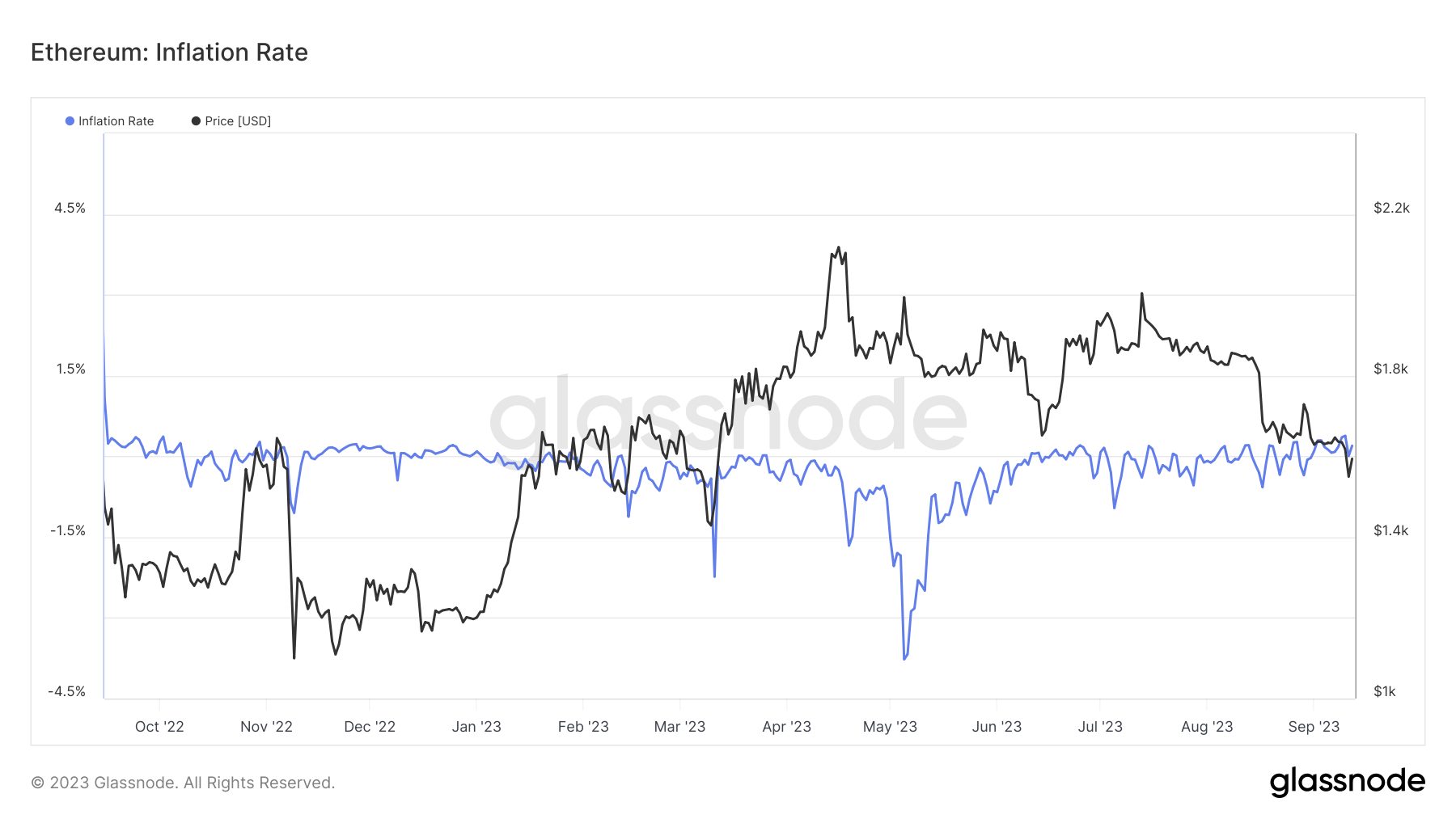

Since Ethereum’s Merge on Sep. 15, 2022, the crypto business has been abuzz with discussions about its provide dynamics. The Merge marked the community’s transition from a Proof-of-Work (PoW) consensus mechanism to a Proof-of-Stake (PoS), considerably altering its issuance fee. This transition, coupled with the implementation of EIP-1559 in August 2021, has led to oscillations in Ethereum’s provide between inflationary and deflationary states.

