Evaluation carried out by CoinShares highlighted that crypto markets noticed a fifth consecutive week of outflows with the present week totaling a $32.1 million loss.

CoinShares sourced knowledge from digital asset funding suppliers, akin to Grayscale and ProShares, which cater to institutional and accredited buyers.

Head of Analysis at CoinShares, James Butterfill, commented this was resulting from “poor sentiment focussed on BTC.”

Crypto markets endure fifth consecutive weekly outflow

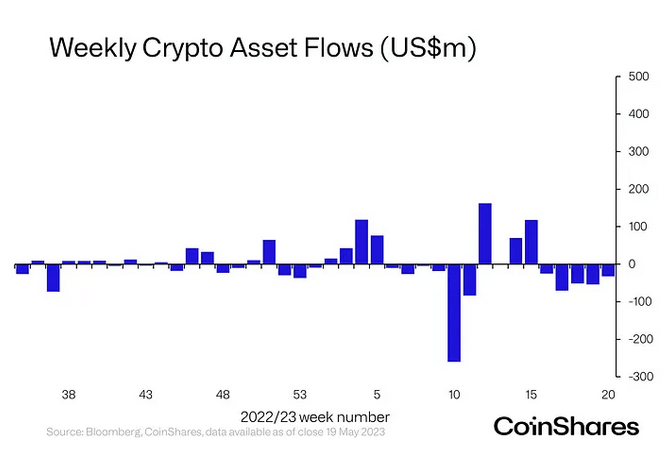

The chart under exhibits the consecutive crypto asset outflows from week 16. The overall outflows throughout this era amounted to $232 million.

For the reason that begin of 2023, there have been extra outflow weeks than inflows, with week 10 (starting Monday, March 6) representing essentially the most important weekly outflows this 12 months, topping roughly $270 million throughout that interval.

Early March was characterised by financial institution failures, which noticed Silvergate, Signature Financial institution, and Silicon Valley Financial institution undone within the present high-interest fee setting.

After that interval, the worth of Bitcoin recovered, bouncing from a low of $22,390 to shut the week beginning March 13 at $28,140, happening to prime $31,000 a month later. Analysts attributed this to a shift in market sentiment towards exhausting property.

Extra not too long ago, the narratives of U.S. regulatory hostility and uncertainty surrounding debates on the U.S. debt ceiling, have taken their toll on crypto property generally.

Germany had the largest outflows

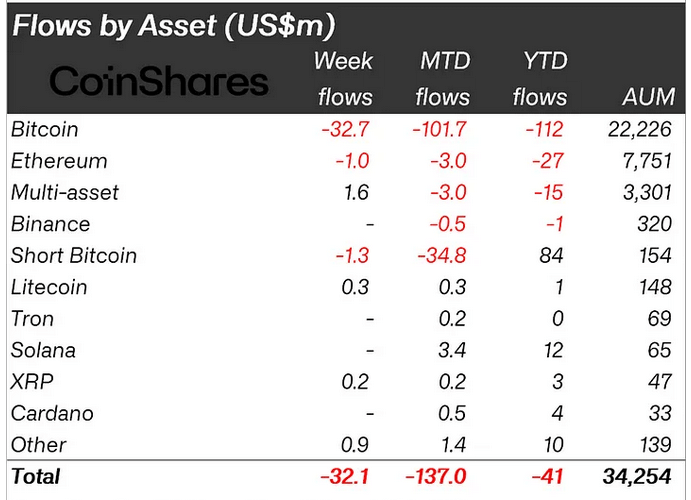

Flows by asset confirmed Bitcoin made up essentially the most important losses, coming in at $32.7 million throughout week 20. Ethereum and Quick Bitcoin additionally suffered losses – albeit at considerably decrease charges of $1 million and $1.3 million, respectively.

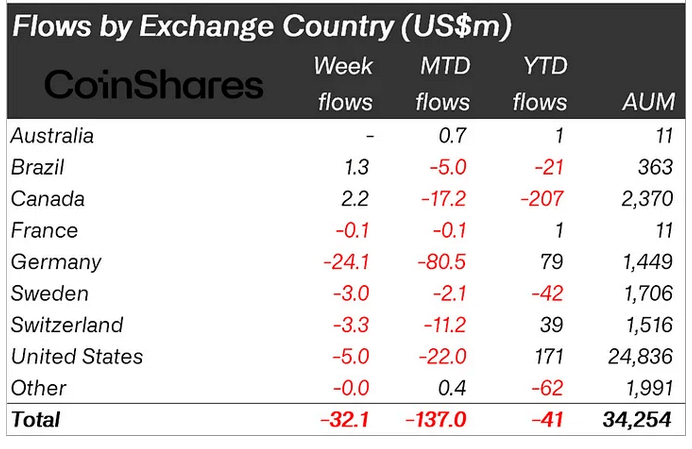

Additional evaluation by nation confirmed Germany was chargeable for essentially the most outflows, accounting for 75% of the weekly drain. The U.S. adopted this at $5 million, then Switzerland at $3.3 million.

CoinShares remarked that the outflow pattern was tied with volumes additionally being materially down for each institutional buyers and spot markets.

“Volumes totaled US$900m for the week, 40% under this 12 months’s common. Volumes for the broader market on trusted exchanges hit their lowest stage since late-2020 at US$20bn for the week.”

The put up Fifth consecutive weekly outflows level to crypto market fragility appeared first on StarCrypto.