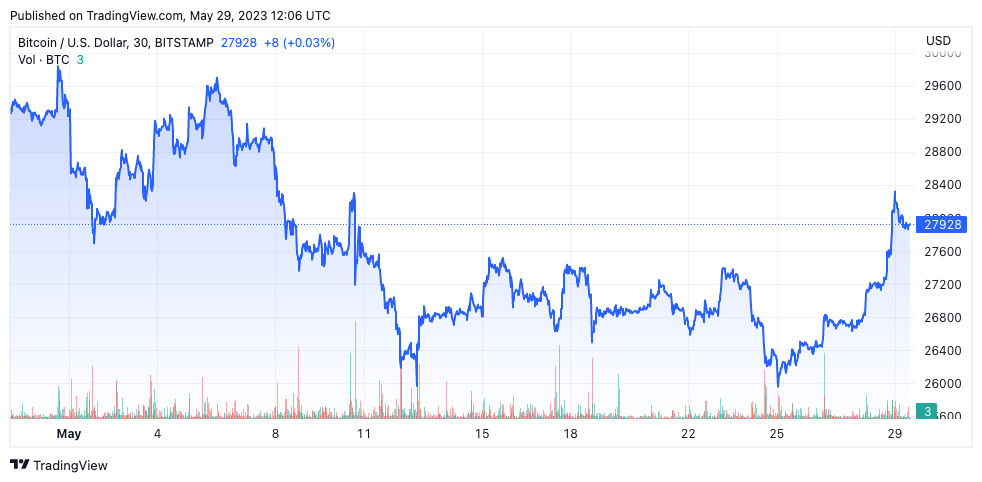

Bitcoin skilled a fleeting spike within the early morning hours on Monday, Could 29, briefly surpassing the $28,000 resistance stage after spending the higher a part of Could comparatively flat. The shopping for stress dwindled over the previous weekend, with Bitcoin stabilizing at $28,800.

Bitcoin’s weekend volatility left a lot of the market unfazed, with whales and long-term holders ramping up accumulation. The 2 cohorts, believed by many to be one of many main drivers of market sentiment, have been dedicated to accumulation all through Could however have used Bitcoin’s weekend volatility to extend their holdings.

