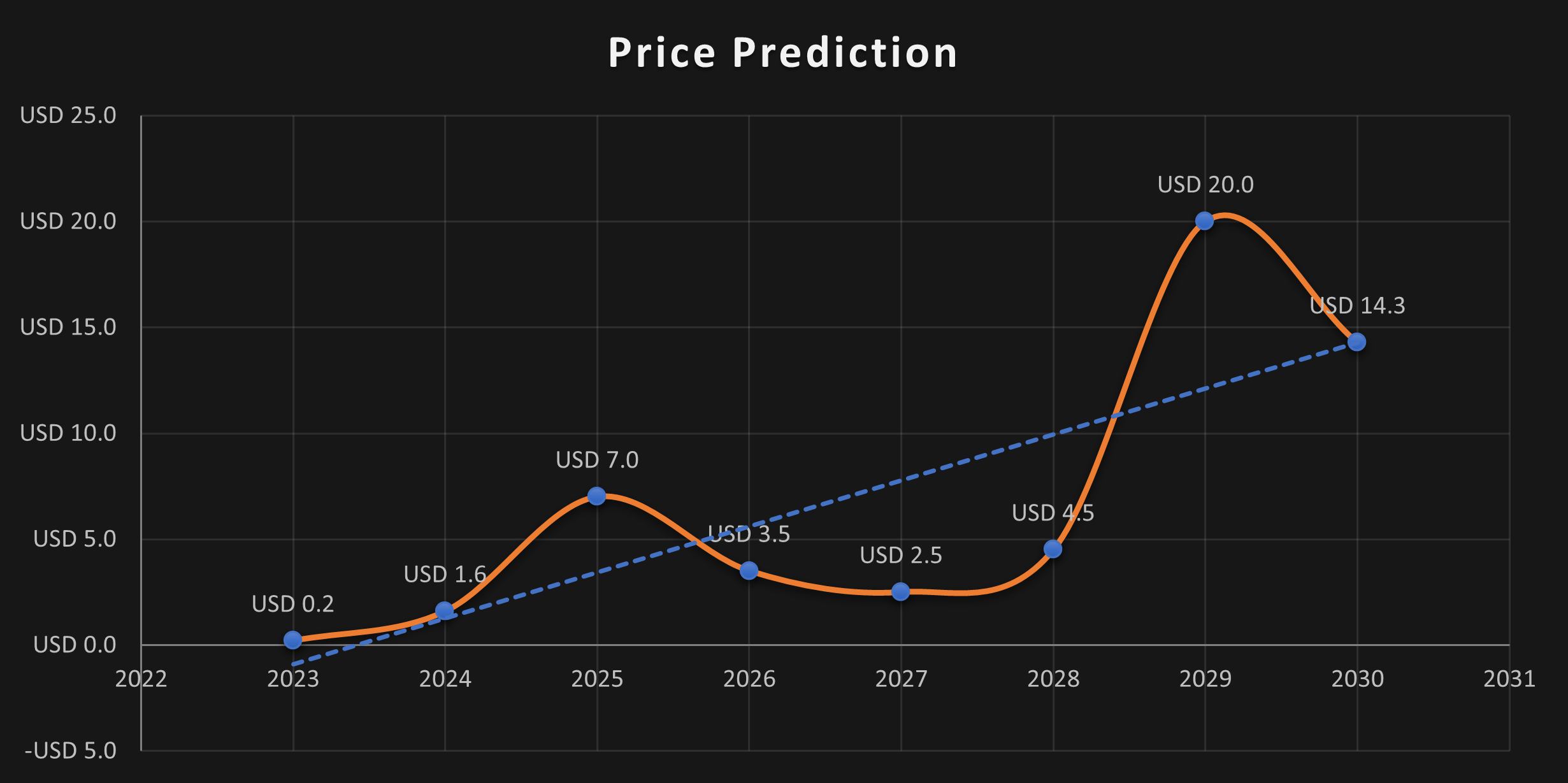

- Bullish SEI value prediction ranges from $0.2 to $20.

- Evaluation means that the SEI value may attain above $0.2.

- The SEI bearish market value prediction for 2023 is $0.1420.

What’s SEI?

Constructed upon a layer-1 blockchain structure utilizing the Cosmos SDK framework, the SEI community is tailor-made particularly for high-frequency buying and selling functions. The Twin Turbo Consensus allows the community to course of transactions at decrease transaction prices and at industry-leading throughput.

The corporate behind the SEI community, SEI Labs introduced the launch of their mainnet on August 15, 2023, and only a day after that they registered SEI on a number of exchanges. Though many DExs undergo the trade trilemma of sustaining scalability, decentralization, and capital effectivity, SEI might preserve stability by leveraging the Cosmos SDK and Tendermint Core.

SEI Market Overview

HTTP Request Failed… Error: file_get_contents(https://api.coingecko.com/api/v3/cash/sei-network): Didn’t open stream: HTTP request failed! HTTP/1.1 429 Too Many Requests

SEI Present Market Standing

The utmost provide of SEI is unavailable, whereas its circulating provide is 1,800,000,000 SEI, in accordance with CoinMarketCap. On the time of writing, SEI is buying and selling at $0.148 representing 24 hours lower of 0.66%. The buying and selling quantity of SEI previously 24 hours is $109,135,728 which represents a 0.12% enhance.

