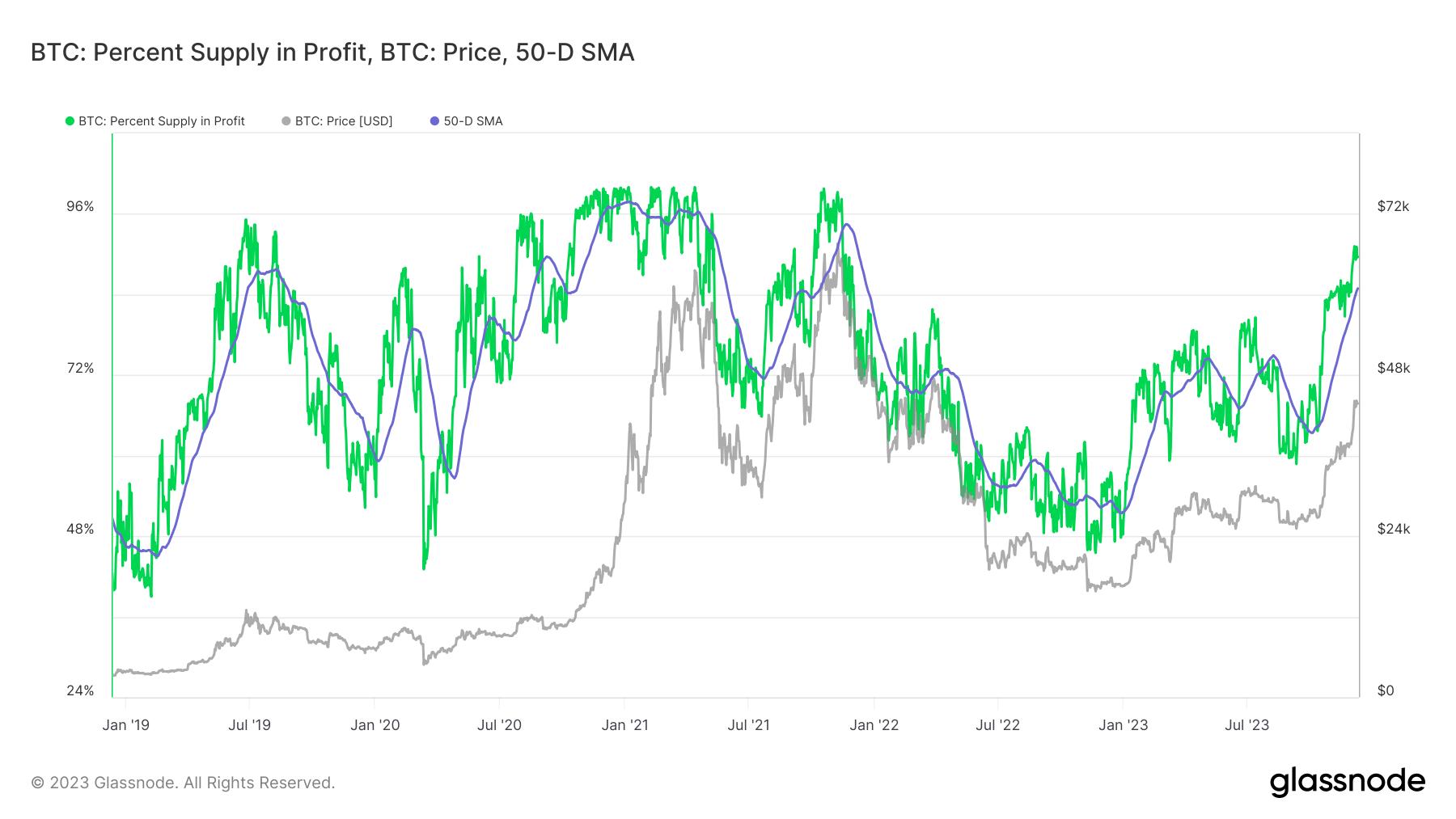

Monitoring the proportion of Bitcoin’s provide in revenue gives essential insights into market developments and potential actions. This metric calculates the proportion of current Bitcoins at the moment held at a worth larger than their buy worth. Its significance lies in offering a snapshot of total market profitability, revealing whether or not most holders are in a state of achieve or loss. Spikes on this metric usually correlate with market optimism, whereas drops can point out rising strain to promote, usually previous market downturns.

