The cryptocurrency market has been a whirlwind of exercise over the previous week, with Bitcoin (BTC) seeing probably the most notable uptick, climbing over the $30,000 mark for the primary time in two months, an important psychological milestone that would return much-needed confidence to the market.

At press time, Bitcoin is buying and selling at $30,343.

Over the weekend, Bitcoin managed to keep up the $30,000 stage, even briefly surpassing $31,000. This value leap was fueled by a wave of stories relating to institutional adoption, which has been a key driver of Bitcoin’s value because the starting of the yr because it signifies rising mainstream acceptance and potential elevated demand for the digital asset.

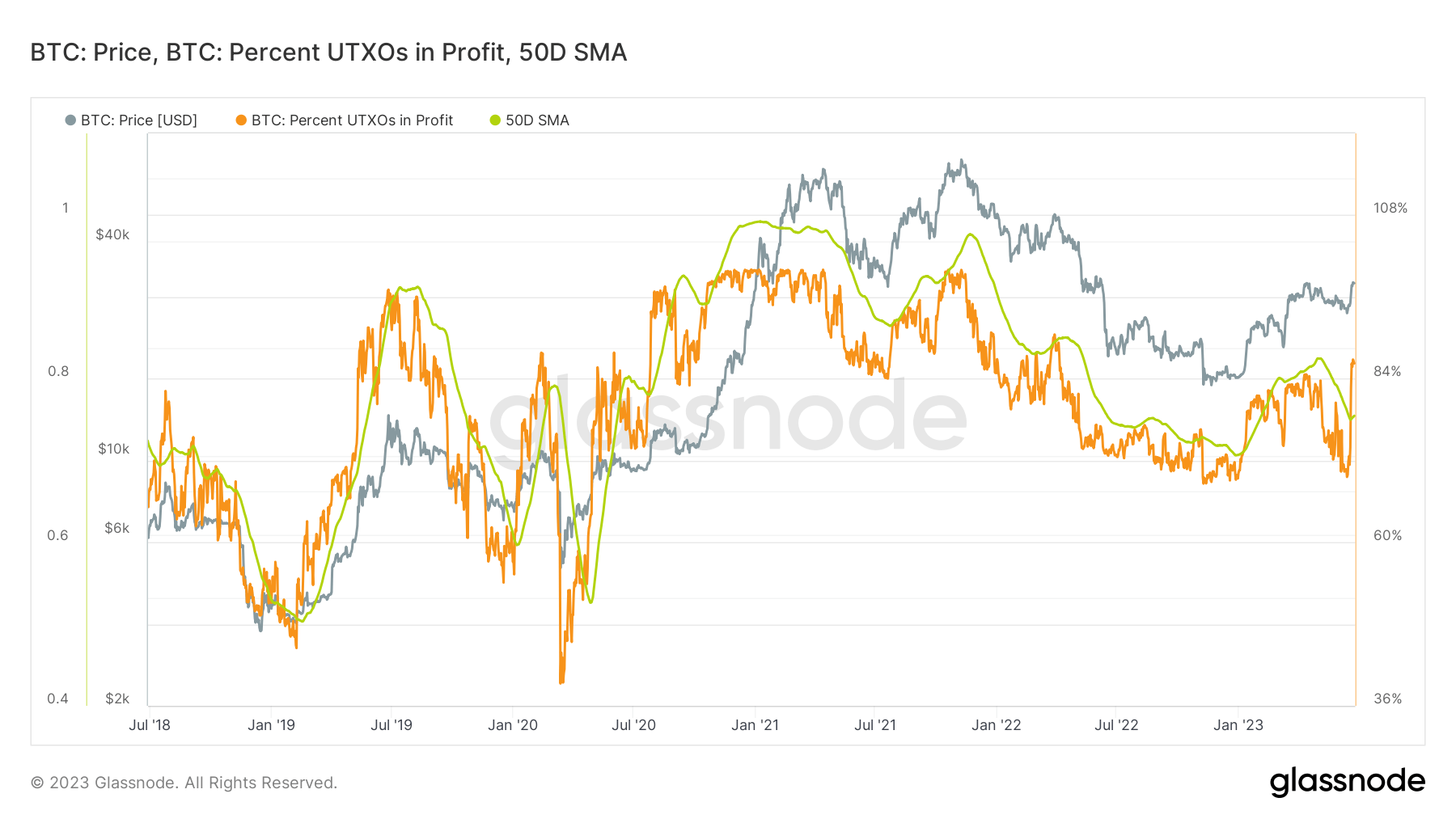

This surge in Bitcoin’s value has elevated the profitability of most holders. That is evident when analyzing on-chain knowledge, particularly UTXOs in revenue. Unspent Transaction Outputs (UTXOs) are the outputs of Bitcoin transactions that haven’t been spent and will be regarded as particular person ‘cash’ or items of cash that reside in a Bitcoin pockets. They’re essential when analyzing the market as a result of they supply a snapshot of the financial exercise on the Bitcoin community.

