- Bullish ANT value prediction ranges from $1.00 to $9.00.

- Evaluation means that the ANT value would possibly attain $8.7.

- The ANT bearish market value prediction for 2023 is $1.55.

Aragon (ANT) Market Overview

| 🪙 Title | Aragon |

| 💱 Image | ant |

| 🏅 Rank | #185 |

| 💲 Worth | $4.14 |

| 📊 Worth Change (1h) | 1.70189 % |

| 📊 Worth Change (24h) | 2.79604 % |

| 📊 Worth Change (7d) | -2.0352 % |

| 💵 Market Cap | $165698151 |

| 📈 All Time Excessive | $14.64 |

| 📉 All Time Low | $0.301888 |

| 💸 Circulating Provide | 40030814.3305 ant |

| 💰 Complete Provide | 43167647.3965 ant |

What’s Aragon (ANT)?

Aragon is a DAO framework that builds instruments for creating, managing, and scaling instruments for everybody to experiment with governance on the velocity of software program. The Aragon Venture is ruled by ANT Holders in a delegated voting DAO. ANT is an ERC-20 token, that’s used to manipulate the Aragon DAO.

Aragon was based in 2016 by Luis Cuende and Jorge Izquierdo. As per the aim of Aragon talked about on a manifesto of Aragon’s web site, it states:

“We consider humankind ought to use expertise as a liberating instrument to unleash all of the goodwill and creativity of our species, quite than as a instrument to enslave and benefit from each other.

Thus, Aragon is a struggle for freedom. Aragon empowers freedom by creating liberating instruments that leverage decentralized applied sciences.”

Analysts’ View on Aragon (ANT)

Bitget a derivatives platform tweeted that ANT was rallying after its Co-founder determined to purchase again 30 million tokens.

Aragon (ANT) Present Market Standing

Aragon has a circulating provide of 40,029,852 ANT cash, whereas its most provide is unavailable in accordance with CoinMarketCap. On the time of writing, ANT is buying and selling at $3.98 representing 24 hours lower of 4.38%. The buying and selling quantity of ANT up to now 24 hours is $8,597,806 which represents a 96.65% improve.

Some prime cryptocurrency exchanges for buying and selling ANT are Binance, OKX, Bitrue, Bybit, and WEEX.

Now that ANT and its present market standing, we will talk about the worth evaluation of ANT for 2023.

Aragon (ANT) Worth Evaluation 2023

At present, Aragon (ANT) ranks 159 on CoinMarketCap. Will ANT’smost latest enhancements, additions, and modifications assist its value go up? First, let’s concentrate on the charts on this article’s ANT value forecast.

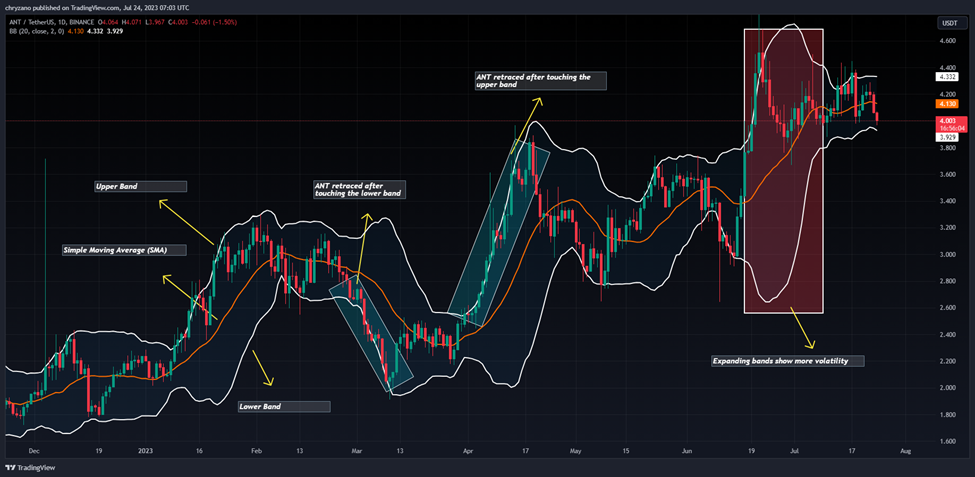

Aragon (ANT) Worth Evaluation – Bollinger Bands

The Bollinger bands are a sort of value envelope developed by John Bollinger. It offers a spread with an higher and decrease restrict for the worth to fluctuate. The Bollinger bands work on the precept of ordinary deviation and interval (time).

