The present state of Bitcoin’s choices and futures markets is witnessing a notable shift, reflecting a broader transformation within the crypto buying and selling panorama.

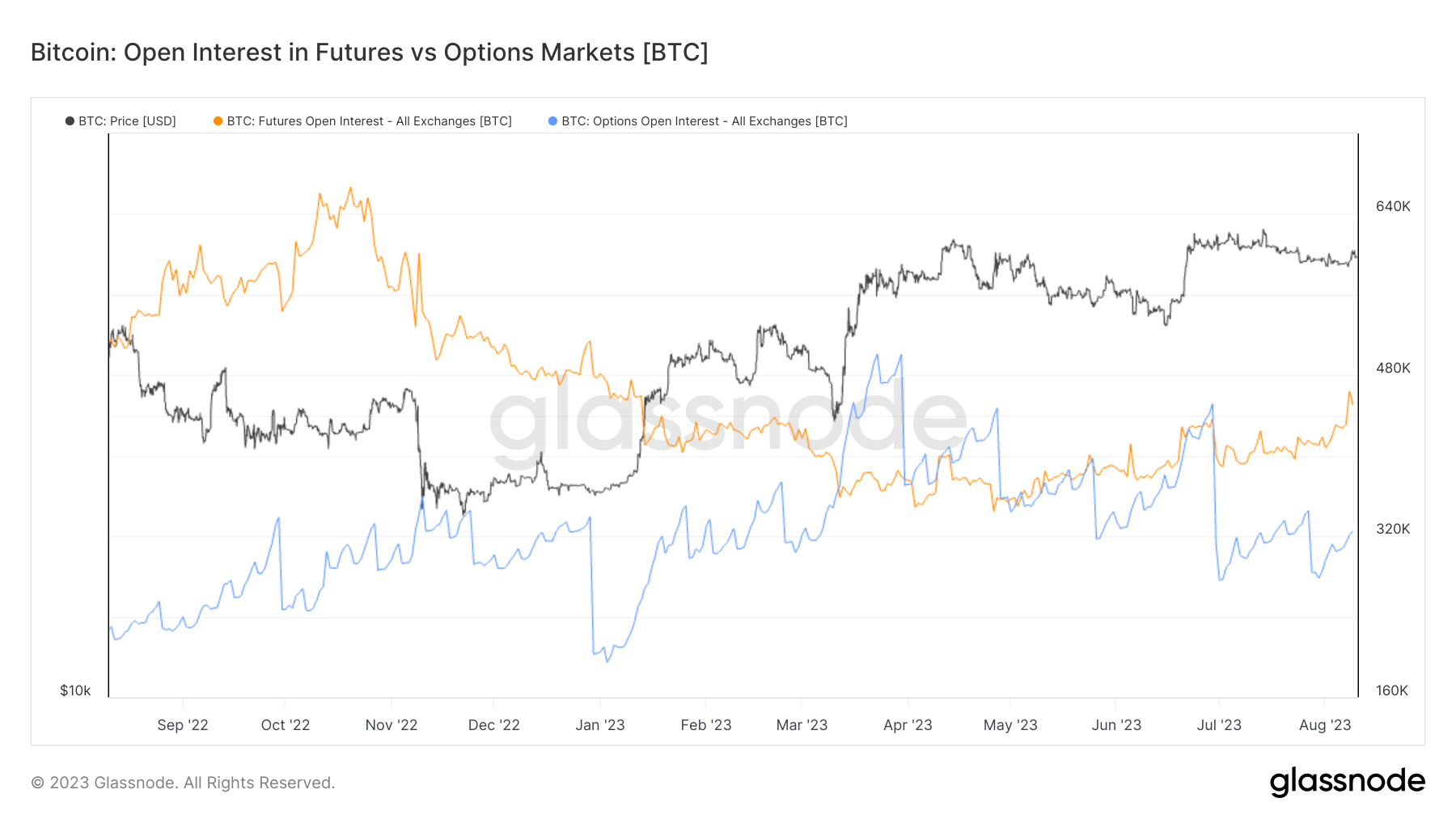

During the last 12 months, Bitcoin choices markets have seen a major uptick in development, with open curiosity greater than doubling. This development in choices buying and selling signifies an elevated curiosity in strategic monetary merchandise that supply flexibility and danger administration capabilities.

Choices now rival futures markets when it comes to open curiosity magnitude, signaling a shift in buying and selling methods and probably an indication of market maturity.

Then again, futures open curiosity has been in regular decline because the collapse of FTX in November 2022.

This decline could also be interpreted as dropping confidence within the futures market, elevating issues about stability and danger administration practices. Nonetheless, 2023 has seen a slight enhance in futures open curiosity, indicating a cautious return of merchants, however the general development stays adverse in comparison with the choices market.

The open curiosity on Bitcoin futures is presently 420,000 BTC, whereas the open curiosity on Bitcoin choices is 312,000 BTC.

The expansion in Bitcoin choices buying and selling displays a extra strategic and risk-averse method to buying and selling Bitcoin. Choices, which give the precise however not the duty to purchase or promote an asset at a selected worth, are favored over futures, which obligate the customer to buy or the vendor to promote the asset at a predetermined future date and worth.

This shift has far-reaching implications for market construction, regulation, and general market conduct. The rise in choices buying and selling might result in totally different worth dynamics, affecting the general volatility of Bitcoin’s worth.

Choices present leverage, which may amplify each good points and losses, attracting extra speculative buying and selling. Whereas this may enhance liquidity, it may additionally enhance short-term volatility as merchants rapidly enter and exit positions.

Nonetheless, it’s vital to notice that choices may also act as a stabilizing drive for the broader crypto market. As choices are sometimes used as a hedging software to guard towards opposed worth actions, they’ll successfully set a ground on potential losses, doubtlessly mitigating sharp declines throughout market downturns.

The shift between futures and choices may additionally change the aggressive panorama of exchanges providing these merchandise. These specializing in choices would possibly see development, whereas futures-centric platforms would possibly face challenges.

The info may additionally replicate modifications in investor conduct, with maybe extra institutional participation in choices as a danger administration software and probably a lower in speculative buying and selling in futures.

The put up The altering panorama of Bitcoin futures and choices markets appeared first on StarCrypto.