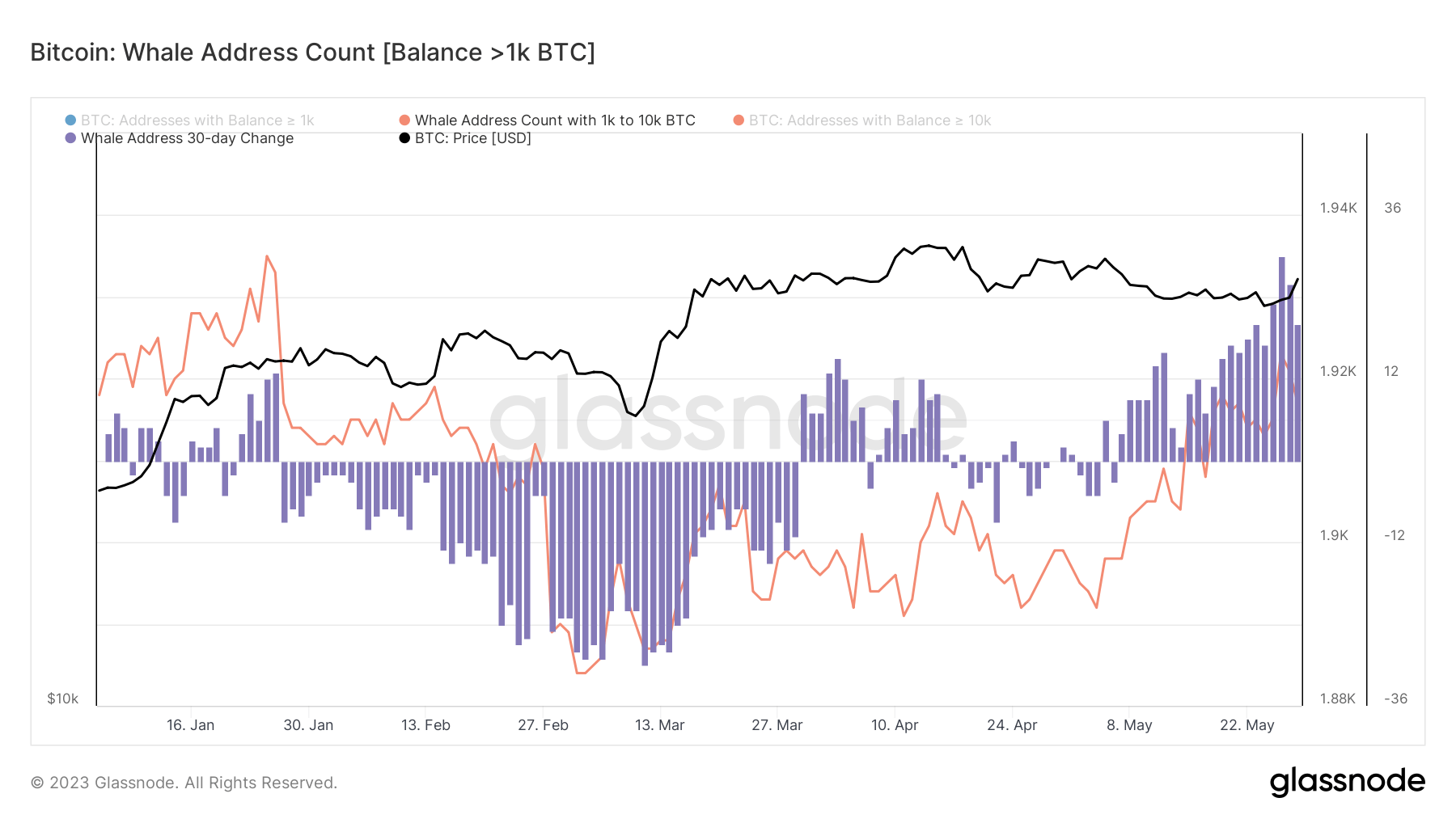

Whale addresses, categorized as addresses holding over 1,000 BTC, have seen an uptick in numbers through the second half of Could, culminating over the weekend.

