- Bullish MINA value prediction ranges from $1.902 to $2.082.

- MINA value may also attain $2 this 2023.

- MINA’s bearish market value prediction for 2023 is $0.399.

Described because the “world’s lightest blockchain,” Mina Protocol is an open-source protocol with the goal of offering “true decentralization,” scalability, and safety to the group. One of many essential explanation why the Mina protocol is called the world’s lightest blockchain is as a result of it maintains a continuing measurement of 22kB. This can permit anybody to function a node and safe the community with none requirement for any subtle software program.

With the utilization of zero-knowledge-proof expertise, Mina has already caught the attention of varied buyers. The continual improvement and complete roadmap of the Mina Protocol might be one other issue that might improve the demand for MINA, the native token of the Mina Protocol.

Let’s now take an in depth have a look at Mina Protocol’s operations and its native token, MINA. Furthermore, this text will conduct a complete evaluation of MINA and forecast the value for 2023, 2024, 2025, 2026, until 2050.

Mina (MINA) Market Overview

| 🪙 Title | Mina Protocol |

| 💱 Image | mina |

| 🏅 Rank | #79 |

| 💲 Worth | $0.707885 |

| 📊 Worth Change (1h) | 2.23596 % |

| 📊 Worth Change (24h) | 7.67818 % |

| 📊 Worth Change (7d) | -17.63288 % |

| 💵 Market Cap | $630124981 |

| 📈 All Time Excessive | $9.09 |

| 📉 All Time Low | $0.422757 |

| 💸 Circulating Provide | 890551451.84 mina |

| 💰 Complete Provide | 1026293212.84 mina |

What’s Mina (MINA)?

Described because the “world’s lightest blockchain,” Mina Protocol is an open-source protocol with the goal of offering “true decentralization,” scalability, and safety to the group. One of many essential explanation why the Mina protocol is called the world’s lightest blockchain is as a result of it maintains a continuing measurement of 22kB. This can permit anybody to function a node and safe the community with none requirement for any subtle software program.

One of many essential points that Mina protocol hopes to sort out is the scale challenge that’s typically noticed in the neighborhood. The builders of the Mina Protocol have included a zero-knowledge proof expertise known as zk-SNARKS to create a blockchain that drastically reduces the necessity for computational energy required in a community.

Aside from the zk-SNARKs, the Mina Protocol has additionally mixed it with the Proof-of-Stake consensus mechanism. Furthermore, the Mina Protocol claims that the community is secured by contributors just like the Block Producers and Snark Producers.

MINA, the native token of the Mina Protocol, can act as a utility token inside the community to execute community transactions. Alike different altcoins, MINA will also be exchanged for different tokens. Furthermore, customers can earn rewards with MINA after they select to stake Mina Protocol’s native token. Block Producers and Snark Producers may also earn incentives with MINA after they show a transaction validity.

MINA Present Market Standing

MINA is ranked within the 75 place based mostly on its market capitalization, in line with CoinMarketCap. The present circulating provide of Mina’s native token is at 890,425,107 MINA, whereas its complete provide is 1,026,222,653.

Furthermore, MINA is priced at $0.6757, experiencing a 19.25% fall in seven days. With a market cap of $601,551,790, MINA additionally witnessed a 2.24% surge in 24 hours. Furthermore, MINA is at the moment experiencing a rising demand because the buying and selling quantity, valued at $16,592,098, skilled a spike of 20.91%% in at some point.

A few of the crypto exchanges for buying and selling MINA are at the moment Binance, OKX, CoinBase, Kraken, and KuCoinl.

Now, let’s dive additional and talk about the value evaluation of Mina Protocol’s native token, MINA, for 2023.

MINA Worth Evaluation 2023

Will the MINA blockchain’s most up-to-date enhancements, additions, and modifications assist its value rise? Furthermore, will the adjustments within the cost and crypto business have an effect on MINA’s sentiment over time? Learn extra to seek out out about MINA’s 2023 value evaluation.

MINA Worth Evaluation – Bollinger Bands

The Bollinger Bands is a technical evaluation device that’s used to investigate value motion and volatility. Bollinger Bands (BB) makes use of the time interval and the stand deviation of the value. Usually, the default worth of BB’s interval is ready at 20. The Bollinger Bands consists of higher and decrease bands which can be utilized collectively, together with the center line(easy shifting common), to find out whether or not the value would rise or fall.