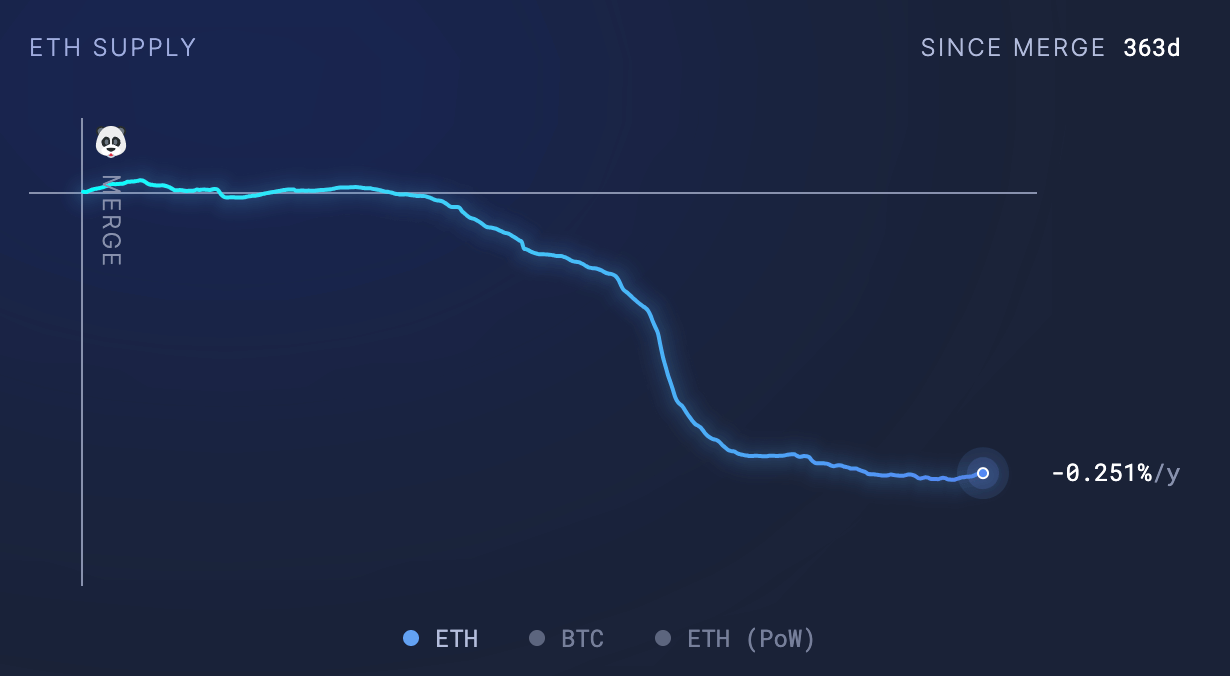

Within the instant aftermath of the Merge, Ethereum’s provide exhibited deflationary traits. This deflationary pattern was primarily pushed by the burning mechanism launched by EIP-1559, which removes a portion of the transaction charges from circulation.

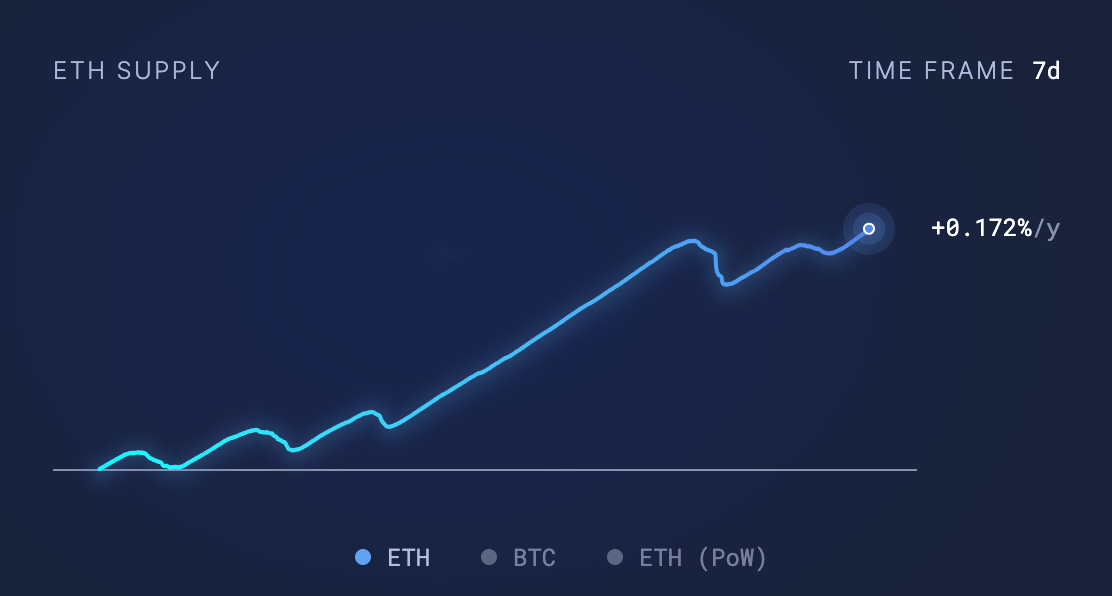

Nevertheless, observing the provision over shorter time frames exhibits inflationary tendencies, with an inflation fee of +0.172% noticed over a 7-day interval.

Over a 30-day interval, this inflation stands at +0.013%.

But, when zooming out to think about the broader image because the Merge, Ethereum’s provide stays deflationary, lowering by -0.251%.

The oscillation between inflationary and deflationary states has profound implications for Ethereum and its stakeholders.

A deflationary asset, by nature, tends to extend in worth over time on account of its growing shortage. This might improve Ethereum’s worth proposition as a retailer of worth just like Bitcoin, probably attracting extra buyers. Nevertheless, extended deflation may additionally result in hoarding behaviors, probably decreasing Ethereum’s velocity and utility as a medium of trade.

On the flip facet, a persistently inflationary provide ensures that validators within the PoS system are rewarded for his or her efforts in securing the community. This steady issuance of recent ETH can present financial safety and sustainability for the Ethereum community.

Nevertheless, there’s a potential dilution of worth for current ETH holders and a doable lower within the buying energy of ETH. Steady inflation may exert downward strain on the value of ETH. If the speed of recent ETH issuance outpaces demand, the value may lower.

For the broader cryptocurrency market, Ethereum’s provide dynamics post-merge function a case examine in balancing community safety with financial incentives. Ethereum’s oscillations spotlight the challenges and complexities of managing a cryptocurrency’s financial coverage in a decentralized ecosystem.

Additional, they will make it arduous for buyers and customers to foretell its financial future, probably resulting in decreased demand for the risky asset.

Ethereum’s provide dynamics because the Merge underscores the intricate interaction between technical upgrades, financial incentives, and market forces.

The put up Analyzing Ethereum’s inflationary and deflationary provide tendencies appeared first on starcrypto.