Sturdy Finance paused its markets on June 12 following a protocol exploit – losses are estimated at round 442 ETH ($800,000) per Peckshield.

In a assertion, the crew confirmed it was conscious of the exploit, including that no extra funds are in danger and no person actions are wanted at the moment – with extra data to comply with pending investigation outcomes.

Sturdy Finance has but to reply to starcrypto’s request for extra feedback as of press time.

Blockchain safety corporations clarify how Sturdy Finance was exploited

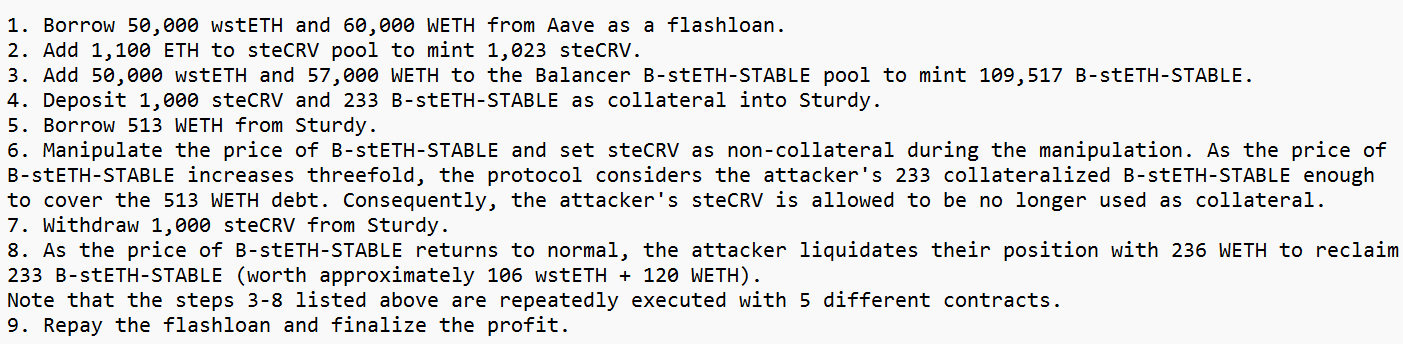

Blockchain safety agency Peckshield initially reported that Sturdy Finance’s exploit was linked to a defective worth oracle. Additional evaluation confirmed “the foundation trigger [was] because of the faulty worth oracle to compute the cB-stETH-STABLE asset worth.”

Web3 information graph protocol 0xScope corroborated this report, including that the hacker transferred the stolen funds to crypto-mixing protocol, Twister Money, and the Change Now alternate.

In the meantime, sensible contract auditor BlockSec famous that along with the oracle worth manipulation reported by Peckshield and 0xScope, the exploit additionally confirmed indicators of a “typical Balancer’s read-only reentrancy” assault.

Utilizing the assault transaction hash, BlockSec defined how the attacker first borrowed over 100,000 staked Ethereum from Aave in a flash mortgage earlier than exploiting a liquidity pool managed by Sturdy Finance’s crew on the Balancer.

In keeping with CertiK, a reentrancy assault permits an attacker to empty funds of a susceptible contract by repeatedly calling the withdraw operate earlier than it updates its steadiness.

The submit Sturdy Finance halts market after $800,000 exploit linked to defective worth oracle appeared first on starcrypto.