Bitcoin’s worth has been a research in tranquility because it broke by the $30,000 degree, setting a good buying and selling vary between $30,000 and $31,000 for many of July. This era of low volatility has left many merchants and analysts unsure about future worth actions. Nevertheless, on-chain knowledge, particularly the Spent Output Revenue Ratio (SOPR), could present a clearer image of the place the market could be heading.

SOPR is an important metric in Bitcoin evaluation. It’s calculated by dividing the value bought by the value paid for a Bitcoin, successfully measuring the revenue or loss made by Bitcoin holders once they promote their cash. A rising SOPR signifies that holders are promoting at a revenue, whereas a declining SOPR suggests promoting at a loss. The entity-adjusted SOPR, which considers solely entities which have been lively for at the least a month, gives a extra correct gauge of the market.

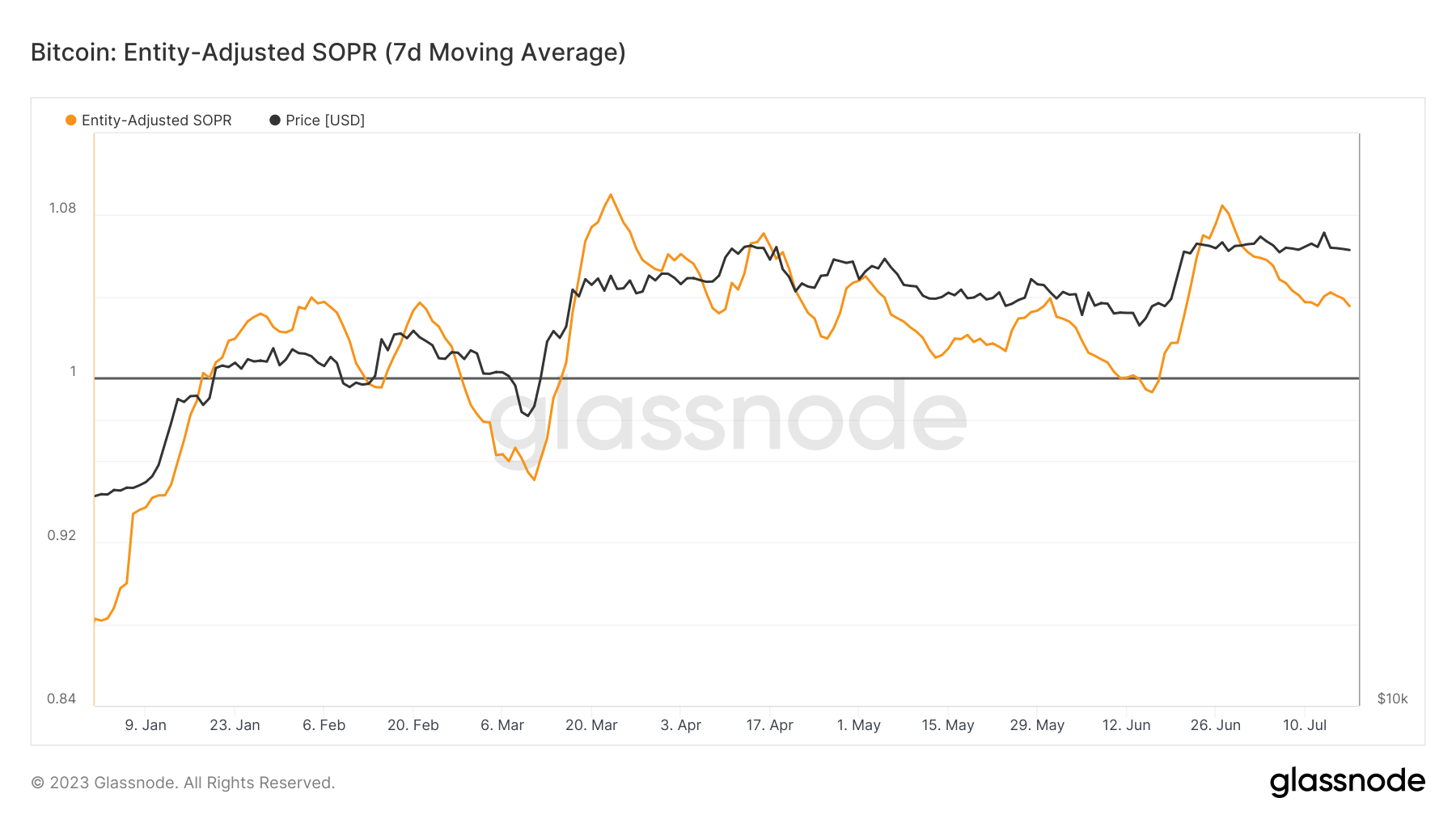

The 7-day transferring common of the entity-adjusted SOPR has been on an upward trajectory because the begin of the yr, breaking above the worth of 1. Regardless of experiencing a number of sharp uptrends in January, February, and June, it has been declining since June 27, dropping to a worth of 1.03 on July 17.