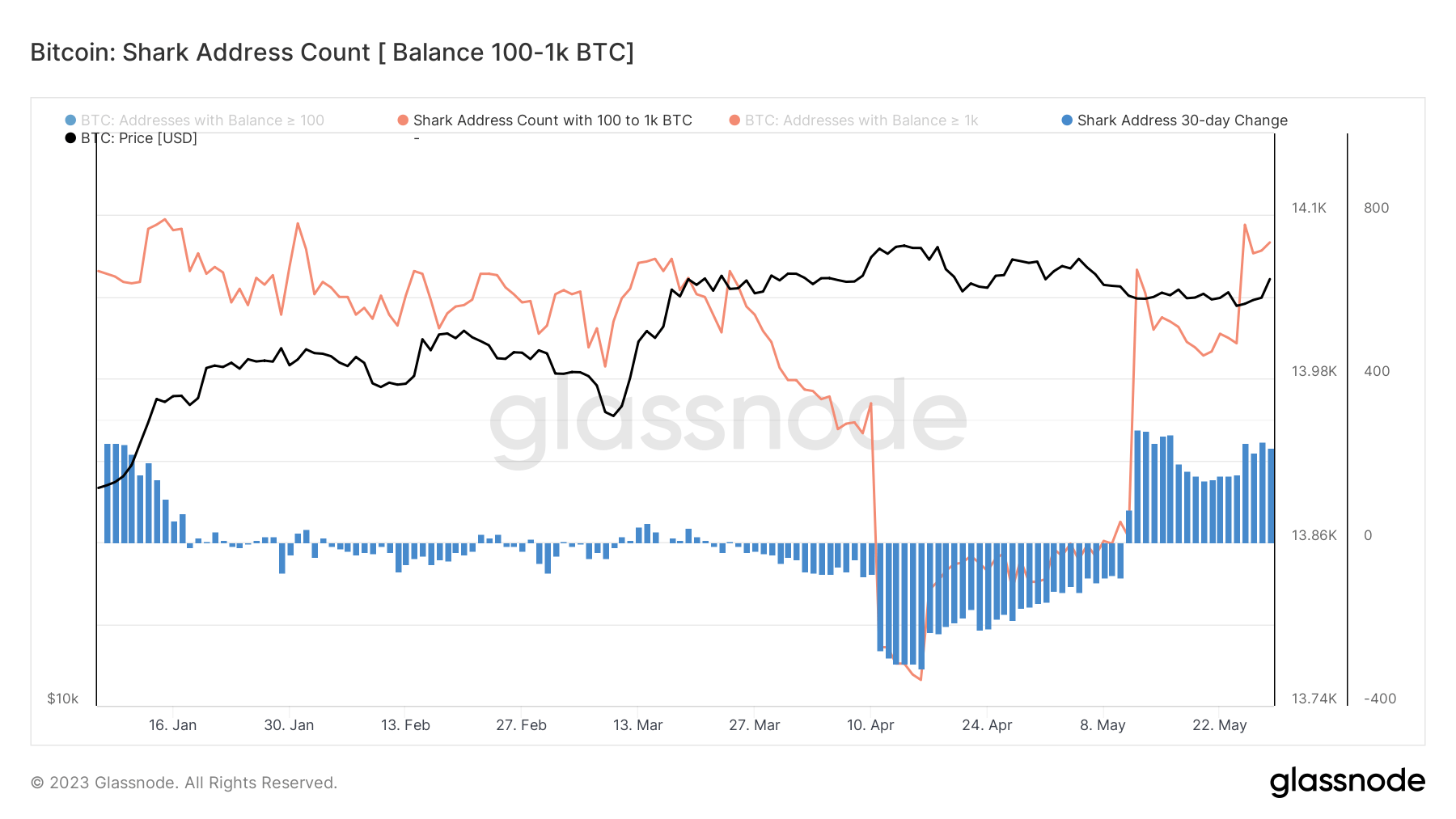

An identical development emerged amongst shark addresses, outlined as these holding between 100 BTC and 1,000 BTC, with Glassnode knowledge displaying an evident enhance.

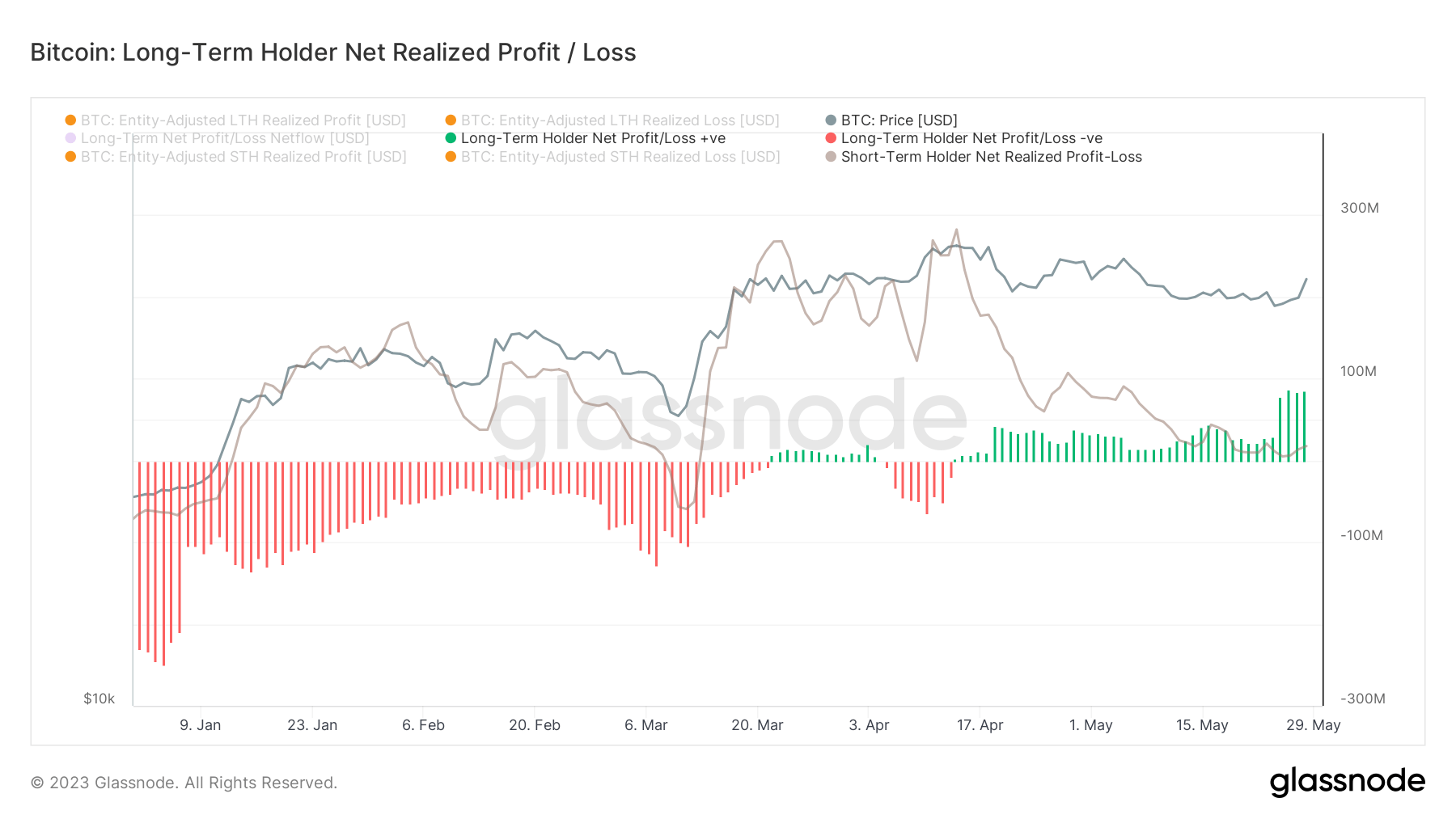

Moreover, long-term holders have detected a big surge within the internet realized revenue/loss (NPL). This implies that these persistent traders have spent their cash above their acquisition value all through Could.