The higher band as proven within the chart is calculated by including two instances the usual deviation to the Easy Transferring Common whereas the decrease band is calculated by subtracting two instances the usual deviation from the Easy Transferring Common. When the bands widen, it reveals there’s going to be extra volatility and after they contract, there may be much less volatility.

When Bollinger bands are utilized in a cryptocurrency chart, we might count on the worth of the cryptocurrency to reside inside the higher and decrease bounds of the Bollinger bands 95% of the time. The above thesis is derived from an Empirical regulation.

The sections highlighted by pink rectangles within the chart above present how the bands develop and contract. When the bands widen, we might count on extra volatility, and when the bands contract, it denotes much less volatility. The inexperienced rectangles present how ANT retraced after touching the higher band (overbought) and the decrease band (oversold).

At present, the Bollinger bands are squeezing, therefore, ANT is fluctuating inside a decent area. As ANT is just under the SMA, it may very well be anticipated to succeed in for help from the decrease Bollinger band. Furthermore, the Bolinger band Breakout indicator reads a bearish worth of 0.133 whereas the bullish worth is 23.251, for the reason that bullish worth is larger than the bearish worth, ANT is in a robust bullish pattern.

In the meantime, when having a look on the Bollinger Bandwidth squeeze indicator, we might see that the yellow bars point out when the bandwidth reduces under 20 on the BBW indicator. The pink line bars present the bandwidth lowering to its lowest worth. At present, the Bandwidth is at 9.209 whereas the bottom bandwidth for ANT has been 6.980. Because the BBW indicator is positioned parallel to the horizontal axis, the bandwidth might stay fixed.

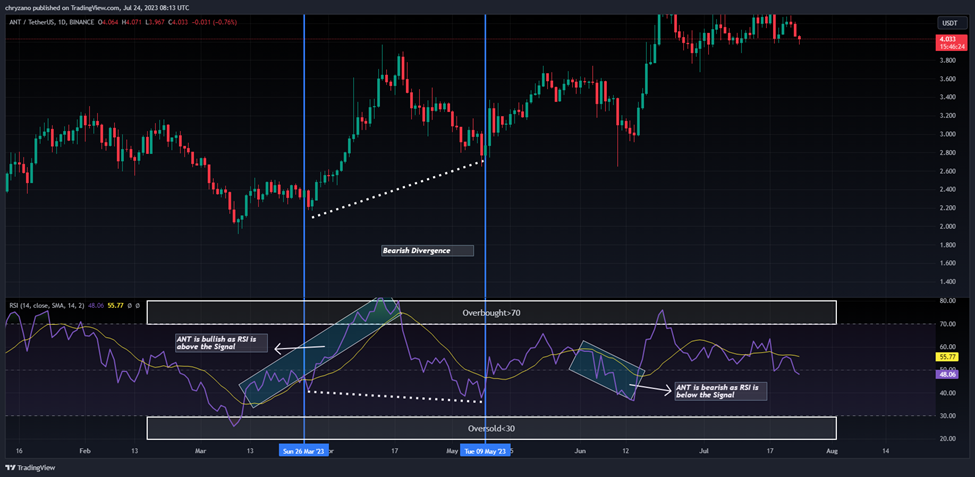

Aragon (ANT) Worth Evaluation – Relative Energy Index

The Relative Energy Index is an indicator that’s used to seek out out whether or not the worth of a safety is overvalued or undervalued. As per its identify, RSI indicators assist decide how the safety is doing at current, relative to its earlier value.

