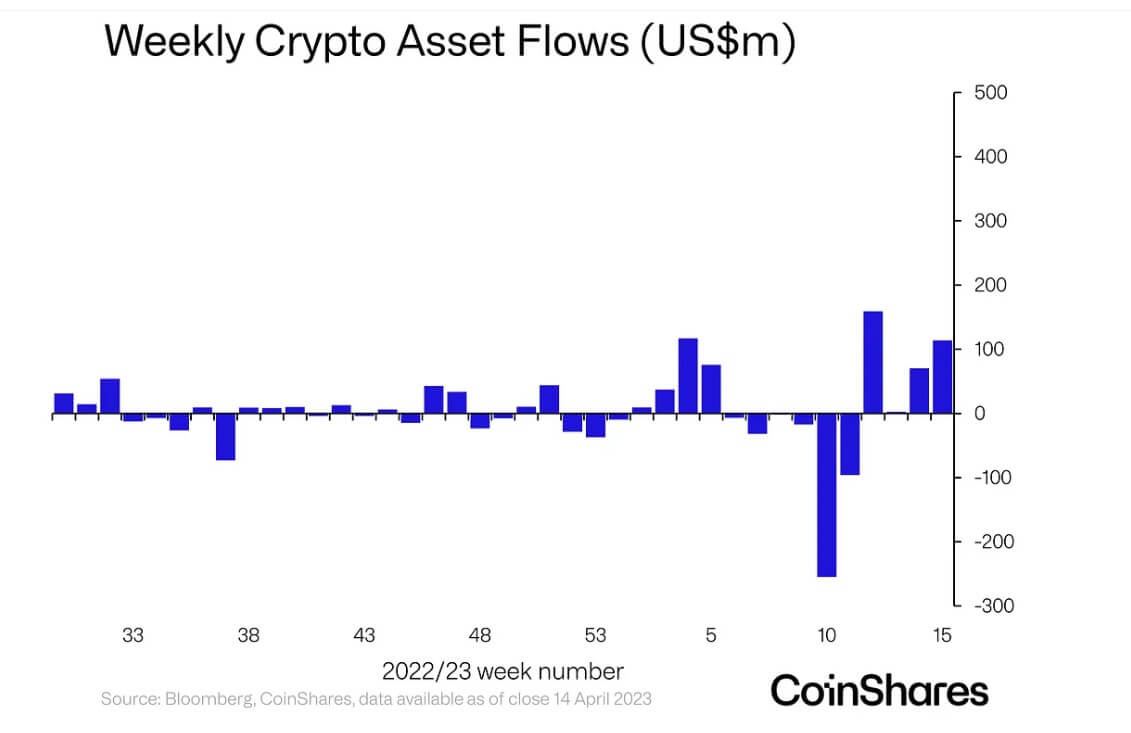

Digital property funding merchandise noticed $114 million in inflows through the week of April 11 as buyers pumped cash into Bitcoin (BTC), in response to CoinShares’ report.

The previous week’s influx marks the fourth consecutive week for crypto merchandise. In keeping with CoinShares, inflows throughout this era now whole $345 million.

Bitcoin influx tops $100 million

BTC dominated inflows to crypto funding merchandise, seeing 91% — $104 million — of all of the investments for the week.

The flagship digital asset traded above $30,000 for the primary time in virtually a yr. Its adoption additionally rose to a new all-time excessive as extra addresses have been holding not less than 0.1 BTC than ever earlier than.

In the meantime, CoinShares funding strategist James Butterfill wrote that the BTC inflows point out a “flight to security by buyers terrified of the continuing conventional finance challenges.”

Butterfill added:

“This bettering sentiment comes at a time of very low volumes within the Bitcoin market, averaging simply $5.6 billion per day in comparison with $12 billion for the total yr.”

Nevertheless, he famous that “opinion stays divided” as a result of Quick Bitcoin merchandise additionally noticed inflows of $14.6 million.

BTC’s whole influx on the year-to-date metric is round $78 million.

Ethereum, others see minimal influx

Ethereum (ETH) noticed an influx of $300,000 through the previous week regardless of the completion of its Shapella improve. The Shappella improve is the primary main ETH community replace because the Merge and would allow validators to withdraw their staked ETH.

The improve positively mirrored on ETH’s worth, pushing it above $2100 for the primary time since Might 2022. As of press time, over 1 million ETH have been withdrawn.

In keeping with Coinshares, there was little exercise in altcoins apart from Polygon (MATIC) and Solana, (SOL) which noticed $2.1 million in outflows, respectively.

In the meantime, blockchain equities returned to their pre-FTX ranges as they noticed inflows of $5.8 million through the week beneath evaluation. The whole worth of property beneath administration for this product reached $1.9 billion — its highest since October 2022.

The put up Buyers flock to Bitcoin after Ethereum’s Shapella improve appeared first on StarCrypto.