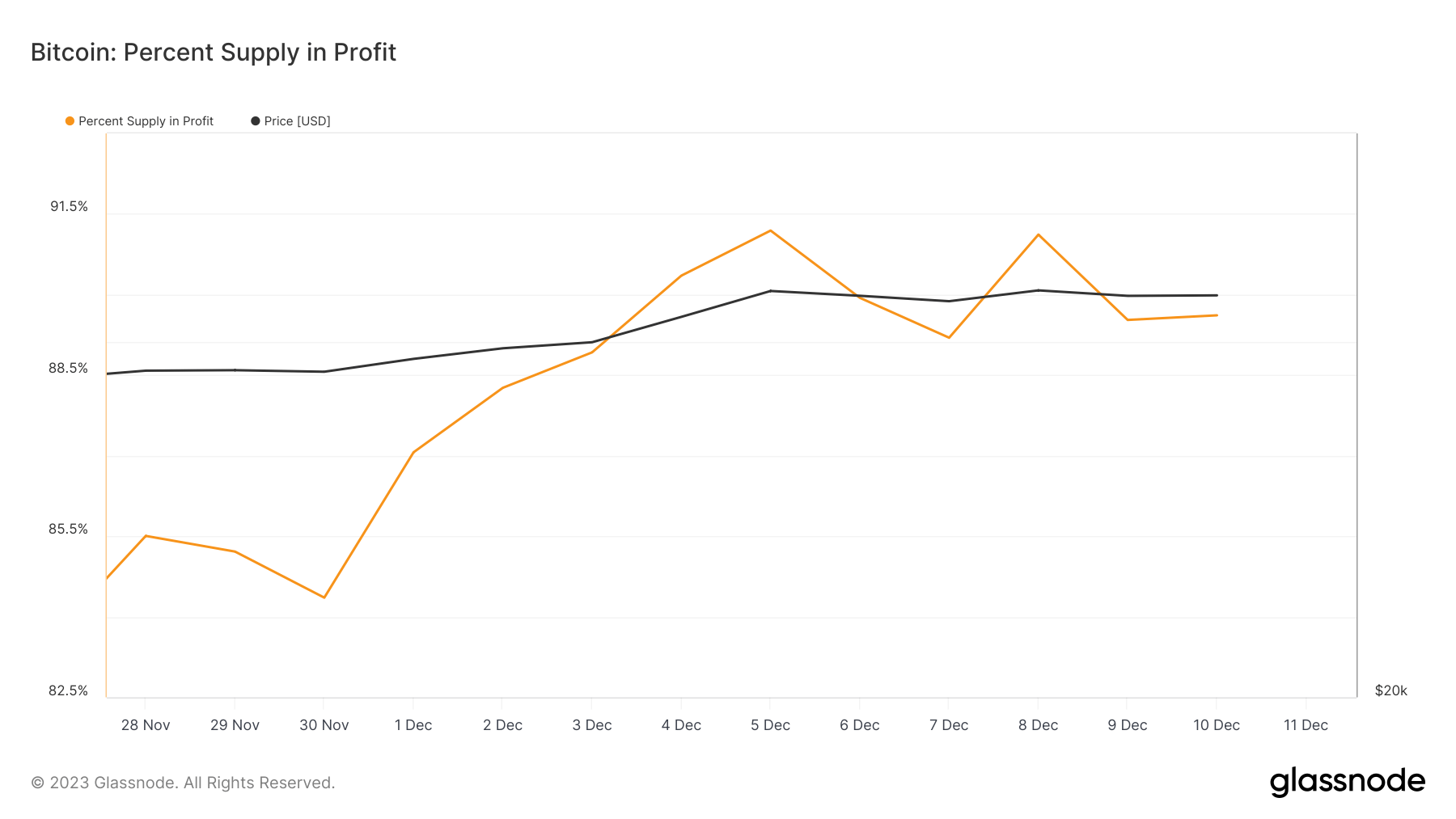

On Dec. 8, 2023, a vital market milestone was achieved as Bitcoin’s provide in revenue exceeded 91.1%, with its worth surging over $44,000. This marked a momentous section of market prosperity unseen since early November 2021. Such a excessive share of Bitcoin in revenue usually alerts a widespread bullish sentiment, as most traders maintain belongings at a worth exceeding their preliminary funding.

Nonetheless, this peak was adopted by a swift correction over the weekend, with Bitcoin’s worth retreating beneath $42,000. This shift resulted within the provide in revenue dwindling to 89.6%, illustrating a considerable profit-taking occasion out there. This discount means that merchants, probably anticipating a extra dramatic decline, have been eager to safe their good points. Such habits usually signifies a market poised at a crucial juncture, with traders cautious of a possible fall beneath pivotal psychological ranges like $40,000.