Furthermore, it has a sign line which is a Easy Transferring Common (SMA) that acts as a yardstick or reference to the RSI line. Therefore, each time the RSI line is above the SMA, it’s thought-about bullish; if it’s under the SMA, it’s bearish.

At present, the RSI learn a worth of 48.06 and it’s below the Sign. As such, though the RSI is neither overbought nor oversold, ANT is bearish. It’s because ANT had extra pink candlesticks in comparison with inexperienced candlesticks. Nevertheless, when collected the sum of the inexperienced candlesticks appears to be lower than the sum of the pink candlesticks. As such, ANT is bearish.

Furthermore, the above chart signifies a bearish divergence. That is symbolized by the ANT’s conduct whereby it made larger lows when the RSI made decrease lows.

The above chart reveals the RSI Multi size indicator studying a worth of 43.3. This indicator plots the distinction between the utmost and minimal size as a median. Because the indicator is neither overbought nor oversold, the pattern may very well be thought-about robust. Nevertheless, for the reason that RSI is dealing with downwards, ANT might drop in costs and the RSI might attain 28, which has been the least worth the RSI has fallen within the latest previous.

If the previous is to occur then ANT would possibly search help from the Crossunder Oversold area (Pale Pink). Nevertheless, if the bulls handle to redeem ANT, there it could check the Crossunder overbought stage (yellow line) yet one more time. Nevertheless, if it manages to interrupt above the afore talked about stage, then it could check the Crossover overbought zone.

Aragon (ANT) Worth Evaluation – Transferring Common

The Exponential Transferring averages are fairly much like the straightforward transferring averages (SMA). Nevertheless, the SMA equally distributes down all values whereas the Exponential Transferring Common offers extra weightage to the present costs. Since SMA undermines the weightage of the current value, the EMA is utilized in value actions.

The 200-day MA is taken into account to be the long-term transferring common whereas the 50-day MA is taken into account the short-term transferring common in buying and selling. Based mostly on how these two traces behave, the power of the cryptocurrency or the pattern could be decided on common.

Specifically, when the short-term transferring common (50-day MA) approaches the long-term transferring common (200-day MA) from under and crosses it, we name it a Golden Cross.

Contrastingly, when the short-term transferring common crosses the long-term transferring common from above then, a loss of life cross happens.

Often, when a Golden Cross happens, the costs of the cryptocurrency will shoot up drastically, however when there’s a Loss of life Cross, the costs will crash.

At present, ANT is bullish as it’s above each EMA and in the intervening time it’s in search of help from the 50-day EMA. Nevertheless, primarily based on previous observations, the 50-day EMA hasn’t been a help stage for EMA however the 200-day EMA has been. Therefore, if ANT retains on lowering, it could search the help of the 200-day. We might even see ANT as soon as once more up above the 50-day EMA if it ricochets off of the 200-day EMA.

Aragon (ANT) Worth Evaluation – Elder Pressure Index

Elder Pressure Index is an indicator that was invented by Alexander Elder, who was an entrepreneur. The indicator primarily makes use of two parameters to adjudicate the shopping for and promoting drive and thereby predicts the market pattern. Specifically, it depends on value change and quantity. As such the power of the shopping for drive or promoting drive depends on both the worth change or the amount.

Each time the EFI is larger than zero, or constructive, lets say that the pattern is bullish, as there may be extra shopping for stress. Nevertheless, when the EFI is within the unfavourable zone, lets say that the cryptocurrency is within the unfavourable zone and the promoting stress is extra

The chart above reveals a bearish divergence. It’s because the ANT was making larger lows whereas the EFI was making decrease lows. At present, the EFI reads a worth of -3.043K, and the road is tilting downwards. Therefore, the EFI might additional fall if the patrons don’t come to the rescue.

