Bitcoin’s (BTC) rally towards $30,000 led to greater than $70 million in liquidations for brief merchants within the final 24 hours, based on Coinglass knowledge.

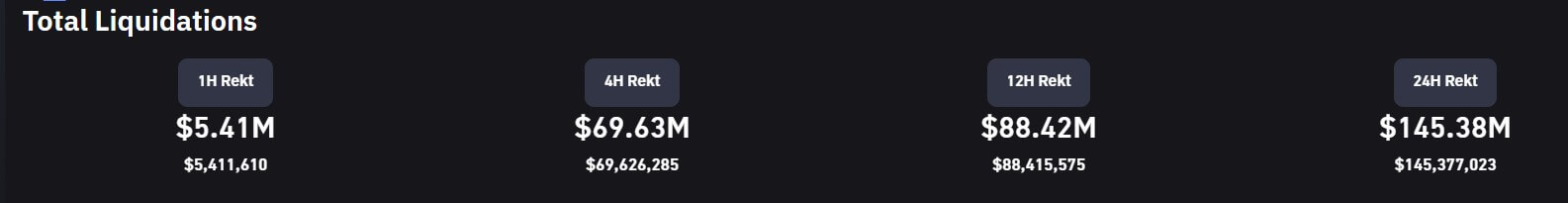

The general crypto market noticed roughly $145 million in liquidation in the course of the interval, largely from merchants who held brief positions in opposition to BTC and different cryptocurrencies.

In line with Coinglass, 37,332 merchants had been liquidated — with essentially the most important liquidation being a $2.2 million BTC-USD brief place on ByBit.

Different liquidated property embody Ethereum (ETH) and Arbitrum (ARB) — with $29.71 million and $4.11 million, respectively. Others like Polygon (MATIC) noticed $2.31 million in liquidation, whereas Litecoin (LTC) recorded $2.27 million.

Many of the liquidations occurred on Huobi, Binance, and ByBit. The three exchanges accounted for 73% of the general liquidations — of which 83% had been brief positions.

Bitcoin eyes $30k

Bitcoin rose by 8.44% within the final 24 hours to commerce at $29,614 on the time of writing, based on StarCrypto’s knowledge.

Fears of one other U.S. banking disaster are fueling the brand new Bitcoin rally. StarCrypto Perception reported that First Republic Financial institution shares plunged by greater than 29% after information emerged that its deposits fell 40% in 22 days.

In the meantime, the U.S. authorities seems unwilling to intervene within the First Republic rescue course of because it did with Silicon Valley Financial institution and Signature Financial institution in March. The federal government took over these banks on the time to stop additional contagion to the broader financial system.

Since this banking disaster started, BTC has rallied by greater than 35%, based on StarCrypto’s knowledge.

Sentiments available in the market have been primarily optimistic. Matrixport chief researcher Markus Thielen stated Bitcoin worth would possibly attain round $45,000 by the top of this yr. Thielen stated:

“Because the US 10 yr bond yield has began to commerce beneath 3.5%, we will assume that inflation shall be an enormous tailwind for threat property – notably Bitcoin.”

The put up Bitcoin makes play for $30k, resulting in $145M liquidations appeared first on StarCrypto.