Some prime cryptocurrency exchanges for buying and selling are Binance, Bybit, Huobi, and Kraken.

Now that you realize about SEI and its present market standing, we will talk about the value evaluation of SEI for 2023.

SEI Value Evaluation – Bollinger Bands

The Bollinger bands are a kind of value envelope developed by John Bollinger. It provides a spread with an higher and decrease restrict for the value to fluctuate. The Bollinger bands work on the precept of normal deviation and interval (time).

The higher band as proven within the chart is calculated by including two instances the usual deviation to the Easy Shifting Common whereas the decrease band is calculated by subtracting two instances the usual deviation from the Easy Shifting Common.

At the moment, it could possibly be famous that the bands are titling upwards. Nevertheless, SEI after testing the higher band is now on its manner down handed the SMA. There nonetheless appears to be some promoting stress though it’s decreasing. Therefore, there’s a excessive chance that SEI won’t attain the decrease band for help earlier than retracing and rising

The above chart exhibits that SEI is presently in a downtrend. It is because SEI touched the higher band after which has been shifting diagonally contained in the band. Furthermore, the Bollinger band width percentile indicator exhibits a price of 51% and the road appears to be positioned parallel with horizontal, therefore, we would not see a giant distinction within the bandwidth sooner or later.

SEI Value Evaluation- Relative Energy Index

The Relative Energy Index is an indicator that’s used to measure whether or not the value of a cryptocurrency is over or undervalued. For this objective, it has two excessive areas referred to as the overbought and oversold areas.

When the RSI reads a price (>70) then the crypto is overbought, which implies that on account of extra shopping for the demand has elevated as such the value has additionally elevated. Then again, when it’s oversold, many are promoting, as such, its value is undervalued.

At the moment, the RSI reads a price of fifty.67. Since this worth is neither within the overbought nor oversold area, we might take into account the pattern to be sturdy. Nevertheless, the RSI is under the Sign line, this denotes that SEI is bearish. If the consumers hold coming into the market on the proper time for SEI, the RSI will routinely go up. Nevertheless, the query lies as to when will the consumers enter the market and save SEI.

SEI Value Evaluation- Shifting Common

The exponential shifting common just isn’t a lot totally different from the easy shifting common. The EMA provides extra weightage to the current costs whereas the SMA equally distributes the values to the frequency. Therefore, when the EMA is plotted within the graph it provides a tough thought about how the cryptocurrency has been performing previously.

Furthermore, the 50-Day EMA is taken into account the short-term size, and the 200-Day EMA is taken into account the long-term. Each time the 50-day EMA crosses the 200-dat EMA from under it’s known as a Golden cross, whereas if it crosses from above, then it’s a loss of life cross.

Trying on the chart above, we might see that each Shifting averages have been falling. This exhibits that SEI costs have been falling within the latest previous. Furthermore, the costs being under the EMA provides one other indication of the bearish market that SEI has been via. When scrutinizing the autumn, there have been makes an attempt SEI tried to cease the autumn and tried shifting upwards however the bears have been sturdy.

We might see {that a} Golden Cross occur lately for SEI. This led to a spike in costs for SEI. Nevertheless, following the Golden Cross, SEI appears to have fallen again to sq. one. At the moment, it’s testing the 50-day EMA however the growing purchase stress appears to burden it and take it down.

SEI Value Prediction 2023-2030 Overview

| Yr | Minimal Value | Common Value | Most Value |

| 2023 | $0.09 | $0.2 | $0.5 |

| 2024 | $1 | $1.6 | $2.5 |

| 2025 | $4 | $7 | $9.5 |

| 2026 | $2.5 | $3.5 | $5.5 |

| 2027 | $1 | $2.5 | $3.5 |

| 2028 | $3 | $4.5 | $7 |

| 2029 | $15 | $20 | $30 |

| 2030 | $10 | $14.3 | $25 |

| 2040 | $25 | $37.8 | $45 |

| 2050 | $55 | $61.6 | $70 |

SEI Value Prediction 2023

When trying on the chart above, we might see that SEI was fluctuating contained in the falling wedge. Nevertheless, now it appears to have damaged out of the wedge. As such, if SEI follows the traditional breakout from a wedge we might count on it to rise and $0.1830. Nevertheless, since resistance 1 just isn’t sturdy, SEI could be even in a position to break it and attain $0.2.

On the flip facet, since SEI is at its backside there appears to be no help for it from the place it’s. As such if SEI is to crash sooner or later, the one help left for it’s at $0.1420. If not it could fall to $0.06 help, the value when SEI was initiated.

SEI Value Prediction – Resistance and Help Ranges

When trying on the chart above we might see that SEI has been crashing since its inception, apart from the surge earlier than August 16. From August SEI fell under the 1:1 Gann fan line and eventually, its crash got here to a stall solely after reaching $0.1487. And, thereafter SEI has been shifting sideways at instances touching the 0.786 fib retracement. At the moment, SEI is testing the two:1 Gann line and due to this fact it’d break it. Nevertheless, within the occasion that SEI fails to interrupt the two:1 Gann line, then it’d slide alongside it.

