- Polkadot Treasury spending surges over 60% in 2023 in comparison with final yr.

- $21 million (3.9 million DOT) spent in varied classes in 2023, up from $13 million (1.7 million DOT) in 2022.

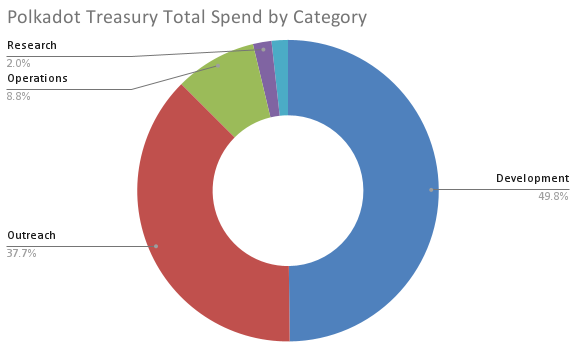

- Spending was categorized into Growth (50%), Outreach (38%), Operations (9%), Analysis (2%), and Different (1%) in 2023.

Blockchain platform Polkadot has simply launched its newest Treasury Report for the third quarter of 2023. As of October 18, it has been revealed that the Polkadot Treasury’s spending has seen over a 60% surge in 2023 in comparison with the earlier yr.

The yr, though not but concluded, has already witnessed a exceptional uptick in spending. A complete of $21 million (equal to three.9 million DOT) has been spent in varied classes, in comparison with $13 million (1.7 million DOT) in 2022.

The report categorizes spending into 4 predominant areas: Growth, Operations, Outreach, and Analysis, with some extra prices labeled as “Different.” It covers all expenditures throughout the Polkadot ecosystem till October 18, 2023.

Polkadot Treasury Whole Spend in 2023 by Class (Supply: Polkadot)

As illustrated within the chart, Growth takes up a good portion, amounting to 50% of the full bills. Outreach constitutes 38%, and Operations accounts for 9%. Analysis took 2%, and different miscellaneous prices make up the remaining of the expenditure.

In comparison with 2022, each the Growth and Operations classes have skilled a doubling in expenditure. Outreach spending has seen almost a ten% improve, whereas Analysis has witnessed a exceptional 65% rise.

The Polkadot Treasury report additional signifies that the relative distribution of spending throughout these classes stays comparatively secure in comparison with the earlier yr.

Disclaimer: The knowledge offered on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any sort. Coin Version is just not accountable for any losses incurred on account of the utilization of content material, merchandise, or providers talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.