Digital asset-based funding merchandise noticed $255 million in outflows through the week of Mar. 6 – 12, marking the fifth consecutive week of losses, in line with CoinShares’ weekly report.

The quantity additionally marks probably the most vital single weekly outflow on file, which presently accounts for 1% of the entire market, as CoinShares’ knowledge signifies. In the course of the week of Mar. 6 – 12, the whole belongings beneath administration (AuM) recorded a ten% decline, which “worn out the inflows seen this 12 months,” in line with the report.

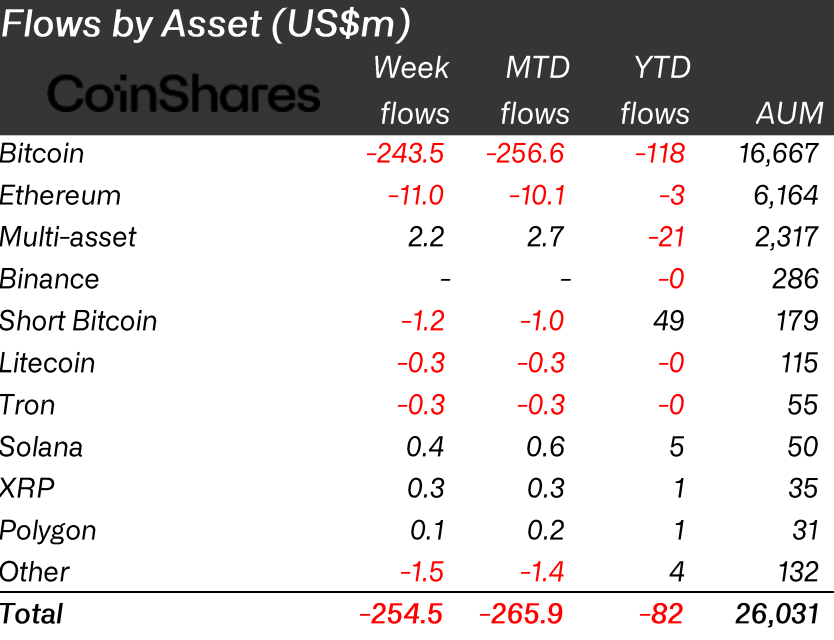

Flows by asset

Bitcoin (BTC) – primarily based funding merchandise recorded the most important outflow final week with $243.5 million outflows, accounting for over 95% of the whole flows recorded through the week.

Ethereum (ETH) adopted BTC by recording the second-highest quantity at $11 million. Although they’ve recorded inflows over the previous few weeks, Brief-BTC merchandise misplaced $1.2 million in outflows and positioned third within the rating.

Litecoin (LTC) and Tron (TRX) additionally recorded 300,000 outflows every. However, Solana (SOL), Ripple (XRP), and Polygon (MATIC) ended the week by rising 400,000, 300,000, and 100,000, respectively.

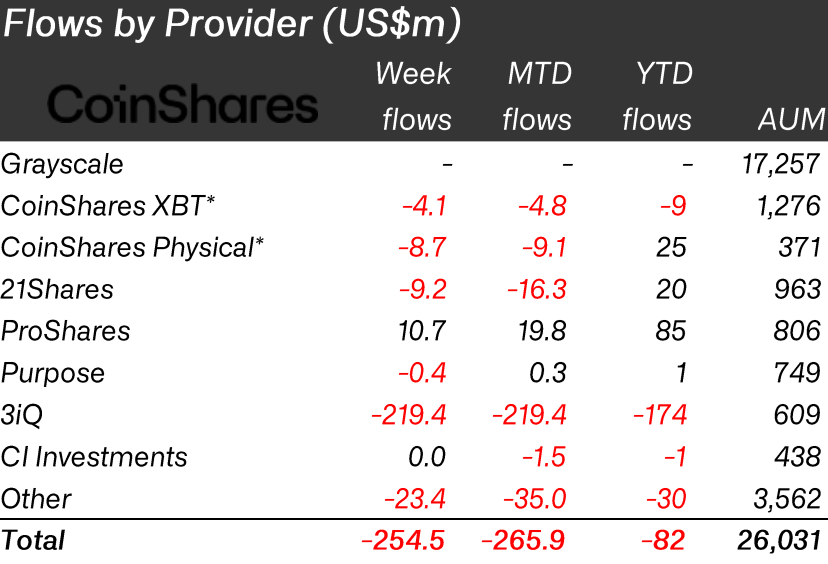

Move by supplier

Trying on the stream of the funds primarily based on the suppliers, 3iQ emerges because the establishment that recorded the very best quantity of outflows by recording $129.4 million.

Coinshares bodily and Coinshares XBT misplaced a mixed $12.8 million, whereas 21Shares recorded $9.2 million in outflows. Objective and different establishments additionally recorded 400,000 and $23.4 million in outflows final week.

However, ProShares emerged as the one establishment that recorded inflows and grew by $10.7 million inside seven days.