbase in comparison with Binance suggests a barely stronger shopping for strain coming from Coinbase customers. This distinction, although refined, may point out heightened expectations amongst U.S. traders (Coinbase’s major consumer base) concerning the potential approval of the spot Bitcoin ETF this week.

The Coinbase premium has been detrimental all through the final quarter and has remained detrimental into 2024 as nicely. The detrimental premium values point out that Bitcoin is buying and selling at a barely lower cost on Coinbase in comparison with Binance. That is uncommon given the overall expectation of a optimistic premium on U.S.-based exchanges as a consequence of regulatory compliance and investor profile. Nonetheless, a better have a look at the premium development reveals a notable lower, with the premium shifting from -0.37 to -0.22 over a day and a half. This implies the value hole between the exchanges is closing, almost definitely as a consequence of a rising shopping for curiosity on Coibase or lowered promoting strain in comparison with Binance.

The general enhance within the worth of Bitcoin on each exchanges is probably going reflecting market optimism and speculative curiosity, significantly as a result of SEC’s upcoming determination on the spot Bitcoin ETF. A optimistic determination is probably going perceived as a legitimizing issue for Bitcoin, because the market expects it to extend institutional participation.

The gradual lower within the detrimental premium means that Coinbase’s costs are slowly aligning extra intently with Binance’s. This might imply that U.S. traders are cautiously optimistic, shopping for extra Bitcoin in anticipation however not as aggressively as worldwide markets (probably as a consequence of regulatory considerations). It may additionally imply that there’s a discount in promoting strain on Coinbase, probably as a consequence of holders ready for the result of the SEC determination.

If the ETF will get authorised, there is likely to be a sudden shift on this development, doubtlessly triggering a surge in shopping for on Coinbase and resulting in a optimistic premium. Conversely, a rejection may widen the detrimental premium as a consequence of a possible sell-off by disenchanted traders.

The put up The Coinbase premium is growing forward of the ETF appeared first on StarCrypto.