The higher band of the BB is calculated by including 2 instances the usual deviations to the center line, whereas the decrease band is calculated by subtracting 2 instances the usual deviation from the center line. Primarily based on the empirical regulation of normal deviation, 95% of the info units will fall inside the two customary deviations of the imply. As such, the costs of the cryptocurrency, when the Bollinger bands are utilized ought to keep inside the higher and decrease bands 95% of the time is the idea behind this.

Earlier, MINA was buying and selling within the backside half of the Bollinger Bands, indicating that the altcoin was going through a weak development. Throughout its time within the backside half, MINA had touched the underside half of the Bollinger. Nevertheless, after MINA touches the decrease band, it began buying and selling within the high half of the Bollinger Bands. MINA’s candlesticks broke into the overbought area, thus, driving the altcoin’s value downwards.

After reaching the overbought area, MINA retraced its steps again to the decrease half. Nevertheless, there may be hope for a bullish market, because the higher bands and decrease bands have began to increase. The continual enlargement of the bands signifies that there’s a probability of development reversal for MINA. If the development reversal occurs, then, MINA transfer into the top-half neighborhood of Bollinger Bands, which is taken into account a uptrend area. Nevertheless, the bands have to increase even additional to verify if the development reversal could occur.

MINA Worth Evaluation – Relative Power Index (RSI)

The Relative Power Index (RSI) is a momentum indicator utilized to seek out out the present development of the value motion and decide whether it is within the oversold or overbought area. Merchants typically use this device to make selections about when to purchase or promote the tokens. When the RSI is usually valued beneath or at 30, it’s thought of an oversold area, and a value correction may occur quickly. Furthermore, when the RSI is valued above or at 70, it’s thought of because the overbought area, and merchants count on the value may fall quickly.

The RSI is valued at 40.64, which might be thought of a weak development because the worth is between 50 and 30. Furthermore, the RSI is beneath the SMA, additional confirming that MINA is falling in a weak development. Nevertheless, there’s a slight chance that MINA may cross paths with the SMA quickly, which may begin the bullish season for MINA. If the RSI retains shifting upward, then, the chance for a robust development is excessive.

MINA Worth Evaluation – Transferring Common

MINA had proven indicators of consolidation because it was buying and selling between the 200MA and the 50MA. Moroever, after few days, MINA skilled a slight uptrend, after it crossed the boundaries of the 50MA. Nevertheless, after few days, MINA fell beneath the 50MA and is at the moment struggling to remain afloat the 200MA.

The 50MA is above the 200MA, which is usually thought of as signal of a bearish sentiment. Nevertheless, the hole between the symptoms is getting slim. If the hole between the 50MA and the 200MA reduces, then, a loss of life cross might be shaped. The loss of life cross may put MINA below the bears’ rule for someday.

MINA Worth Evaluation – Transferring Averages Convergence Divergence

The Transferring Common Convergence Divergence (MACD) indicator can be utilized to establish potential value developments, momentums, and reversals in markets. MACD will simplify the studying of a shifting common cross simpler. The MACD indicator is calculated by subtracting the long-term EMA (Exponential Transferring Common) indicator from the short-term EMA. Usually, the default values for the MACD are set at 12-day EMA, 26-day EMA, and 9-day EMA. Furthermore, MACD is taken into account a lagging indicator because it can not present commerce alerts with none previous value information.

Merchants have reported that often the Transferring Common may create false alerts concerning the value momentum, nevertheless, MACD performs an vital position as it will possibly affirm the developments and establish the potential reversals.

Moreover, there are two strategies by which merchants can speculate the value’s momentum: the crossover methodology and the histogram methodology. Within the crossover methodology, when the MACD line crosses above the sign line, the development may change from a downtrend to a protracted development. Nevertheless, if MACD crosses beneath the sign line, this might point out the beginning of a downtrend.

Within the Histogram methodology, the bars above the sign line point out an uptrend. In the meantime, the Histogram bars beneath the sign line point out a bearish development.