The Bull-Bear-Energy (BBP) indicator additionally confirms that the bears have the higher hand available in the market. BBP reads a worth of -0.323. Furthermore, the amount has been fairly fixed as per the amount MA. This means that the change in value hasn’t been supported by the amount. Therefore, there may very well be a pattern change.

Aragon (ANT) Worth Prediction 2023-2030 Overview

| 12 months | Minimal Worth | Common Worth | Most Worth |

| 2023 | $7.5 | $8.69 | $10.25 |

| 2024 | $11.75 | $14.411 | $16.75 |

| 2025 | $18.5 | $19.643 | $22.5 |

| 2026 | $7.95 | $9.63 | $12.5 |

| 2027 | $12.00 | $13.447 | $15.5 |

| 2028 | $16.25 | $17 | $18.9 |

| 2029 | $25.5 | $28.746 | $31.25 |

| 2030 | $22.5 | $24.3881 | $27.25 |

| 2040 | $40.15 | $43.95 | $50.5 |

| 2050 | $60 | $65.1395 | $80 |

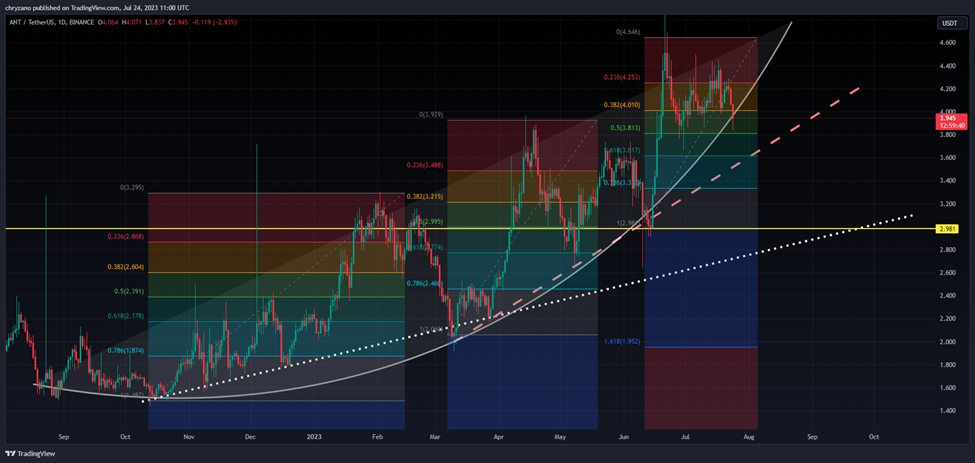

Aragon (ANT) Worth Prediction 2023

Contemplating the chart above, we might see that ANT was on an exponential rise since September 2022. Furthermore, the tangent line constructed on the fringe of the curve reveals the growing gradient of ANT.

When the entire exponential rise is trisected with the Fibonacci retracement instrument, we might delve into the mechanics of every spike. As an illustration, the primary two Fibonacci retracements from the left present ANT in search of help at 0.786 and 0.618 retracement ranges. As such, if ANT is to be dismantled off of its exponential rise, then we might count on to fall to the 0.5 stage.

Nevertheless, within the occasion that ANT the 0.5 stage doesn’t help ANT’s fall, then, we might count on it to succeed in help from the 0.618 stage at Assist 1 ($3.711). That is additionally the area the place the damaged pattern line meets the retracement stage. As such, ANT might comply with the damaged pattern line and rise,

Within the occasion that ANT breaks the pattern of rising alongside the damaged trendline then it could search assist from Assist 2, at $2.916. If help 2 holds ANT, it might be able to rise alongside the dotted line.

Nevertheless, if the exponential rise and each pattern traces are breached, then ANT might search help from Assist 3 ($2.054), Assist 4 ($1.826), and Assist 5 ($1.556).

