Bitcoin (BTC) miners offered a major quantity of their mined Bitcoin in June to fund their operations, in response to Glassnode knowledge analyzed by StarCrypto.

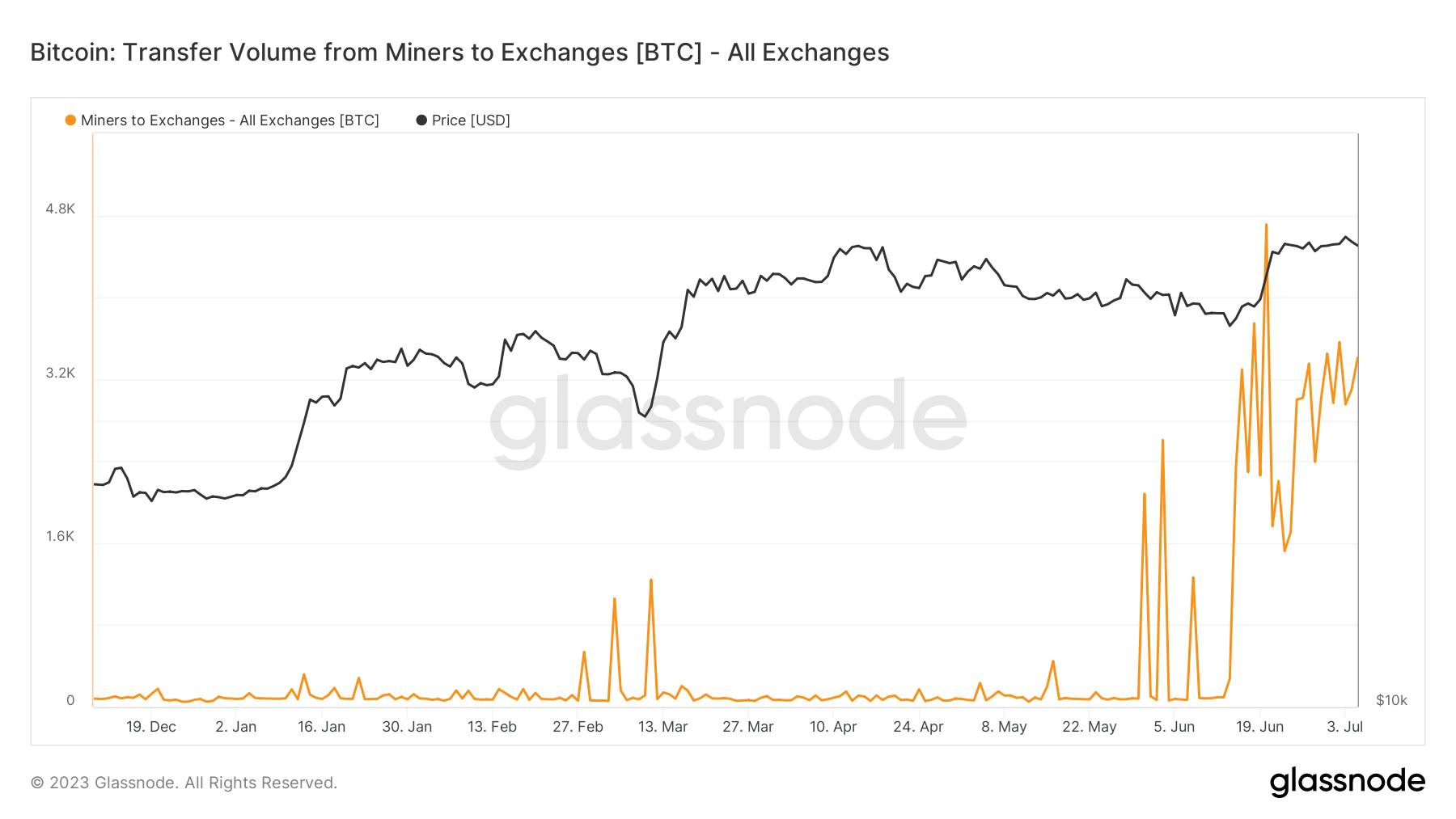

In accordance with the chart beneath, miners’ trade movement peaked at 4,710 BTC on June 20—the best fee of the previous 5 years. Different days of the month additionally noticed important spikes, averaging over 2000 BTC to exchanges.