Wanting on the chart, MACD has confirmed that MINA will face a bearish sentiment. The MACD line is beneath the sign line and the gaps proceed to widen. Nevertheless, there may be nonetheless an opportunity that this might fast development reversal. As noticed beforehand, MACD was exhibiting a rollercoaster-type efficiency because the indicator went above and beneath the sign line for a while.

If it follows an identical sample, then, MACD expertise fast development reversals for a while earlier than, lastly, experiencing a long-term bullish development. Nevertheless, merchants should be cautious as MINA may keep below the bears’ spell for a very long time.

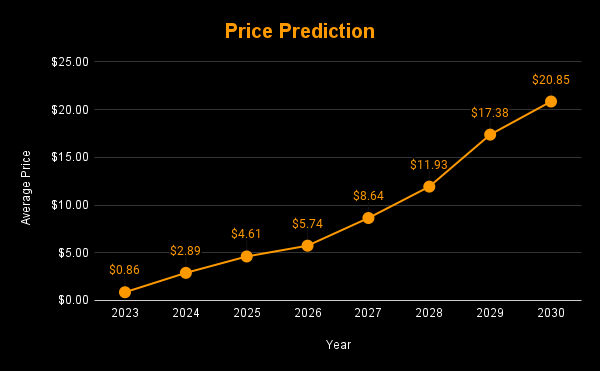

MINA Worth Prediction 2023-2030 Overview

| 12 months | Minimal Worth | Common Worth | Most Worth |

| 2023 | $0.56 | $0.86 | $2.08 |

| 2024 | $1.67 | $2.89 | $4.32 |

| 2025 | $3.02 | $4.61 | $6.51 |

| 2026 | $4.53 | $5.74 | $7.48 |

| 2027 | $7.69 | $8.64 | $10.95 |

| 2028 | $10.89 | $11.93 | $13.08 |

| 2029 | $16.55 | $17.38 | $18.47 |

| 2030 | $19.15 | $20.85 | $22.65 |

| 2040 | $46.71 | $48.59 | $53.64 |

| 2050 | $67.39 | $68.32 | $72.17 |

Mina (MINA) Worth Prediction 2023

Wanting on the charts, MINA is at the moment buying and selling between the Weak Excessive area and the Help area. Furthermore, the altcoin is shifting nearer to the Help area as it’s going through a downtrend. The MACD line can be beneath the sign line, which is an indication of bearish sentiment. Nevertheless, there may be nonetheless an opportunity that the altcoin may transfer upwards if the MACD line crosses above the sign line.

The Common Directional Index (ADX) is at the moment valued at 13.52, which is lower than 20. At any time when the ADX is beneath 20, signifies a weak development. ADX additionally confirms that the MINA would face the bears’ claws quickly. If MINA wants to succeed in the Weak Excessive area, the ADX crosses the 20-value area. Finally, merchants want to attend for affirmation relating to MINA’s bullish development.

In the meantime, the value prediction of MINA for 2023 stays to be bullish and is anticipated to succeed in past the extent of $1.929. The bearish value prediction vary for MINA is between $0.561 to $0.399.

| Bullish Worth Prediction | Bearish Worth Prediction |

| $1.902 – $2.082 | $0.399 – $0.561 |

MINA Worth Prediction – Resistance and Help Ranges

Wanting on the chart, MINA is at the moment buying and selling between the Weak Resistance and the Help. If MINA breakthrough the Weak Resistance, there’s a excessive chance that the altcoin may commerce at $1.929. If 2023 proves to turn out to be extraordinarily bullish, then, MINA may attain the Resistance 2 degree at $2.983, which is the extraordinarily bullish value degree for the altcoin.

Nevertheless, if MINA continues to face the bears’ assault, then, the altcoin commerce on the Help degree of $0.421 and even decrease.

MINA Worth Prediction 2024

Merchants are trying ahead to this 12 months because it might be a historic second for cryptocurrencies, because the Bitcoin halving is anticipated to occur in 2024. More often than not, every time BTC rises, merchants have noticed an identical surge within the altcoins. MINA may be affected by Bitcoin halving and will commerce past the value of $4 by the tip of 2024.

MINA Worth Prediction 2025

MINA may nonetheless expertise the after-effects of the Bitcoin halving and is anticipated to commerce above its 2024 value. Many commerce analysts speculate that BTC halving may create a huge effect on the crypto market. Furthermore, much like many altcoins, MINA will proceed to rise in 2025 forming new resistance ranges. It’s anticipated that MINA would commerce past the $6 degree.

