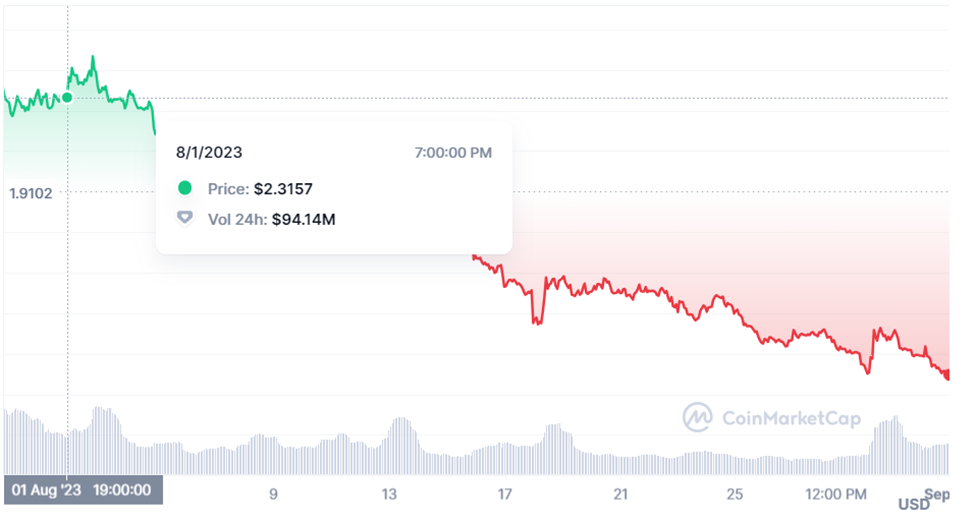

- Worldcoin’s value has misplaced over 52% of its worth in beneath a month.

- Latest information reveals that over 98.52% of WLD traders are in losses.

- Furthermore, privateness considerations have worsened WLD’s bearish development.

Worldcoin (WLD), the privacy-focused venture that took the crypto trade by storm, has been in a major bearish development. Though the bearish development is just not distinctive to WLD because it impacts the general market, information reveals that WLD’s case is far worse.

Particularly, in line with CoinMarketCap information, WLD traded at $2.4 precisely a month in the past. For the reason that coin now trades at $1.11, it implies WLD has misplaced over 52% of its worth in beneath a month.

Moreover, a crypto fanatic just lately shared information from a good information analytic agency that paints a grimmer image of WLD traders. Particularly, Twitter (X) consumer Slim Daddy quoted from IntoTheBlock that 98.52% of WLD traders are in losses. This information signifies that lower than 2% of WLD holders have been in cash because the July hype.

This declining curiosity in WLD, which started the primary week of August, began after Kenya halted Worldcoin resulting from privateness and safety worries. The federal government suspended Worldcoin’s operations, citing the venture’s controversial biometric scans of Kenyan residents.

As Coin Version reported, Kenya is just not the one nation that took a stance towards Worldcoin. The report talked about that a number of authorities companies are investigating the legality and goal of accumulating biometric information from residents to safeguard privateness and safety.

In the meantime, it’s a totally different ball recreation for Argentina. Worldcoin just lately claimed that its venture obtained a hotter reception from Argentinians. It talked about that just about 10,000 individuals willingly signed up for Worldcoin Orb verification in someday. Nevertheless, the craze round Worldcoin in Argentina barely impacted WLD positively.