Nevertheless, regardless of the notable drop, the ratio stays in a profit-dominant regime. Which means, on common, the entities promoting their Bitcoin are nonetheless doing so at a revenue.

Based on market evaluation, the present sideways SOPR pattern may point out a market in a consolidation section, probably setting the stage for the subsequent vital worth motion in Bitcoin.

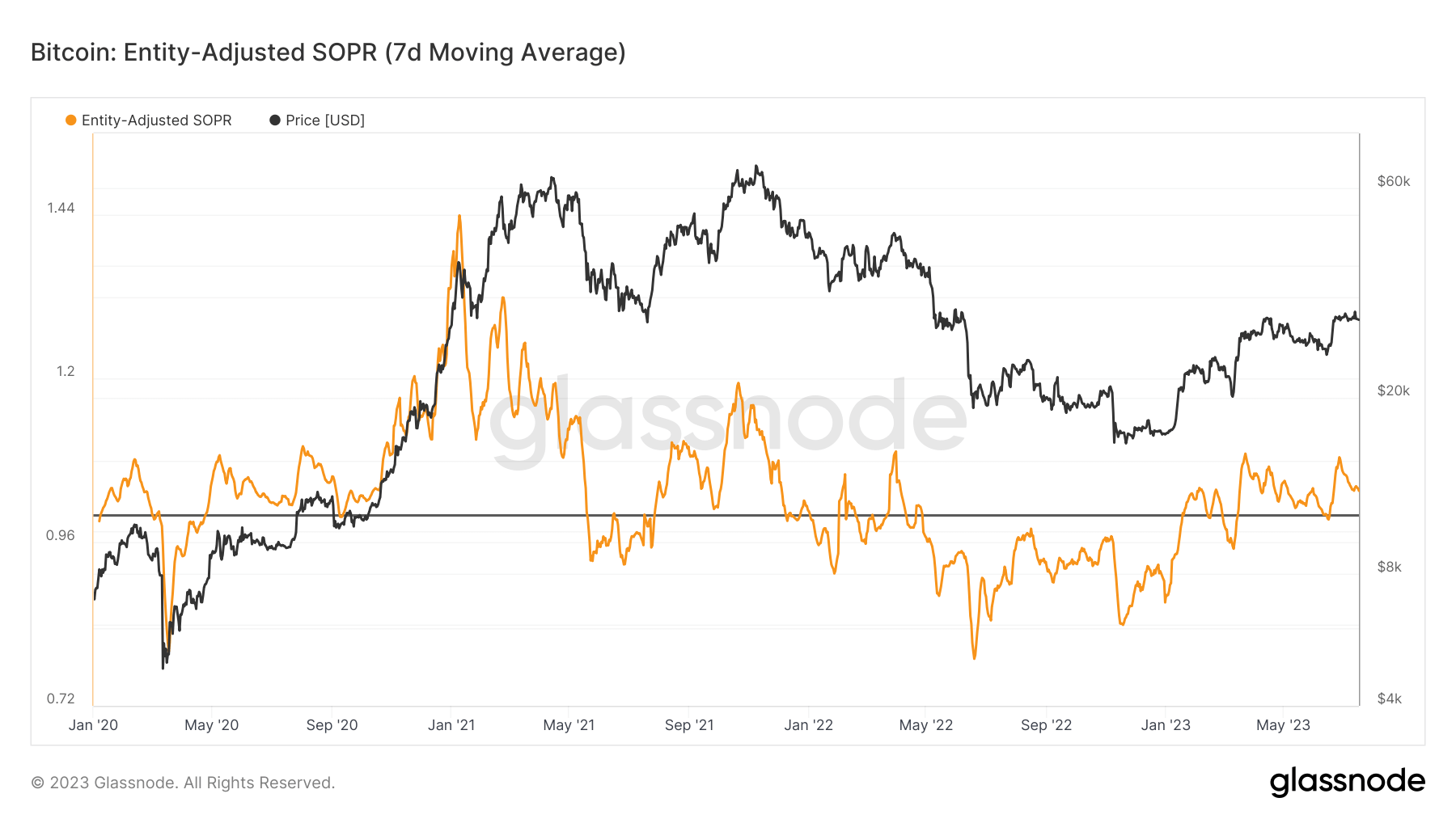

On the planet of buying and selling and investing, consolidation is a interval of indecision that ends when the asset’s worth breaks past the restrictive obstacles. A considerable worth rally may comply with this era, as in 2016 and 2019.

Furthermore, a gentle SOPR may additionally counsel a balanced market the place the variety of Bitcoin sellers making earnings is roughly equal to these incurring losses.. This equilibrium may probably result in a extra secure market, decreasing the probability of utmost worth volatility within the quick time period.

The publish Sideways SOPR: A prelude to Bitcoin’s subsequent huge transfer? appeared first on StarCrypto.