MINA Worth Prediction 2026

It’s anticipated that after a protracted interval of bull run, the bears would come into energy and begin negatively impacting the cryptocurrencies. Throughout this bearish sentiment, MINA may tumble into its help area of $5. Furthermore, when MINA stays within the oversold area, there might be a value correction quickly. MINA, by the tip of 2026, might be buying and selling past the $7 resistance degree after experiencing the value correction.

MINA Worth Prediction 2027

Naturally, merchants count on a bullish market sentiment after the crypto business was affected negatively by the bears’ claw. MINA is anticipated to rise after its slumber within the bear season. Furthermore, MINA may even break extra resistance ranges because it continues to recuperate from the bearish run. Subsequently, MINA is anticipated to commerce at $10 by the tip of 2027.

MINA Worth Prediction 2028

As soon as once more, the crypto group is trying ahead to this 12 months as there will likely be a Bitcoin halving. Alike many altcoins, MINA will proceed to kind new greater highs and is anticipated to maneuver in an upward trajectory. Therefore, MINA could be buying and selling at $13 after experiencing an enormous surge by the tip of 2028.

MINA Worth Prediction 2029

2029 is anticipated to be one other bull run as a result of aftermath of the BTC halving. Nevertheless, merchants speculate that the crypto market would step by step turn out to be secure by this 12 months. In tandem with the secure market sentiment and the slight value surge anticipated after the aftermath, MINA might be buying and selling at $18 by the tip of 2029.

MINA Worth Prediction 2030

After witnessing a bullish run available in the market, MINA and plenty of altcoins would present indicators of consolidation and would possibly commerce sideways for a while whereas experiencing minor spikes. Subsequently, by the tip of 2030, MINA might be buying and selling at $22.

MINA Worth Prediction 2040

The long-term forecast for MINA signifies that this altcoin may attain a brand new all-time excessive(ATH). This could be one of many key moments as HODLERS could count on to promote a few of their tokens on the ATH level. Nevertheless, MINA could face a slight fall earlier than beginning its upward journey as soon as once more. It’s anticipated that the typical value of MINA may attain $50 by 2040.

MINA Worth Prediction 2050

The group believes that there will likely be widespread adoption of cryptocurrencies, which may preserve gradual bullish positive aspects. By the tip of 2050, if the bullish momentum is maintained, MINA may surpass the resistance degree of $70.

Conclusion

MINA has been a part of the watch-out listing for a lot of buyers because it goals to make its mark within the blockchain business. If buyers proceed to indicate curiosity in MINA and these tokens of their portfolio, then, it may proceed to stand up. MINA’s bullish value prediction reveals that it may go past the $1.902 degree. Furthermore, MINA may surpass the $70 degree by the tip of 2050.

FAQ

Described because the “world’s lightest blockchain,” Mina Protocol is an open-source protocol with the goal of offering “true decentralization,” scalability, and safety to the group. One of many essential explanation why the Mina protocol is called the world’s lightest blockchain is as a result of it maintains a continuing measurement of 22kB. This can permit anybody to function a node and safe the community with none requirement for any subtle software program.

MINA will be traded on many crypto exchanges equivalent to Binance, OKX, CoinBase, Kraken, and KuCoin.

It was launched in 2020.

MINA achieved its All-Time Excessive of $9.9141 in June 2021.

MINA is anticipated to succeed in $1.9 by 2023.

MINA is anticipated to succeed in $4 by 2024.

MINA is anticipated to succeed in $6 by 2025.

MINA is anticipated to succeed in $7 by 2026.

MINA is anticipated to succeed in $10 by 2027.

MINA is anticipated to succeed in $13 by 2028.

MINA is anticipated to succeed in $18 by 2029.

MINA is anticipated to succeed in $22 by 2030.

MINA is anticipated to succeed in $50 by 2040.

MINA is anticipated to succeed in $70 by 2050.

Disclaimer: The views and opinions, in addition to all the knowledge shared on this value prediction, are printed in good religion. Readers should do their very own analysis and due diligence. Any motion taken by the reader is strictly at their very own danger. Coin Version and its associates is not going to be held chargeable for any direct or oblique harm or loss.