Within the occasion that the exponential rise is maintained, ANT would possibly check Resistance 1 at $6.032. And with extra energy from the bulls, it would even be capable to check Resistance 2 at $7.108 and perhaps even Resistance 3 at $8.69. These three Resistance ranges may very well be achieved if ANT rises sooner or later. However the query is which rising path will ANT select. Will it select the exponential rise, the damaged pattern line, or the dotted traces? If it chooses the exponential rise, the faster it’s going to rise whereas if it chooses the damaged or the dotted pattern line, it will likely be slower with the latter being the slowest.

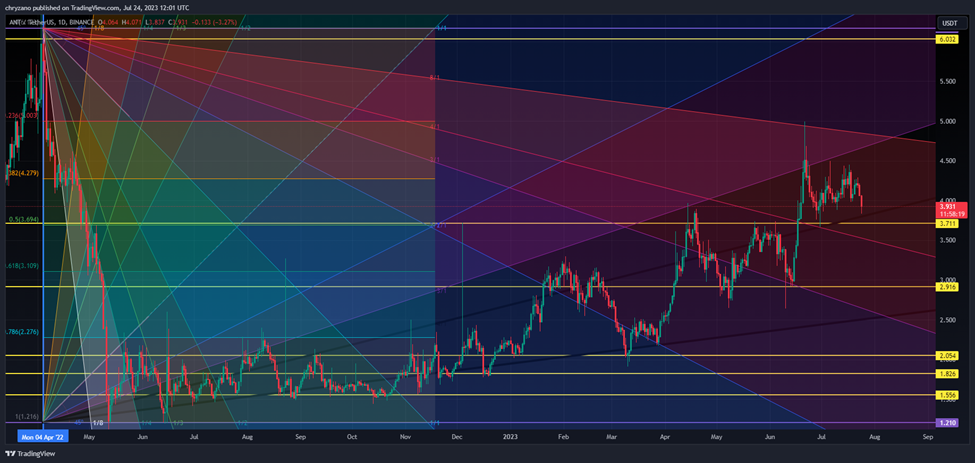

Aragon (ANT) Worth Prediction – Resistance and Assist Ranges

Contemplating the chart above, it may very well be famous that ANT fell just under the 1:4 Gann line again in Might 2022. Nevertheless, following the autumn ANT went by a interval of consolidation from Late Might 2022 to mid-November 2022. Come December 2022, ANT was dominated by the bulls who helped ANT rise alongside the 8:1 Gann line.

At instances ANT was capable of rise above the 4:1 Gann line, whereas at different instances it searched for help from the 8:1 Gann line. At present, it has been held from falling by the 4:1 Gann line. Nevertheless, even within the occasion that ANT breaches the 4:1 Gann line, there lies help for it at $3.711. If the $3.7 stage fails to carry ANT, then it could search help and slide down alongside the three:1 Gann line.

Aragon (ANT) Worth Prediction 2024

There might be Bitcoin halving in 2024, and therefore we should always count on a constructive pattern available in the market because of person sentiments and the search by buyers to build up extra of the coin. Nevertheless, the 12 months of BTC halving didn’t yield the utmost ANT primarily based on the earlier halving. Therefore, we might count on ANT to commerce at a value not under $14.4 by the tip of 2024.

Aragon (ANT) Worth Prediction 2025

ANT might expertise the after-effects of the Bitcoin halving and is anticipated to commerce a lot larger than its 2024 value. Many commerce analysts speculate that BTC halving might create a big impact on the crypto market. Furthermore, much like many altcoins, ANT will proceed to rise in 2025 forming new resistance ranges. It’s anticipated that ANT would commerce past the $19.6 stage.

Aragon (ANT) Worth Prediction 2026

It’s anticipated that after an extended interval of bull run, the bears would come into energy and begin negatively impacting the cryptocurrencies. Throughout this bearish sentiment, ANT might tumble into its help areas. Throughout this era of value correction, ANT might lose momentum and be approach under its 2025 value. As such it may very well be buying and selling at $9.6 by 2026.

