- CTSI reveals bullish stable momentum with potential for additional features.

- Low volatility ranges again CTSI’s bullish power, enhancing investor confidence.

- Optimistic MACD and KST line scores sign a possible upward pattern in CTSI worth.

After an extended bear run within the early hours of the day, Cartesi’s (CTSI) worth fell to a 24-hour low of $0.2417 earlier than regaining help. Conversely, Bulls defied the bear’s rule and pushed the CTSI worth to a 30-day contemporary excessive of $0.3392. As of press time, the bullish momentum remained intact, leading to a 20.97% achieve to $0.2978.

If the constructive pattern continues and the worth breaks via the $0.3392 barrier, the subsequent resistance degree is likely to be round $0.3856, maybe resulting in a worth rise. Nonetheless, a correction might happen if the momentum slows and fails to interrupt via the resistance degree. This correction might trigger the worth to fall towards the help degree, presenting a shopping for alternative for merchants who missed the primary breakout.

In the course of the bull run, the CTSI’s market capitalization and 24-hour buying and selling quantity elevated by 19.97% and 287.00%, respectively, to $206,008,986 and $344,685,379. This enhance signifies that CTSI is in sturdy demand amongst traders and merchants and will achieve momentum quickly.

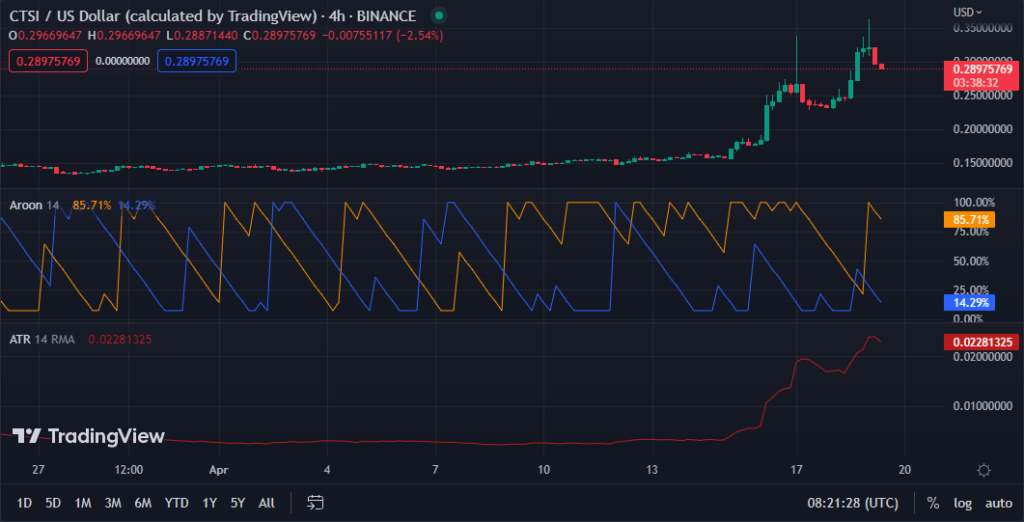

The Aroon up studying of 85.71% and the Aroon down studying of 14.29% signifies that the bullish momentum within the CTSI might final barely longer. This motion means that the bull power is gaining power and that now is an effective time for merchants to contemplate establishing an extended place in CTSI.

The distinction of 71.42 between each Aroons illustrates the market’s sturdy constructive tendency, suggesting that the worth of CTSI might climb additional within the close to future.

For the reason that ATR is 0.02281305, the bullish power of the CTSI appears to be backed by low volatility ranges, suggesting that the worth might proceed to rise slowly with out abrupt and dramatic oscillations. This motion enhances investor confidence and permits merchants to take lengthy bets within the CTSI.

With a worth of 0.02901049, the MACD line is advancing above the sign line, supporting the market’s constructive angle and signalling a possible upward pattern within the CTSI.

This pattern alerts the growing momentum of the CTSI’s worth motion, and merchants might discover buying possibilities to revenue from the anticipated worth achieve.

With a Know Certain Factor (KST) line score of 542.5443, the CTSI’s worth pattern is stable and more likely to proceed rising within the foreseeable future. This KST pattern demonstrates the bull’s eagerness to drive the worth larger, and merchants may even see buying CTSI as a doubtlessly rewarding alternative.

Bulls are taking cost of CTSI because it hits a 30-day excessive, backed by growing market capitalization and buying and selling quantity, low volatility, and bullish stable indicators.

Disclaimer: The views, opinions, and knowledge shared on this worth prediction are printed in good religion. Readers should do their analysis and due diligence. Any motion taken by the reader is strictly at their very own danger. Coin Version and its associates won’t be answerable for direct or oblique harm or loss.