- Bullish XVG value prediction ranges from $0.0077 to $0.013.

- Evaluation means that the XVG value may attain $0.0030.

- The XVG bearish market value prediction for 2023 is $0.0014.

What’s Verge (XVG)?

Verge is a privacy-focused cryptocurrency and blockchain that seeks to supply a quick, environment friendly, decentralized funds community. As such, it improves upon the unique Bitcoin blockchain and goals to meet its preliminary function of offering people and companies with a quick, environment friendly, and decentralized manner of creating direct transactions.

The enhancements embrace further privateness options which combine the anonymity community Tor into its pockets, referred to as vergePay. Moreover, it offers the choice of sending transactions to stealth addresses.

As per its “blackpaper,” Verge was created as a technique to fulfill Bitcoin founder Satoshi Nakamoto’s imaginative and prescient of a decentralized, trustless digital cost system whereas additionally offering extra privateness than is on the market with Bitcoin. Therefore, to perform this criterion, Verge depends on a collection of key privateness options.

It anonymizes the site visitors and masks IP addresses and routes all site visitors to and from its vergePay pockets via the Tor community. Moreover, it additionally affords dual-key stealth addressing, whereby senders can create one-time pockets addresses on behalf of recipients to assist defend the recipients’ privateness. In addition to they may use atomic swaps to energy trustless peer-to-peer cross-blockchain transactions.

Analysts’ View on Verge (XVG)

Verge ranked first among the many prime gainers by gaining roughly 143% throughout the previous 7 days in response to CoinMarketCap. Moreover, it too captured the fourth place amongst trending crypto.

Verge (XVG) Present Market Standing

Verge has a circulating provide of 16,520,252,125 XVG cash, whereas its most provide is 16,555,000,000 XVG cash, in response to CoinMarketCap. On the time of writing, XVG is buying and selling at $0.008119 representing 24 hours enhance of 6.25%. The buying and selling quantity of XVG up to now 24 hours is $74,467,143 which represents a 0.99% enhance.

Some prime cryptocurrency exchanges for buying and selling XVG are Binance, LBank, Bitget, Bybit, and BingX.

Now that XVG and its present market standing, we will talk about the value evaluation of XVG for 2023.

Verge (XVG) Worth Evaluation 2023

Presently, Verge (XVG) ranks 165 on CoinMarketCap. Will XVG’s most up-to-date enhancements, additions, and modifications assist its value go up? First, let’s give attention to the charts on this article’s XVG value forecast.

Verge (XVG) Worth Evaluation – Bollinger Bands

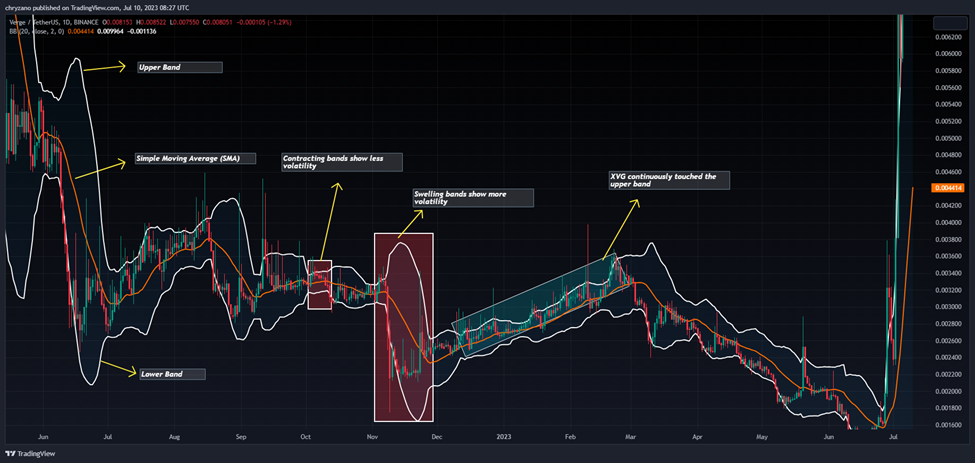

The Bollinger bands are a kind of value envelope developed by John Bollinger. It provides a variety with an higher and decrease restrict for the value to fluctuate. The Bollinger bands work on the precept of normal deviation and interval (time).

The higher band as proven within the chart is calculated by including two instances the usual deviation to the Easy Transferring Common whereas the decrease band is calculated by subtracting two instances the usual deviation from the Easy Transferring Common. When the bands widen, it reveals there’s going to be extra volatility and once they contract, there’s much less volatility.