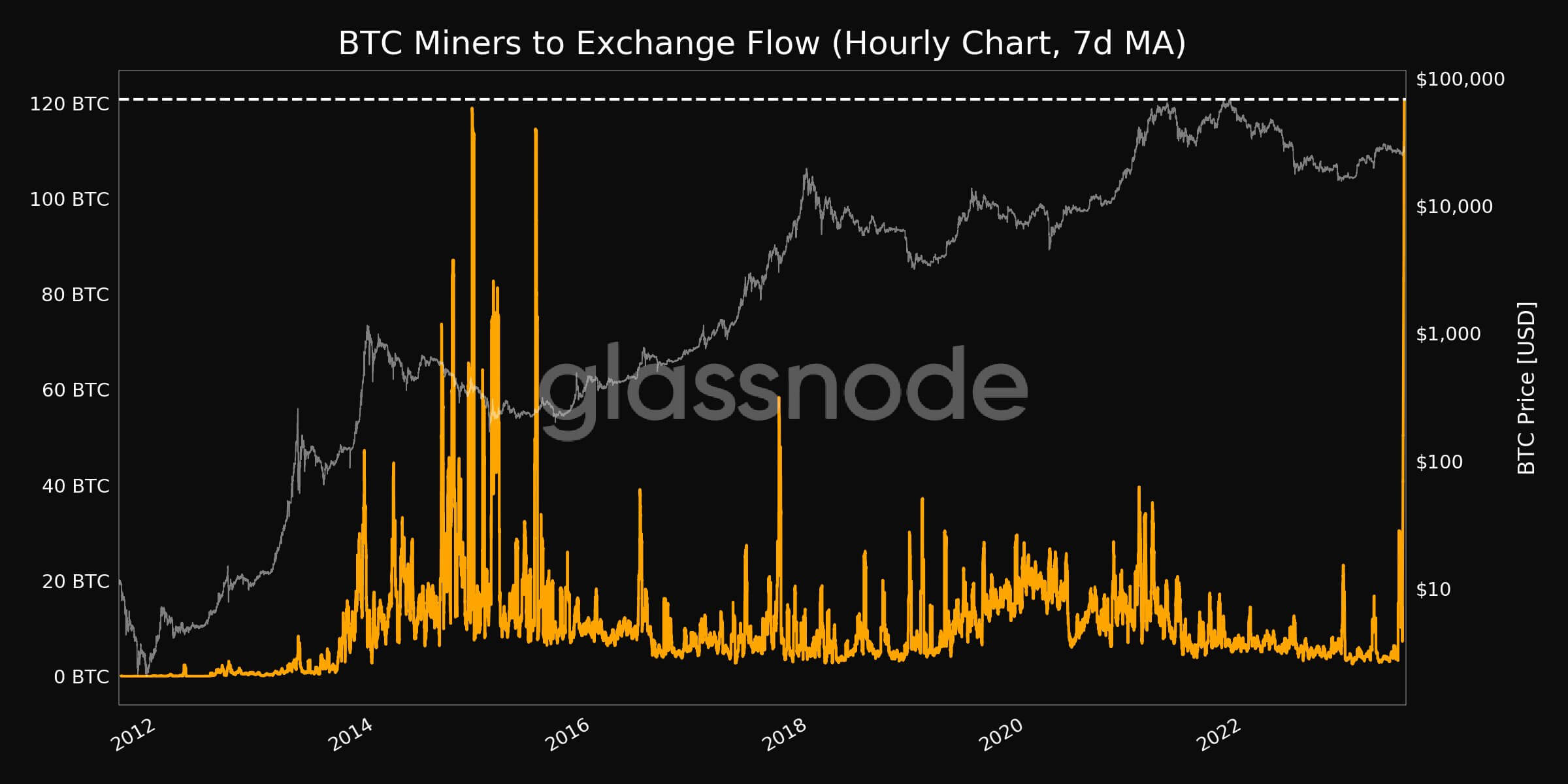

Glassnode acknowledged that the seven days shifting common hourly movement from miners to exchange reached as excessive as 120.77 BTC, one of many highest ranges since 2015.