SEI Value Prediction 2024

There will probably be Bitcoin halving in 2024, and therefore we must always count on a optimistic pattern out there on account of consumer sentiments and the hunt by traders to build up extra of the coin. Nevertheless, the yr of BTC halving didn’t yield the utmost for SEI primarily based on the earlier halving. Therefore, we might count on SEI to commerce at a value, not under $1.6 by the tip of 2024.

SEI Value Prediction 2025

SEI could expertise the after-effects of the Bitcoin halving and is predicted to commerce a lot greater than its 2024 value. Many commerce analysts speculate that BTC halving might create a big impact on the crypto market. Furthermore, much like many altcoins, SEI will proceed to rise in 2025 forming new resistance ranges. It’s anticipated that SEI would commerce past the $7 stage.

SEI Value Prediction 2026

It’s anticipated that after a protracted interval of bull run, the bears would come into energy and begin negatively impacting the cryptocurrencies. Throughout this bearish sentiment, SEI might tumble into its help areas. Throughout this era of value correction, SEI might lose momentum and be manner under its 2025 value. As such it could possibly be buying and selling at $3.5 by 2026.

SEI Value Prediction 2027

Naturally, merchants count on a bullish market sentiment after the crypto {industry} was affected negatively by the bears’ claw. Furthermore, the build-up to the following Bitcoin halving in 2028 might evoke pleasure in merchants. Nevertheless, there’ll be a dip in value earlier than the joy will probably be reciprocated in SEI. As such we might count on SEI to commerce at round $2.5 by the tip of 2027.

SEI Value Prediction 2028

Because the crypto group’s hope will probably be re-ignited trying ahead to Bitcoin halving like many altcoins, SEI could reciprocate its previous habits throughout the BTC halving. Therefore, SEI could be buying and selling at $4.5 after experiencing a substantial surge by the tip of 2028.

SEI Value Prediction 2029

2029 is predicted to be one other bull run as a result of aftermath of the BTC halving. Nevertheless, merchants speculate that the crypto market would steadily change into secure by this yr. In tandem with the secure market sentiment, SEI could possibly be buying and selling at $20 by the tip of 2029.

SEI Value Prediction 2030

After witnessing a bullish run out there, SEI and plenty of altcoins would present indicators of consolidation and may commerce sideways and transfer downwards for a while whereas experiencing minor spikes. Subsequently, by the tip of 2030, SEI could possibly be buying and selling at $14.3.

SEI Value Prediction 2040

The long-term forecast for SEI signifies that this altcoin might attain a brand new all-time excessive(ATH). This may be one of many key moments as HODLERS could count on to promote a few of their tokens on the ATH level.

If they begin promoting then SEI might fall in worth. It’s anticipated that the common value of SEI might attain $37.8 by 2040.

SEI Value Prediction 2050

Since Cryptocurrency will probably be revered and broadly accepted my most individuals throughout the 2050s, we’ll see the plenty imagine extra in it. As such SEI might attain $61.6.

Conclusion

If traders proceed exhibiting their curiosity in SEI and add these tokens to their portfolio, it might proceed to rise. SEI’s bullish value prediction exhibits that it might attain the $0.2 stage.

FAQ

The SEI community is a layer-1 blockchain structure constructed by utilizing the Cosmos SDK framework. It was tailored for high-frequency buying and selling functions.

SEI tokens might be traded on many exchanges like different digital belongings within the crypto world. Binance,Gate.io, Pancakeswap V2, Bitget are presently the most well-liked cryptocurrency exchanges for buying and selling SEI.

SEI has a chance of surpassing its current all-time excessive (ATH) value of $0.2736 in August 2023. Nevertheless, as a result of optimistic sentiments of its traders, this could possibly be reached inside a brief body of time.

SEI is among the few cryptocurrencies that has retained its bullish momentum previously seven days. If this momentum is maintained, SEI may attain $1.7 quickly after its breaks the Resistance 1 stage.

SEI has been probably the most appropriate investments within the crypto area. It has been rising exponentially, therefore, merchants could also be allured to put money into SEI.

SEI has a gift all-time low value of $0.007989.

The utmost provide of SEI is unavailable.

SEI might be saved in a chilly pockets, sizzling pockets, or trade pockets.

SEI is predicted to achieve $1.6 by 2024.

SEI is predicted to achieve $7 by 2025.

SEI is predicted to achieve $3.5 by 2026.

SEI is predicted to achieve $2.5 by 2027.

SEI is predicted to achieve $4.5 by 2028.

SEI is predicted to achieve $20 by 2029.

SEI is predicted to achieve $14.3 by 2030.

SEI is predicted to achieve $37.8 by 2040.

SEI is predicted to achieve $61.6 by 2050.

Disclaimer: The views and opinions, in addition to all the data shared on this value prediction, are revealed in good religion. Readers should do their analysis and due diligence. Any motion taken by the reader is strictly at their very own danger. Coin Version and its associates is not going to be held answerable for any direct or oblique harm or loss.