When Bollinger bands are utilized in a cryptocurrency chart, we may count on the value of the cryptocurrency to reside throughout the higher and decrease bounds of the Bollinger bands 95% of the time. The above thesis is derived from an Empirical legislation.

The sections highlighted by purple rectangles within the chart above present how the bands increase and contract. When the bands widen, we may count on extra volatility, and when the bands contract, it denotes much less volatility. The inexperienced rectangles present how XVG retraced after touching the higher band (oversold).

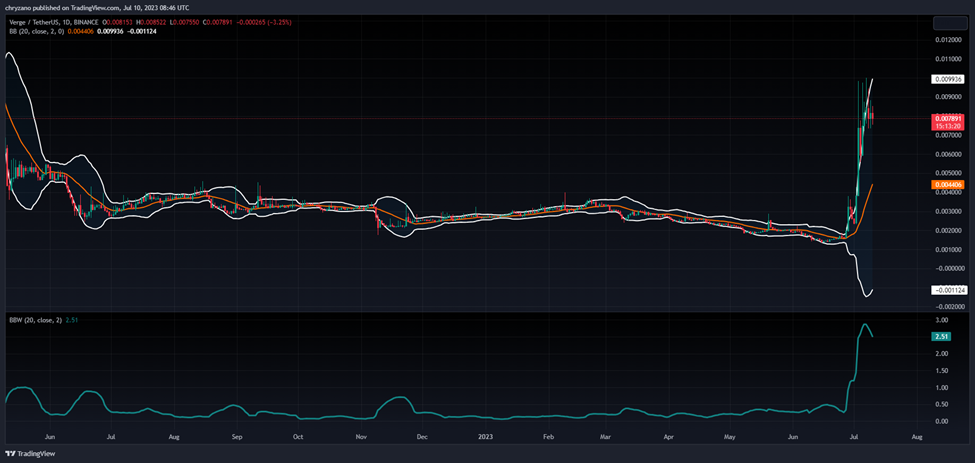

Presently, the gaping Bollinger bands signify that there’s very excessive volatility available in the market. The Bollinger band width (BBW) indicator provides a studying of two.51, an unprecedented worth within the current previous of XVG value fluctuation.

It could possibly be famous that after repeatedly testing the higher band, XVG appears to have retraced and fallen again throughout the bands. If XVG fluctuates conventionally, it might search help on the Easy Transferring Common. Based mostly on XVG’s previous habits, we may count on the value to fall inside only a few days of the SMA.

As such, these seeking to enter a brief place may have to think about getting into the market to make the utmost. It’s because the BBW indicator pointing downward means that this unstable scenario will fade away quickly, as such intra-day merchants and scalpers might must make hay when the solar shines.

Verge (XVG) Worth Evaluation – Relative Energy Index

The Relative Energy Index is an indicator that’s used to seek out out whether or not the value of a safety is overvalued or undervalued. As per its identify, RSI indicators assist decide how the safety is doing at current, relative to its earlier value.

Presently, the RSI within the overbought area reads a price of 72.24. Nonetheless, the RSI is slightly below the sign, therefore, it could possibly be thought of bearish. Furthermore, the RSI Tops and Bottoms indicator which measures the divergence within the tops within the overbought area and the bottoms within the oversold provides a sign that the current prime is invalid.

This implies the XVG lose worth within the coming days. As such, merchants anticipating to promote XVG may have to think about having their stop-loss near 75.32 or 79.64, as proven within the chart. It’s because in case the value rises up upon getting set your brief place, there’s sufficient room for it to oscillate earlier than it continues falling again.

Since XVG remains to be within the overbought area regardless of crossing beneath the Sign, it might proceed to abide within the overbought area, as lengthy its value is above $0.002586, (Crossunder Overbought). Nonetheless, as soon as, XVG crosses beneath the bull zone, it might take a look at the bull zone as soon as once more as at earlier instances. This may increasingly beat back sellers, who’ve a decent cease loss, this might reverse the downward value motion of XVG within the upward route.

Verge (XVG) Worth Evaluation – Transferring Common

The Exponential Transferring averages are fairly much like the easy shifting averages (SMA). Nonetheless, the SMA equally distributes down all values whereas the Exponential Transferring Common provides extra weightage to the present costs. Since SMA undermines the weightage of the current value, the EMA is utilized in value actions.