Aragon (ANT) Worth Prediction 2027

Naturally, merchants count on a bullish market sentiment after the crypto trade was affected negatively by the bears’ claw. Furthermore, the build-up to the subsequent Bitcoin halving in 2028 might evoke pleasure in merchants. Nevertheless, that pleasure has not been reciprocated in ANT. As such, we might count on ANT to commerce just under its 2026 worth at round $13.4 by the tip of 2027.

Aragon (ANT) Worth Prediction 2028

Because the crypto group’s hope might be re-ignited trying ahead to Bitcoin halving like many altcoins, ANT might reciprocate its previous conduct throughout the BTC halving. Therefore, ANT can be buying and selling at $17 after experiencing a substantial surge by the tip of 2028.

Aragon (ANT) Worth Prediction 2029

2029 is anticipated to be one other bull run because of the aftermath of the BTC halving. Nevertheless, merchants speculate that the crypto market would step by step change into secure by this 12 months. In tandem with the secure market sentiment, ANT may very well be buying and selling at $28.75 by the tip of 2029.

Aragon (ANT) Worth Prediction 2030

After witnessing a bullish run available in the market, ANT and lots of altcoins would present indicators of consolidation and would possibly commerce sideways and transfer downwards for a while whereas experiencing minor spikes. Due to this fact, by the tip of 2030, ANT may very well be buying and selling at $24.3

Aragon (ANT) Worth Prediction 2040

The long-term forecast for ANT signifies that this altcoin might attain a brand new all-time excessive(ATH). This may be one of many key moments as HODLERS might count on to promote a few of their tokens on the ATH level.

If they begin promoting then ANT might fall in worth. It’s anticipated that the common value of ANT might attain $44 by 2040.

Aragon (ANT) Worth Prediction 2050

The group believes that there might be widespread adoption of cryptocurrencies, which might keep gradual bullish beneficial properties. By the tip of 2050, if the bullish momentum is maintained, it might hit $65

Conclusion

If buyers proceed displaying their curiosity in ANT and add these tokens to their portfolio, it might proceed to rise. ANT’s bullish value prediction reveals that it might attain the $8.7 stage.

FAQ

Aragon is a DAO framework that builds instruments for creating, managing, and scaling instruments for everybody to experiment with governance on the velocity of software program

ANT tokens could be traded on many exchanges like Binance, OKX, Bitrue, Bybit, and WEEX.

ANT has a chance of surpassing its current all-time excessive (ATH) value of $14.79 in 2021.

ANT is among the few cryptocurrencies that has gained worth up to now seven days. If ANT continues this streak, it could attain $8.7.

ANT has been one of the appropriate investments within the crypto area. It’s extremely unstable, as such, it has fairly a margin when its value fluctuates. Therefore, merchants could also be allured to spend money on ANT. It’s a very good funding within the quick time period and in the long run as effectively.

The current all-time low value of ANT is $0.2858.

The utmost provide of ANT is 43,166,685 ANT.

ANT could be saved in a chilly pockets, sizzling pockets, or change pockets.

ANT is anticipated to succeed in $8.7 by 2023.

ANT is anticipated to succeed in $14.4 by 2024.

ANT is anticipated to succeed in $19.6 by 2025.

ANT is anticipated to succeed in $9.6 by 2026.

ANT is anticipated to succeed in $13.44 by 2027.

ANT is anticipated to succeed in $17 by 2028.

ANT is anticipated to succeed in $28.75 by 2029.

ANT is anticipated to succeed in $24.3 by 2030.

ANT is anticipated to succeed in $44 by 2040.

ANT is anticipated to succeed in $65 by 2050.

Disclaimer: The views and opinions, in addition to all the knowledge shared on this value prediction, are printed in good religion. Readers should do their analysis and due diligence. Any motion taken by the reader is strictly at their very own threat. Coin Version and its associates is not going to be held answerable for any direct or oblique injury or loss.