- FUD brought on XRP to lose about 3.78% of its worth however it has held on tight to $0.48.

- Bulls haven’t been in a position to take full management however XRP might rise above $0.50 quickly.

- With growing volatility, merchants are optimistic in regards to the XRP value motion.

Since its spectacular run to $0.88, Ripple (XRP) has been hovering between $0.45 and the psychological $0.5 zone. One motive for that is the tightening liquidity, attributable to the Worry, Uncertainty, and Doubt (FUD) at present out there.

One other floor for XRP’s consolidation and decline might be the unpredictability round Ripple’s lawsuit with the U.S. SEC. XRP has misplaced 3.78% of its worth within the final seven days. Nonetheless, the token ranked because the sixth most precious asset by way of market cap, and was in a position to maintain on to $0.48 at press time.

Indicators Be a part of Arms to Increase XRP

In accordance with the XRP/USD 4-hour chart, bulls have been in a position to push XRP upwards to $0.46 on September 11. Whereas the market shouldn’t be but out of bears’ attain, hitting the $0.48 ceiling has served as a large increase for XRP.

Moreover, the Relative Energy Index (RSI) has additionally exited the 18.11 level it was on September 11. On the time of writing, the RSI was 44.93. The rise is an indication of a major rise in shopping for strain.

If the RSI continues to rise and possibly crosses the 50.00 mid-point, then XRP may have an opportunity at shifting above the $0.50 psychological stage. However to attain this, bulls should be certain that bears don’t neutralize their presence out there.

One other optimistic outlook XRP lovers can look to is the Bollinger Bands (BB). For some time, XRP’s volatility was very low because the bands contracted. Nonetheless, as of this writing, the BB indicated a excessive stage of volatility.

Because of this there might be important value fluctuations both to the upside or draw back. If XRP’s patrons outweigh sellers persistently, then, a push within the course of $0.60 shouldn’t be written off.

Merchants’ Goal Is Decrease than $0.60

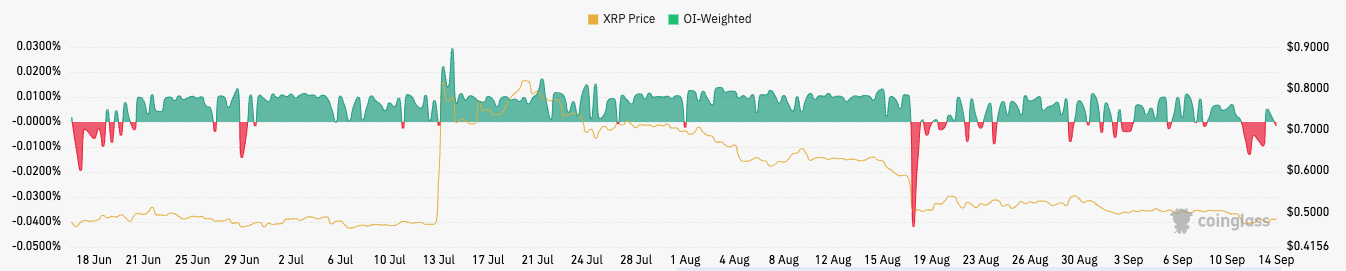

In the meantime, merchants appeared to have modified their sentiment in direction of the token, as indicated by the funding charge. In accordance with Coinglass, XRP’s funding charge had moved into the optimistic area. For context, funding charges are funds made between longs and shorts to maintain their contracts open.

A damaging funding charge means that merchants are bearish on the worth motion. Conversely, a optimistic funding charge means merchants are bullish on the worth motion. However from Coinglass’ information, merchants’ goal of the subsequent XRP value is nicely beneath $0.60

In conclusion, XRP’s subsequent course may nicely depend upon market sentiment, and shopping for or promoting strain. Nonetheless, merchants shouldn’t ignore the exterior elements like developments surrounding Ripple’s case with the SEC. Presently, XRP has an opportunity of rising above $0.50.

Disclaimer: The views, opinions, and knowledge shared on this value prediction are revealed in good religion. Readers should do their analysis and due diligence. Any motion taken by the reader is strictly at their very own threat.