The 200-day MA is taken into account to be the long-term shifting common whereas the 50-day MA is taken into account the short-term shifting common in buying and selling. Based mostly on how these two traces behave, the power of the cryptocurrency or the development will be decided on common.

Particularly, when the short-term shifting common (50-day MA) approaches the long-term shifting common (200-day MA) from beneath and crosses it, we name it a Golden Cross.

Contrastingly, when the short-term shifting common crosses the long-term shifting common from above then, a demise cross happens.

Normally, when a Golden Cross happens, the costs of the cryptocurrency will shoot up drastically, however when there’s a Dying Cross, the costs will crash.

At any time when the value of cryptocurrency is above the 50-day or 200-day MA, or above each we might say that the token is bullish. Contrastingly, if the token is beneath the 50-day or 200-day, or beneath each, then we may name it bearish (triangle part).

Presently, XVG is above each the EMA’s as such it could possibly be thought of bullish. Furthermore, since each shifting averages are titling upwards, XVG is bullish within the brief and long run. The golden cross appears to have produced this exponential rise for XVG.

Within the occasion that XVG crashes, it’s intuitively understood that it might search help on the 50-day EMA. Nonetheless, primarily based on the remark made within the historic habits of XVG, it could possibly be famous that the 50-day EMA has been extra of a resistance than a help stage.

Verge (XVG) Worth Evaluation – Elder Power Index

Elder Power Index is an indicator that was invented by Alexander Elder, who was an entrepreneur. The indicator primarily makes use of two parameters to adjudicate the shopping for and promoting drive and thereby predicts the market development. Particularly, it depends on value change and quantity. As such the power of the shopping for drive or promoting drive depends on both the value change or the quantity.

At any time when the EFI is bigger than zero, or optimistic, let’s imagine that the development is bullish, as there’s extra shopping for strain. Nonetheless, when the EFI is within the damaging zone, let’s imagine that the cryptocurrency is within the damaging zone and the promoting strain is extra.

Furthermore, the Elder Power is also used to determine development reversals and breakouts. As an example when the EFI is making decrease highs whereas the cryptocurrency is making increased highs, then let’s imagine that it is a bearish divergence.

Nonetheless, within the occasion that the cryptocurrency is making decrease lows whereas the EFI is making increased lows, then it’s a bullish divergence represented within the chart.

Presently, the EFI reads a price of 11.084M. Nonetheless, since it’s going through downward, there’s a excessive chance that the EFI may preserve decreasing. This thesis could possibly be supported by the Bear-Bull-Energy indicator which reveals that the bears are gaining management of the market with a price of 0.003606. This worth may edge nearer to zero and if it crosses the zero mark, then the bears could have whole dominance over the market.

Verge (XVG) Worth Prediction 2023

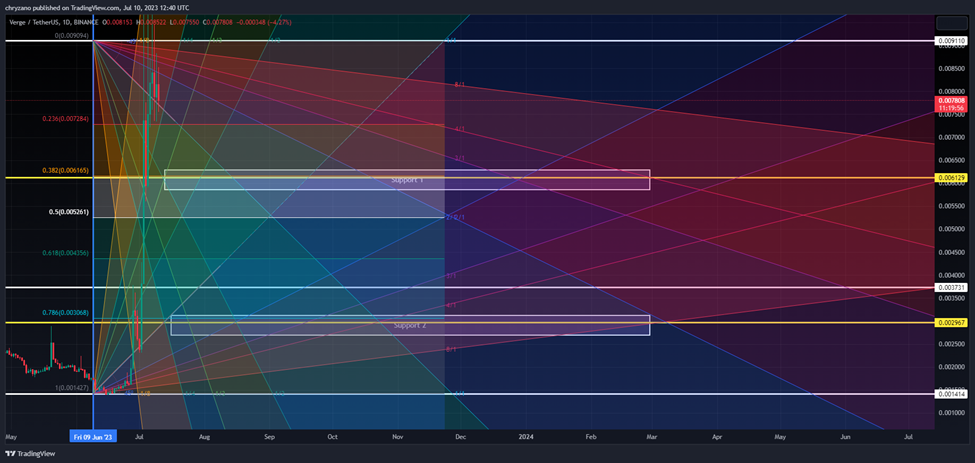

When contemplating the chart above, it could possibly be seen that XVG was buying and selling inside a falling wedge since Could 2023. As soon as it broke out of the falling wedge, it rose exponentially surpassing a traditional breakout.

