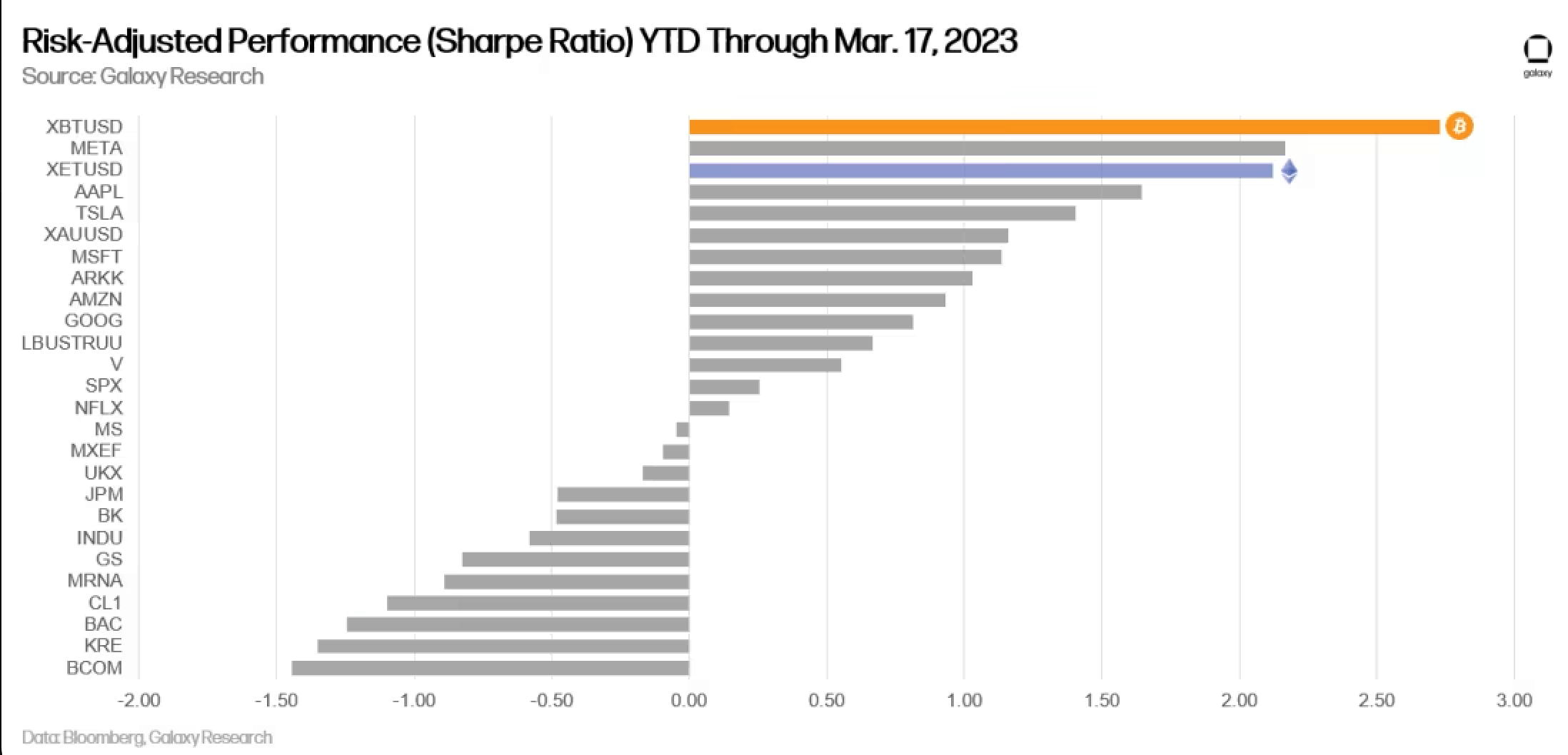

In keeping with new information from the digital asset administration firm Galaxy, Bitcoin (BTC) is the best-performing asset of the yr in comparison with equities, fixed-income securities, indices, and commodities on a risk-adjusted foundation.

The newly launched information corresponds to gold growing and equities lowering. It explains how the volatility of Bitcoin is on a multi-year downward pattern, and that futures open curiosity and perpetual swap funding charges counsel the rally isn’t based mostly purely on hypothesis.

On-chain information exhibits ongoing accumulation, longer holding occasions, and rising possession dispersion. The upcoming 4th halving is anticipated to precede a longer-term bullish advance.

