- SNX faces sturdy bearish momentum at $1.85, whereas RPL struggles to breach $18.60 resistance.

- Crypto markets shiver as US inflation rises, triggering SNX, RPL, MNT, TON, and GMX value drops.

- MNT and TON skilled important drops, signaling bearish sentiment regardless of the buying and selling exercise.

Buyers’ enthusiasm has been dampened by the discharge of US inflation statistics displaying a 0.5% improve within the Producer Worth Index (PPI) for September. On account of the cloud of uncertainty that this unfavorable information has forged over the crypto market.

The settlement amongst main establishments that the US will enter a recession in 2023 provides to the priority. Whereas inflation and rate of interest tendencies have endured, investor temper has remained cautious as a result of prospect of additional price rises, as mirrored within the equities market’s combined efficiency.

Considerably, the worth of SNX, RPL, MNT, TON, and GMX tokens has been dropping, matching the broader decline within the cryptocurrency market. This drop in cryptocurrency costs has alarmed traders who had beforehand loved large features within the business.

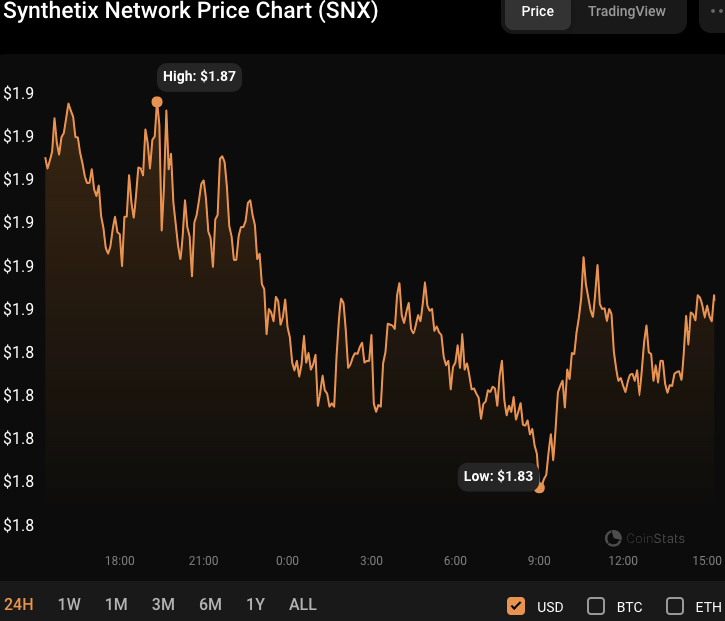

SNX/USD Technical Evaluation

The adverse hand within the Synthetix (SNX) market has been sturdy within the current 24 hours, driving the value down from an intraday excessive of $1.88 to a low of $1.83. Reflecting the sturdy bear hand, at press time, SNX was priced at $1.85, down 1.30% from its intra-day excessive.

SNX/USD 24-hour value chart (supply: CoinStats)

Consequently, SNX’s market worth dropped to $501,011,983, and its 24-hour buying and selling quantity dipped to $17,530,781. If adverse momentum breaks by means of the $1.83 help stage, SNX would possibly fall decrease and check the subsequent help stage at $1.80.

Nevertheless, if patrons are available in and push the value over $1.88, it would indicate a possible turnaround and a constructive view for SNX within the rapid time period.

RPL/USD Technical Evaluation

Regardless of a bullish begin to the day, Rocket Pool (RPL) was unable to interrupt by means of the $18.60 barrier, with bears retracing value to a low of $17.92 earlier than closing at $17.93. The failure to interrupt above the resistance stage indicators that the market is below promoting strain.

RPL/USD 24-hour value chart (supply: CoinStats)

If RPL continues to come across promoting strain at $17.92, it might fall decrease towards the subsequent help stage of $17.50. Nevertheless, if patrons get better management and push the value above $18.60, it would herald a constructive turnaround and indicate a potential short-term upward rise for RPL.

Through the adverse rally, RPL’s market cap and 24-hour buying and selling quantity declined by 2.68% and 9.95%, respectively, to $354,372,046 and $2,305,532.

MNT/USD Technical Evaluation

Mantle (MNT) has additionally dropped sharply within the final 24 hours, with bears successfully reducing the value from a excessive of $0.3468 to a 30-day low of $0.3327. Bears have been nonetheless in command of the market on the time of publication, with the MNT value valued at $0.3291, representing a 4.885% lower.

MNT/USD 24-hour value chart (supply: CoinStats)

MNT’s market capitalization and 24-hour buying and selling quantity fell 4.83% and 5.83%, respectively, to $1,026,763,575 and $29,507,666 because of the adversarial temper. If bears break by means of the $0.3327 help stage, the subsequent stage to search for is round $0.3200, which can result in further adverse strain on the MNT value.

GMX/USD Technical Evaluation

The GMX market started the day with constructive momentum, however resistance on the intra-day excessive of $35.46 proved too sturdy to beat. In consequence, bears took management of the market and drove the value all the way down to a 7-day low of $34.49, the place help was created. At press time, GMX had fallen from its intraday excessive by 0.57% to $35.21.

GMX/USD 24-hour value chart (supply: CoinStats)

Nevertheless, GMX’s market capitalization declined by 4.61% to $320,021,901, regardless of an increase in 24-hour buying and selling quantity of 12.22% to $8,798,236, indicating higher buying and selling exercise. This improve demonstrates that, regardless of the value fall, the GMX market nonetheless has important demand and liquidity.

TON/USD Technical Evaluation

Toncoin (TON) costs have likewise retraced, sliding from a excessive of $2.00 to a 7-day low of $1.92. This value drop could be ascribed to profit-taking by traders after the earlier sturdy surge. Nevertheless, the commerce quantity for TON has stayed comparatively constant, displaying that the cryptocurrency stays common at its current value stage.

Whereas TON’s market capitalization declined by 1.965 % to $6,705,912,507, its 24-hour buying and selling quantity elevated by 78.56% to $22,092,727. Nevertheless, bearish affect was nonetheless current at press time, as indicated by the 1.98% drop to $1.95.

TON/USD 24-hour value chart (supply: CoinStats)

If adverse momentum breaks by means of the $1.92 help stage, the subsequent possible stage of help for TON could be round $1.85.

This stage has traditionally served as a stable help throughout prior market declines, and if hit, it might draw patrons trying to find an entry alternative. Nevertheless, if the bearish strain persists, TON would possibly fall decrease in direction of the $1.80 stage, the place extra help could also be discovered.

In conclusion, crypto markets face headwinds amid financial uncertainties, however potential turnarounds in SNX, RPL, MNT, GMX, and TON current alternatives for savvy traders.

Disclaimer: The views, opinions, and data shared on this value prediction are revealed in good religion. Readers should do their analysis and due diligence. Any motion taken by the reader is strictly at their very own danger. Coin Version and its associates won’t be responsible for direct or oblique harm or loss.

Common Disclaimer: The knowledge offered on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any variety. Coin Version isn’t accountable for any losses incurred because of the utilization of content material, merchandise, or companies talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.