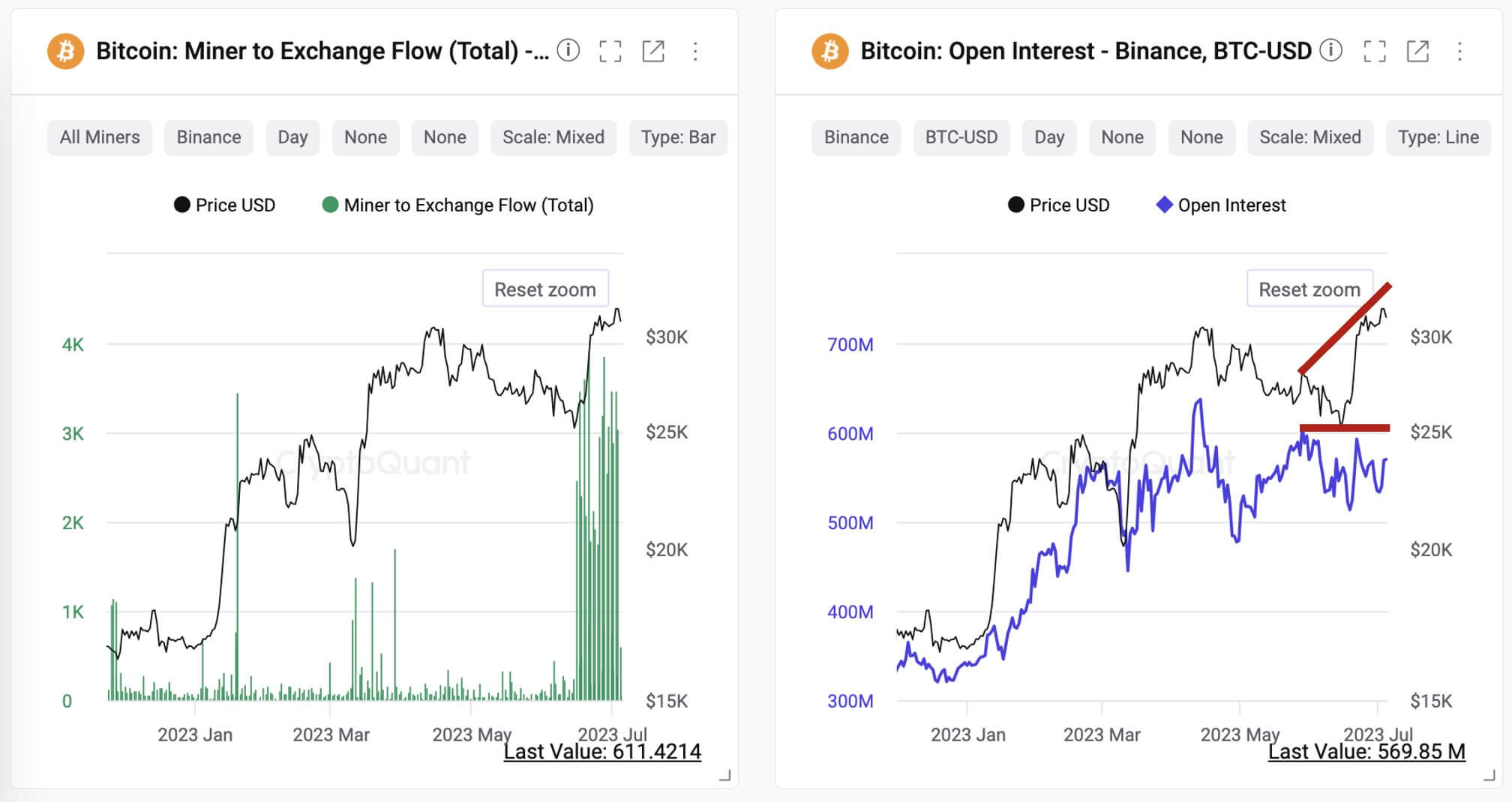

On July 4, CryptoQuant CEO Ki Younger Ju stated miners despatched over 54,000 BTC to Binance up to now three weeks. Ju identified that there was “no important change in BTC-USD open curiosity, suggesting much less chance of filling collaterals to punt new lengthy positions.”

Ju added:

“Spot promoting appears extra possible.”

Of their just lately launched operational updates, Bitcoin miners Marathon Digital, Cleanspark, and Hut 8 confirmed these transactions.

In a July 6 press assertion, Marathon Digital stated it offered 700 BTC, representing 71.5%, of its mined 979 BTC in June for an undisclosed sum. Its rival, Hut 8, offered 217 BTC—100% of the Bitcoin it produced in Could and 70 Bitcoin produced in June—for $7.9 million.

In the meantime, Cleanspark offered 84% of the 491 BTC it mined in June for $11.2 million, in response to a July 3 assertion.

These buying and selling actions counsel miners needed to capitalize on BTC’s latest worth surge to safe income. In June, BTC principally traded above $25,000, peaking at $31,268 after a number of conventional monetary establishments, together with BlackRock and others, filed for Bitcoin ETFs.

The submit Bitcoin miners money in on June worth surge, promoting hundreds of BTC appeared first on StarCrypto.