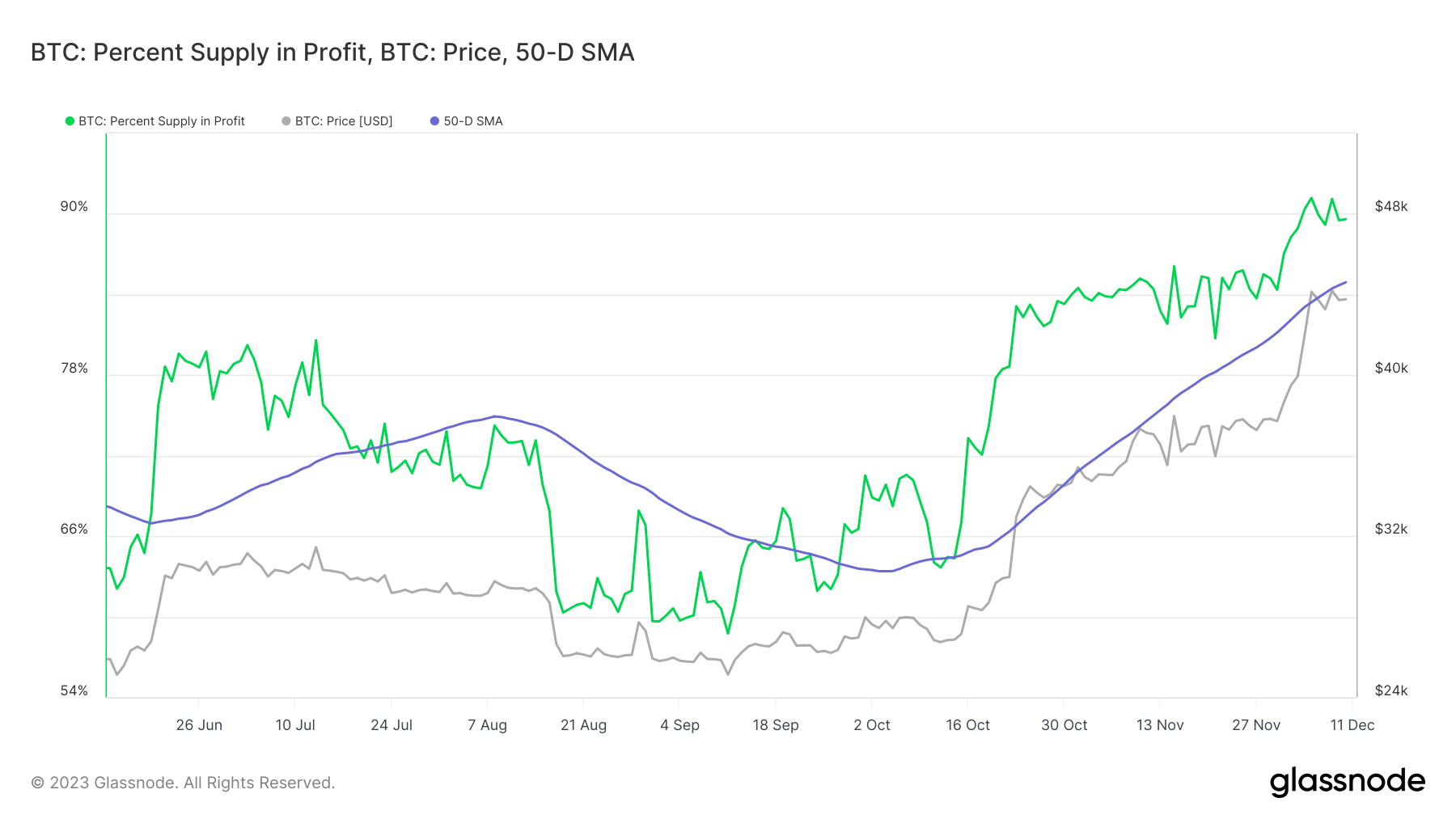

Whereas uncooked knowledge on Bitcoin’s provide in revenue offers instant insights, it might probably usually be deceptive as a consequence of its susceptibility to day by day market fluctuations. To garner a extra correct and long-term perspective, analyzing the 50-day transferring common (MA) of this metric is extra instructive. The 50-day MA smooths out short-term volatility, providing a clearer image of underlying market developments. When the proportion of Bitcoin’s provide in revenue constantly hovers above this common, it usually displays a bullish market sentiment. Conversely, persistently low figures beneath the MA can trace at bearish developments.

Since early October, the 50-day MA for Bitcoin’s provide in revenue has witnessed a marked enhance. It rebounded from a low of 63.3% in early October to 84.91% by Dec. 11, after a decline from 74.9% in early August. Notably, the availability in revenue has remained above its 50-day MA since Oct. 14, underscoring a sustained bullish outlook amongst traders.

This persistent elevation above the 50-day MA is a robust indicator of market confidence. It means that the overarching sentiment stays constructive regardless of short-term corrections and volatility. Traders are seemingly unfazed by non permanent downturns, sustaining their holdings in anticipation of future good points.

The submit Bitcoin’s provide in revenue exhibits bullish sentiment regardless of volatility appeared first on StarCrypto.