As an example, as per one of the best observe of buying and selling the falling wedge, it’s an accepted norm to have the take revenue by transposition the peak of the wedge at its early stage, on the breakout level. Had it been a traditional breakout XVG may have reached Help 1 at round $0.006129 but it surely went above $0.01.

For the reason that spike appears to be over it’s possible that the XVG could possibly be shifting downwards seeking help. As such, XVG might settle at help 1. Nonetheless, Help 1 has been a stronghold for XVG, therefore, it might crash to Help 2 at $ 0.002967. Within the occasion that Verge rises, merchants might count on it to achieve Resistance 1 at round $0.0129.

Verge (XVG) Worth Prediction – Resistance and Help Ranges

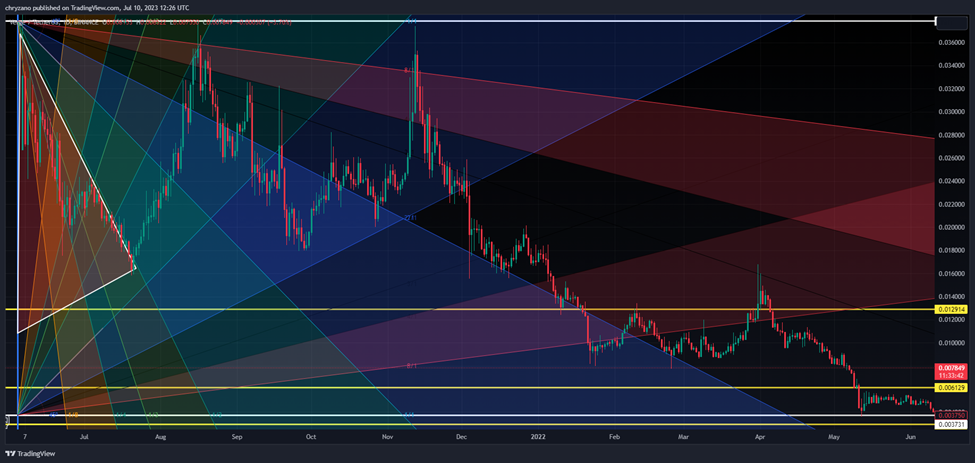

When contemplating the chart above (June 2021-Could 2022), the preliminary value lack of XVG highlighted by the purple triangle reveals how XVG examined the 1:2 Gann line because it slid alongside it. Nonetheless, after this section of shedding worth, XVG began to achieve worth earlier than as soon as once more shedding worth. This time it resorted for help from the three:1 Gann line.

Presently, it could possibly be seen that XVG has obtained help from the 1:1 Gann line. As such it might slide alongside the 1:1 Gann line and attain Help 2 if Help 1 fails to carry up. Nonetheless, within the occasion that the bulls empower and assist XVG achieve worth, it might discover help on the 3:1 Gann line which has been a powerful help as proven within the earlier chart above.

FAQ

What’s Verge (XVG)?

Verge is a privacy-focused cryptocurrency and blockchain that seeks to supply a quick, environment friendly, decentralized funds community. It goals to reinforce the unique Bitcoin blockchain.

XVG tokens will be traded on many exchanges like Binance, LBank, Bitget, Bybit, and BingX.

XVG has a risk of surpassing its current all-time excessive (ATH) value of $0.3006 in 2017.

XVG is without doubt one of the few cryptocurrencies that has gained worth up to now seven days. If XVG continues this streak, it might attain $0.013.

XVG has been one of the appropriate investments within the crypto area. It’s extremely unstable, as such, it has fairly a margin when its value fluctuates. Therefore, merchants could also be allured to spend money on XVG. It’s a very good funding within the brief time period and in the long run as properly.

The current all-time low value of XVG is $0.000002167.

The utmost provide of XVG is 16,555,000,000 XVG cash.

The utmost provide of XVG is 16,555,000,000 XVG cash.

XVG will be saved in a chilly pockets, scorching pockets, or alternate pockets.

XVG is anticipated to achieve $0.0029 by 2023.

Disclaimer: The views and opinions, in addition to all the data shared on this value prediction, are revealed in good religion. Readers should do their analysis and due diligence. Any motion taken by the reader is strictly at their very own threat. Coin Version and its associates won’t be held responsible for any direct or oblique harm or loss.