Bitcoin efficiency as in comparison with different property

Bitcoin has been the top-performing asset of 2023 when measuring risk-adjusted efficiency (Sharpe ratio) in comparison with equities, fixed-income securities, indices, and commodities. It has constantly been the most effective performers throughout numerous timeframes, excluding the one-year timeframe.

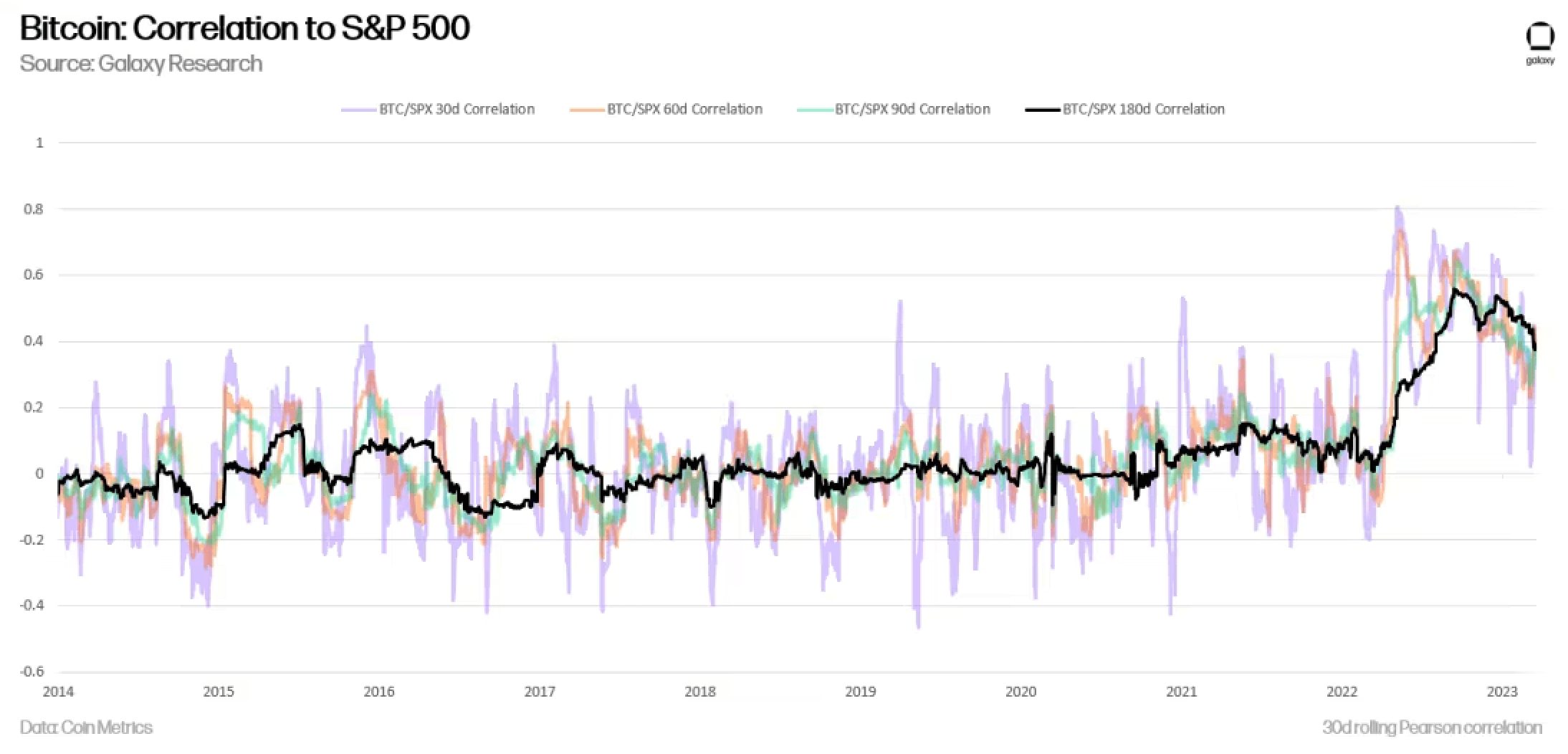

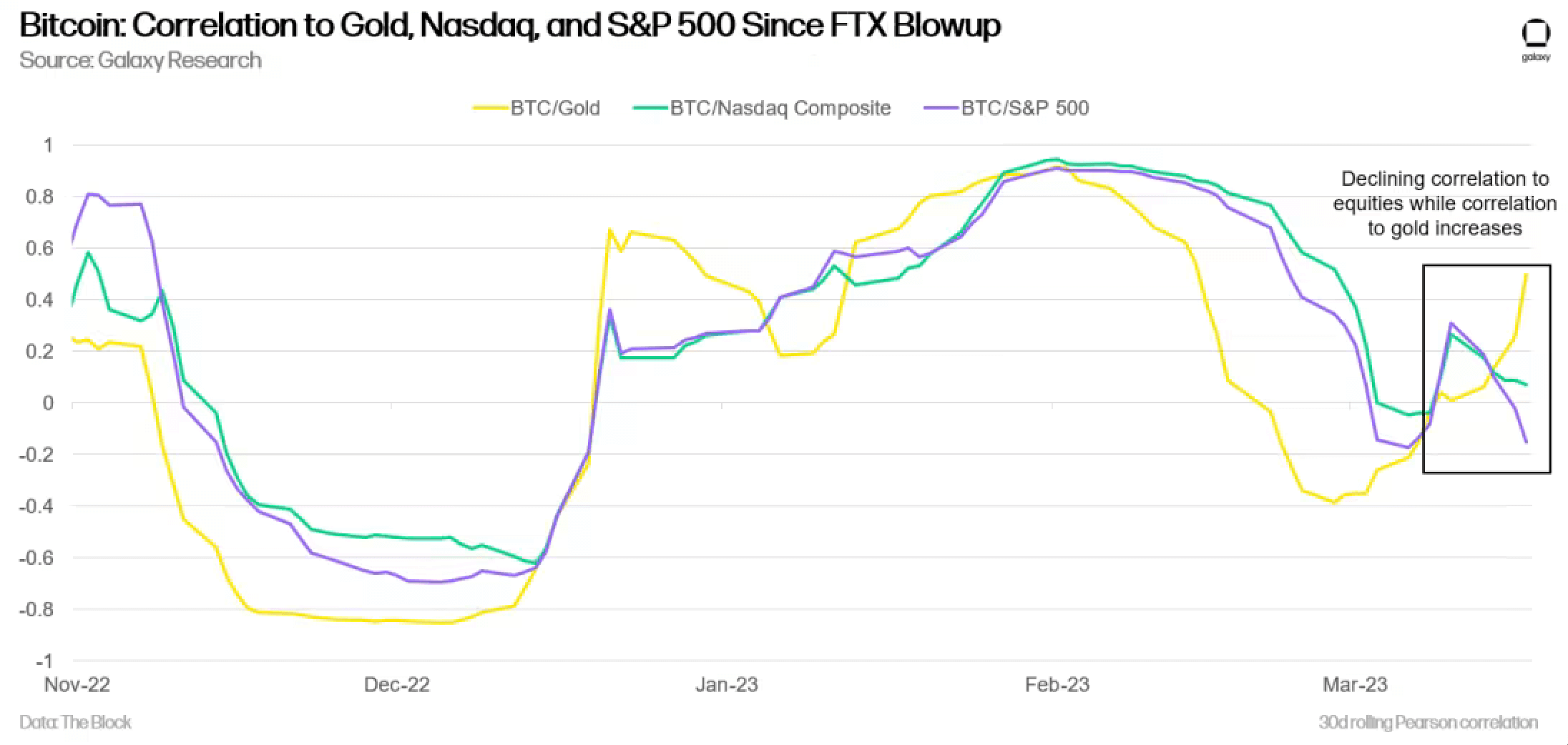

Bitcoin’s correlation with equities has been excessive over the previous 18 months however has just lately decreased. In the meantime, its correlation with gold has elevated considerably — significantly for the reason that banking disaster.

These correlations point out that Bitcoin has exhibited safe-haven traits within the present financial local weather — demonstrating the worth of Bitcoin’s elementary traits.

Notable future provide occasions

There are two upcoming provide occasions for Bitcoin — one bullish and one probably bearish. The 4th halving — set for April 2024 — is anticipated to carry the inflation fee beneath 1%, traditionally resulting in subsequent bull runs. Galaxy notes that the drop in new each day issuance could also be much less impactful than anticipated.

Moreover, the Mt. Gox chapter trustee holds 141,686 BTC — which it stated just lately it doesn’t plan to promote. The biggest creditor —the Mt. Gox Funding Fund — opted to obtain early cost in roughly 70% BTC and 30% money and doesn’t plan to promote the BTC it receives.

The early distribution date is anticipated September and it’s anticipated that the majority BTC won’t be bought upon distribution. There could also be second-order impacts in BTC lending markets if collectors look to lend their BTC both off-chain or on-chain by way of changing to WBTC, in response to Galaxy.

Learn the complete Galaxy report.