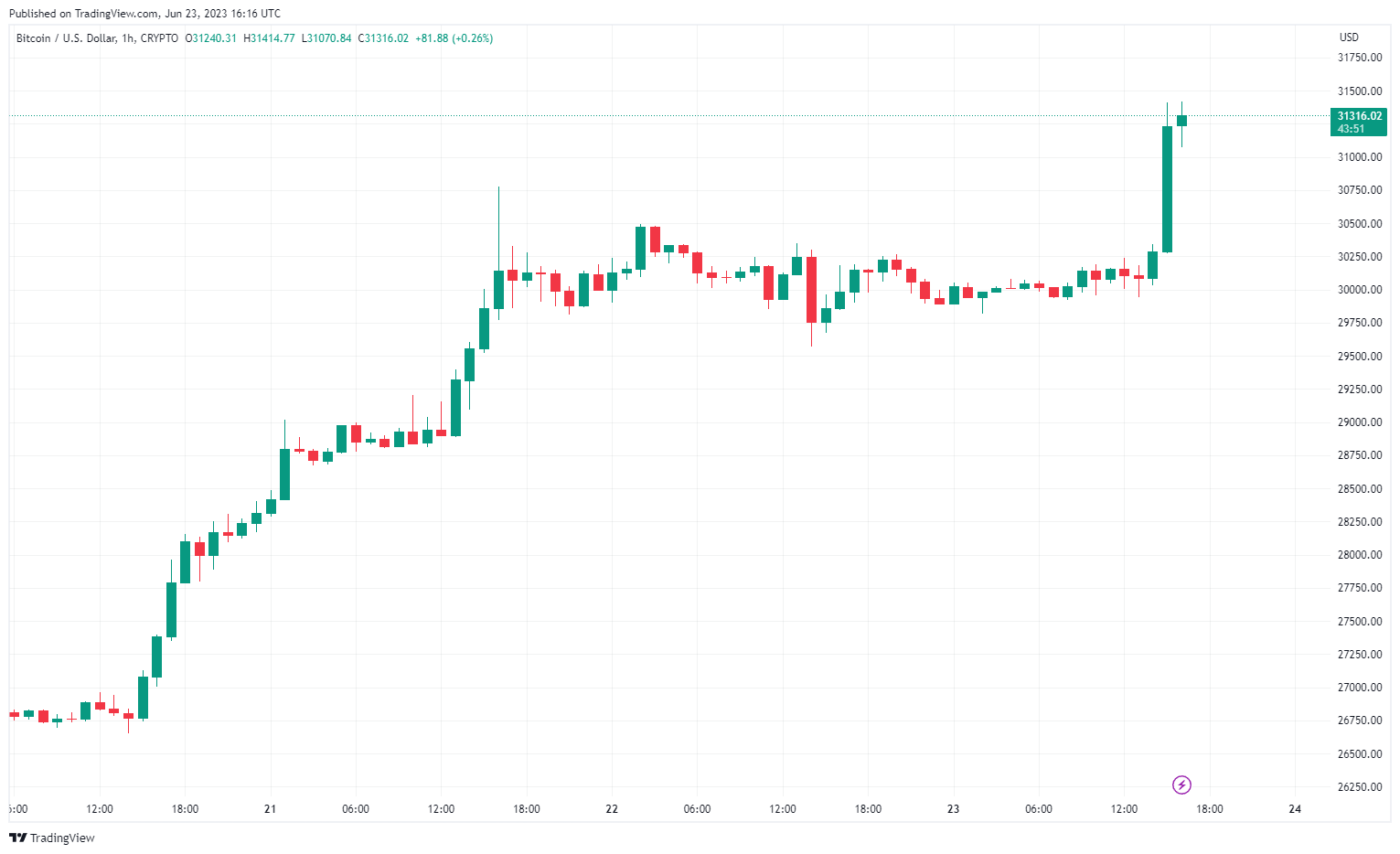

As ongoing regulatory pressures ramp up in the direction of a number of cryptocurrencies, Bitcoin (BTC)has proven spectacular resilience, breaking the $31,000 barrier at this time and marking its highest shut of the yr.

This leap comes after a chronic interval of stagnant buying and selling, with Bitcoin wavering between $25,000 and $30,000 since March 16.

The liquidation volumes for every cryptocurrency over the previous 4 hours have been $30.01 million in Bitcoin, $17.27 million in Ethereum (ETH), and $3.15 million in Bitcoin Money (BCH), in response to Coinglass knowledge. These values contribute to the overall 4-hour liquidation quantity of $72.20 million, comprised of $13.01 million of lengthy positions and $59.18 million of brief positions.

Bitcoin was buying and selling at $31,234 as of press time.

BTC surge after institutional curiosity

This Bitcoin surge follows a wave of institutional curiosity. International funding large BlackRock submitted an utility final week to the U.S. Securities and Trade Fee for a spot Bitcoin ETF. The regulator has but to grant approval for a spot Bitcoin ETF.

Including to the optimistic sentiment round Bitcoin, the launch of EDX Markets on June 20, which coincided with Bitcoin reclaiming the $28,000 mark, has been well-received by the market. Backed by heavyweights Constancy, Charles Schwab, and Citadel Securities, EDX Markets is a promising institutional crypto alternate.

Bitcoin’s rise is a stark distinction to the remainder of the cryptocurrency market, which has been struggling within the aftermath of the SEC’s unprecedented lawsuits towards Binance and Coinbase. The SEC has alleged that a number of widespread cryptocurrency tokens are, of their view, unregistered securities.

SEC Chair Gary Gensler has been express about his plan to take motion towards crypto corporations that, in his view, function outdoors U.S. regulation. Gensler has said that every one cryptocurrencies, with the only exception of Bitcoin, qualify as securities beneath U.S. regulation. Nonetheless, Gensler’s stance on Ethereum, the second-largest cryptocurrency by market cap, stays unclear.

The put up Bitcoin breaks $31k because it continues to shake off latest slumps appeared first on StarCrypto.