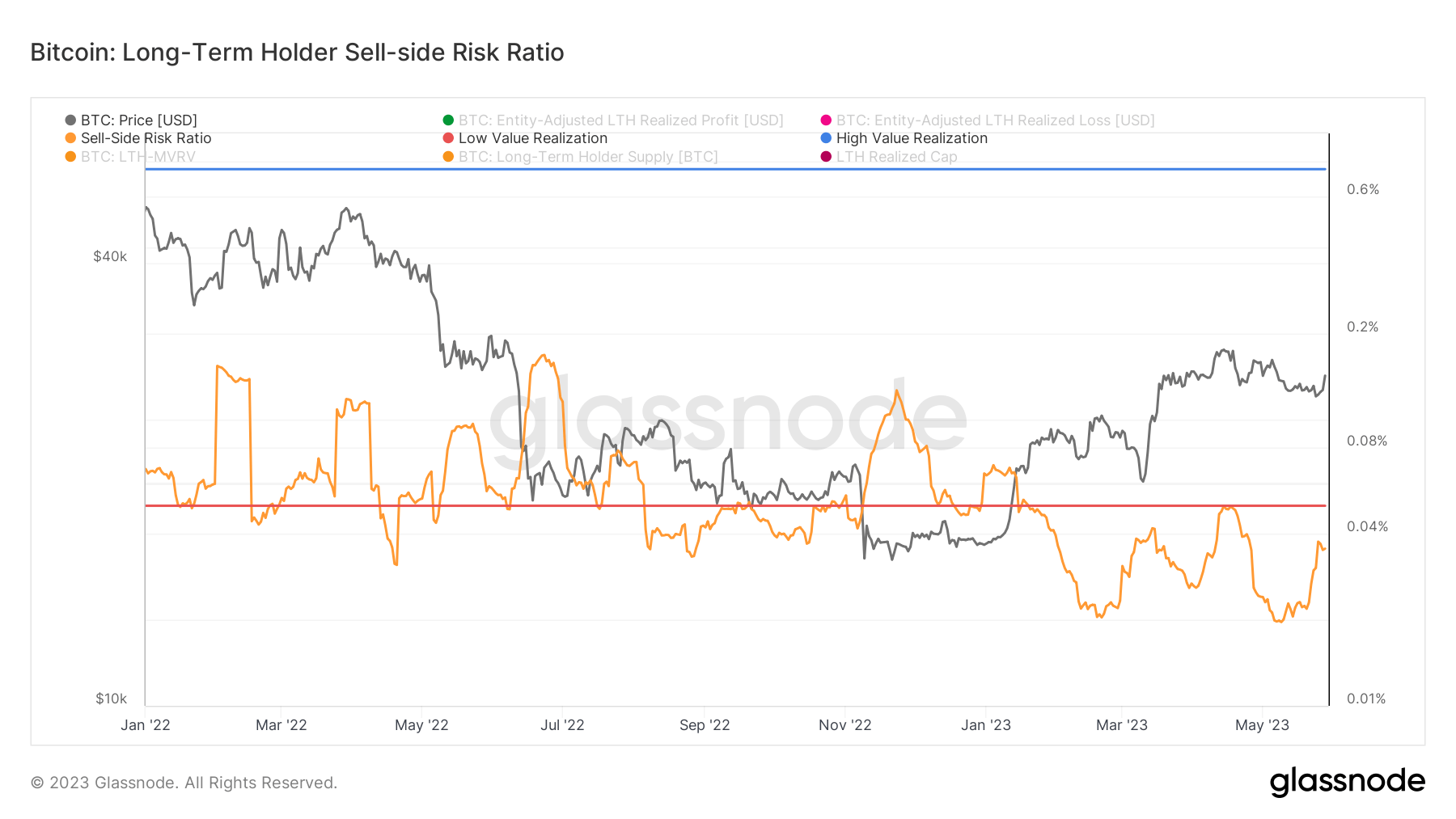

StarCrypto evaluation discovered that the cash collected by these cohorts aren’t more likely to hit the exchanges any time quickly. A notable lower and the continuation of the downtrend seen within the sell-side danger ratio from long-term holders signifies that the collected Bitcoin is being held for its long-term development potential.

Regardless of the ambiguous worth conduct we’ve seen over the week, the lively accumulation by whales and long-term holders could stabilize the market. Whereas different cohorts, corresponding to shrimp and short-term holders, have additionally been accumulating, the numerous market affect of whales and long-term holders means that their accumulation patterns may pave the way in which for a extra stable basis for future development.

The publish Bitcoin touches $28,000 as whales, long-term holders ramp up accumulation appeared first on StarCrypto.