Bitcoin’s market capitalization has eclipsed that of Tesla, the electrical automotive large led by Elon Musk, fueled by its current rally close to $37,000 throughout the early hours of Nov. 9.

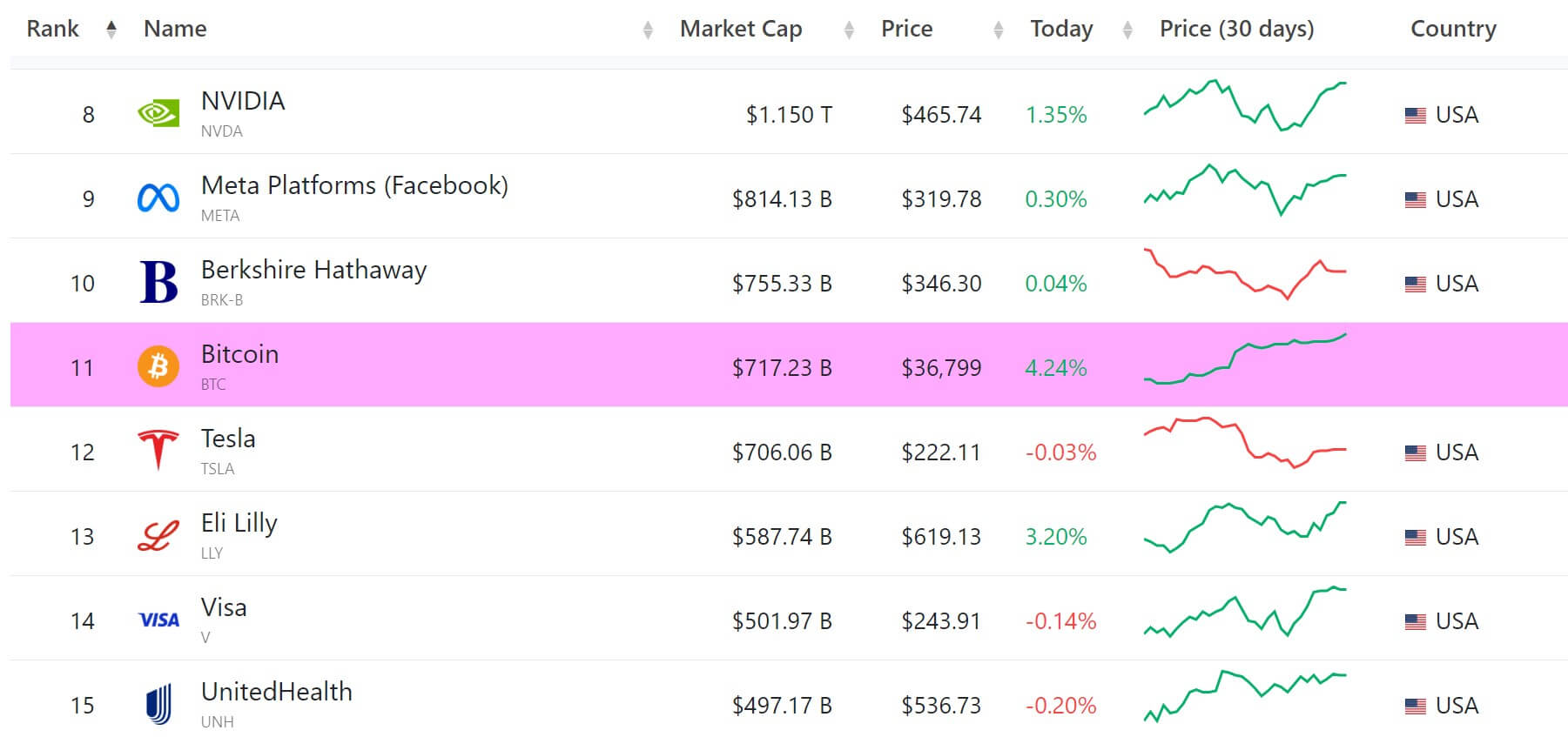

As of press time, BTC’s market cap stands at $717.23 billion, surpassing Tesla’s $706.06 billion by $11 billion, in accordance with knowledge from CompaniesMarketCap.

BTC elevated by greater than 4% over the past 24 hours, including $28 billion to its market cap.

This achievement elevates Bitcoin to the eleventh spot among the many world’s largest property by market cap, surpassing outstanding entities resembling pharmaceutical large Eli Lilly and monetary fee chief Visa.

However, it nonetheless lags just a few billion {dollars} behind Warren Buffet’s Berkshire Hathaway, which presently ranks because the tenth largest firm by market capitalization.

BTC eyes $37k

Bitcoin’s worth has grown by greater than 120% on the year-to-date metrics, in accordance with Tradingview knowledge. Over the past 24 hours, BTC’s value recorded notable progress, rallying to a contemporary 18-month excessive close to $37,000 earlier than retracing to its present ranges of $36,568.

Consequently, crypto merchants who held brief positions in BTC misplaced greater than $65 million throughout the reporting interval, in accordance with a earlier StarCrypto evaluation.

ETF approval window

In the meantime, BTC’s value efficiency mirrors the rising optimism across the doable approval of a spot Bitcoin exchange-traded fund (ETF) product by the U.S. Securities and Change Fee (SEC).

StarCrypto reported that the SEC has an 8-day window opening beginning Nov. 9 to approve the quite a few spot BTC ETF functions earlier than it.

Bloomberg ETF analyst James Seyffart identified that the monetary regulator has its first alternative to permit all 12 filers to launch for the primary time because it did not contest its loss towards crypto funding agency Grayscale. He added:

“This window for all 12 ends by 11/17. However theoretically, SEC may decide on the primary 9 on this checklist at any level from now till Jan 10, 2024.”