Estimating the revenue and lack of Bitcoin’s provide is necessary because it offers perception into the market sentiment and potential future value actions. One technique to assess that is by analyzing the variety of present UTXOs which might be in revenue or loss.

Glassnode calculates the variety of UTXOs in revenue/loss by counting all present UTXOs whose value at creation time was decrease or increased than their present value. To account for the growing variety of UTXOs over time, the info is normalized by the scale of the UTXOs to acquire the relative variety of UTXOs in revenue/loss, i.e., the proportion.

The share of UTXOs in revenue approaches 100% each time a earlier all-time excessive is damaged. In response to Glassnode, making use of the 50-day easy shifting common (SMA) to the info suits the historic knowledge optimally and creates a a lot better sign that signifies each international and native Bitcoin cycle tops.

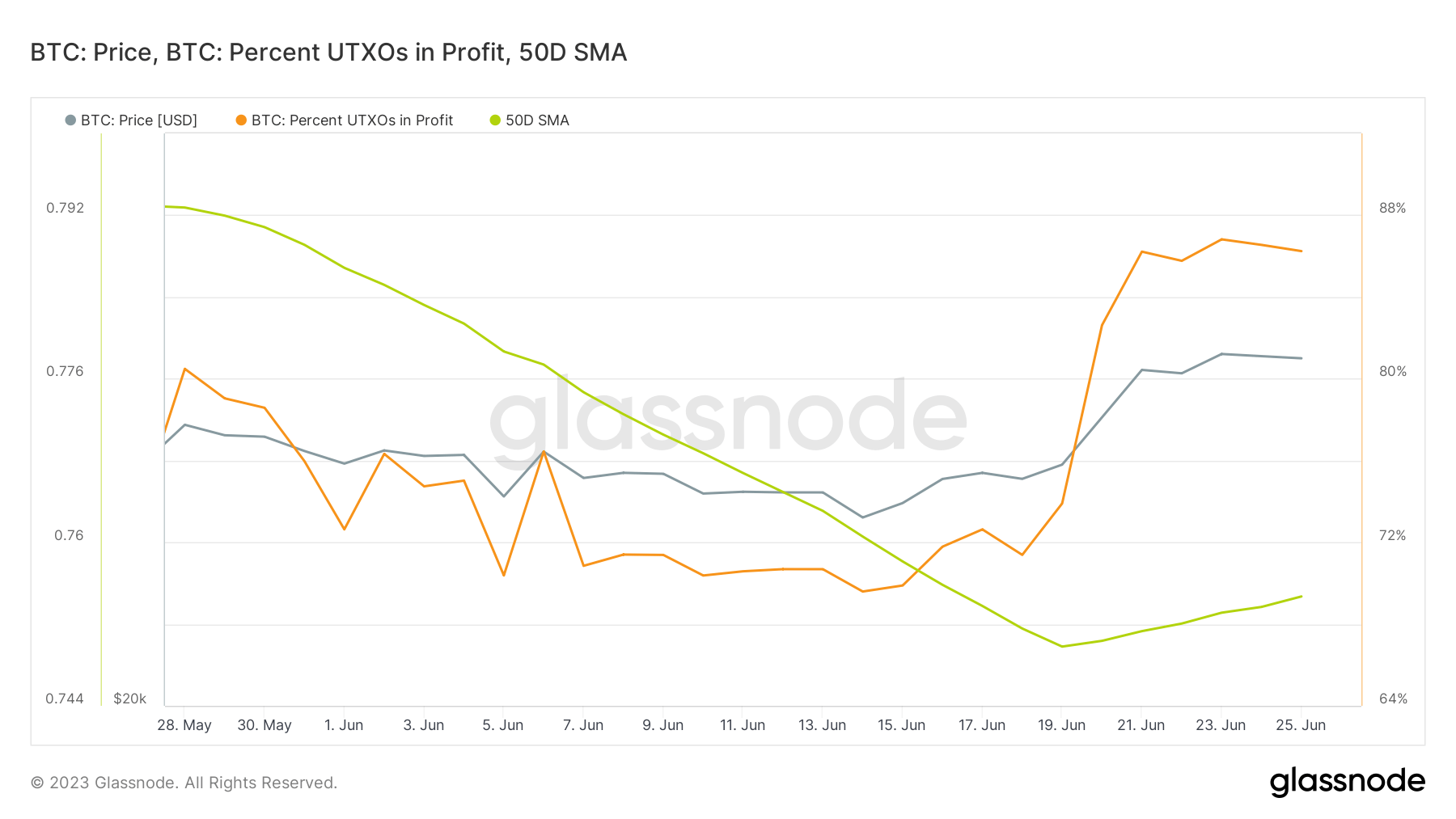

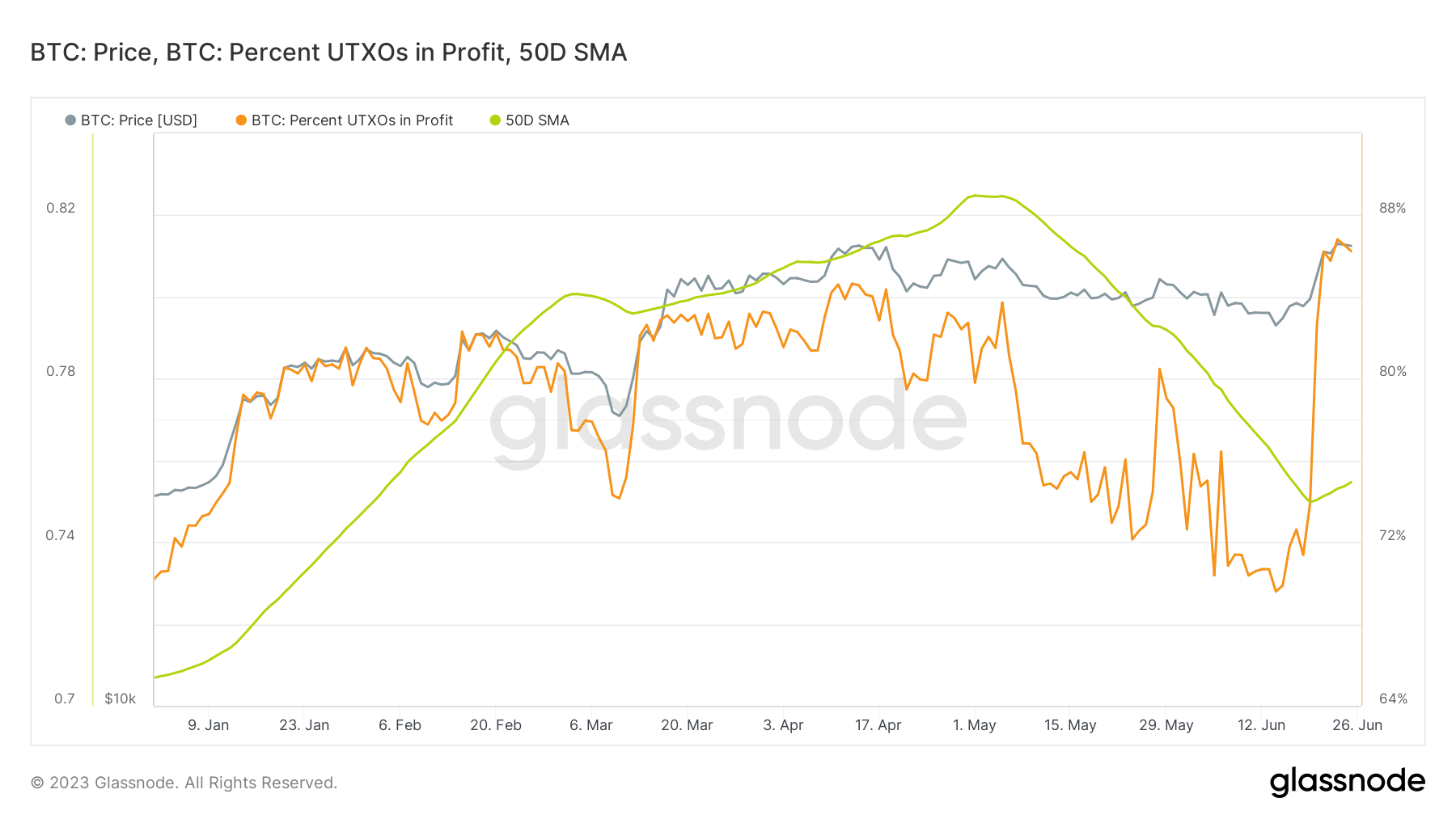

StarCrypto evaluation discovered that 86.24% of Bitcoin UTXOs are at the moment in revenue. It is a sharp spike from 69.59% recorded on June 14 and a slight drop from the 14-month excessive of 86.8% recorded on June 23. This means that the majority Bitcoin holders are at the moment worthwhile, which may considerably have an effect on the market’s future trajectory.

Nonetheless, the 50-day easy shifting common (SMA) for Bitcoin UTXOs in revenue at the moment stands at 75%, a big drop from the 82.4% stage recorded in Could.

The SMA is a generally used technical indicator that helps clean out value knowledge by making a always up to date common value. On this context, it offers a clearer image of the general development within the profitability of Bitcoin UTXOs over the previous 50 days. The drop within the SMA means that regardless of the latest surge in Bitcoin’s value, the general profitability of UTXOs has been on a downward development over the previous two months.

This might be as a result of a lot of components, together with Bitcoin holders promoting at a loss or the creation of recent UTXOs at increased value ranges. Nonetheless, with the latest value surge pushing the proportion of UTXOs in revenue to over 86%, it stays to be seen whether or not this development will proceed.

The put up Over 86% of unspent Bitcoin in revenue as BTC continues to commerce above $30k appeared first on StarCrypto.