Outlined as addresses which have held Bitcoin for over 155 days, long-term holders are sometimes thought of the spine of the market. They create assist as they have an inclination to build up BTC when costs are declining, and gas bull rallies as they distribute the accrued cash when the market is in an upswing.

Due to this fact, figuring out the Bitcoin backside requires trying on the conduct of long-term holders, as a real backside is reached solely when LTHs capitulate.

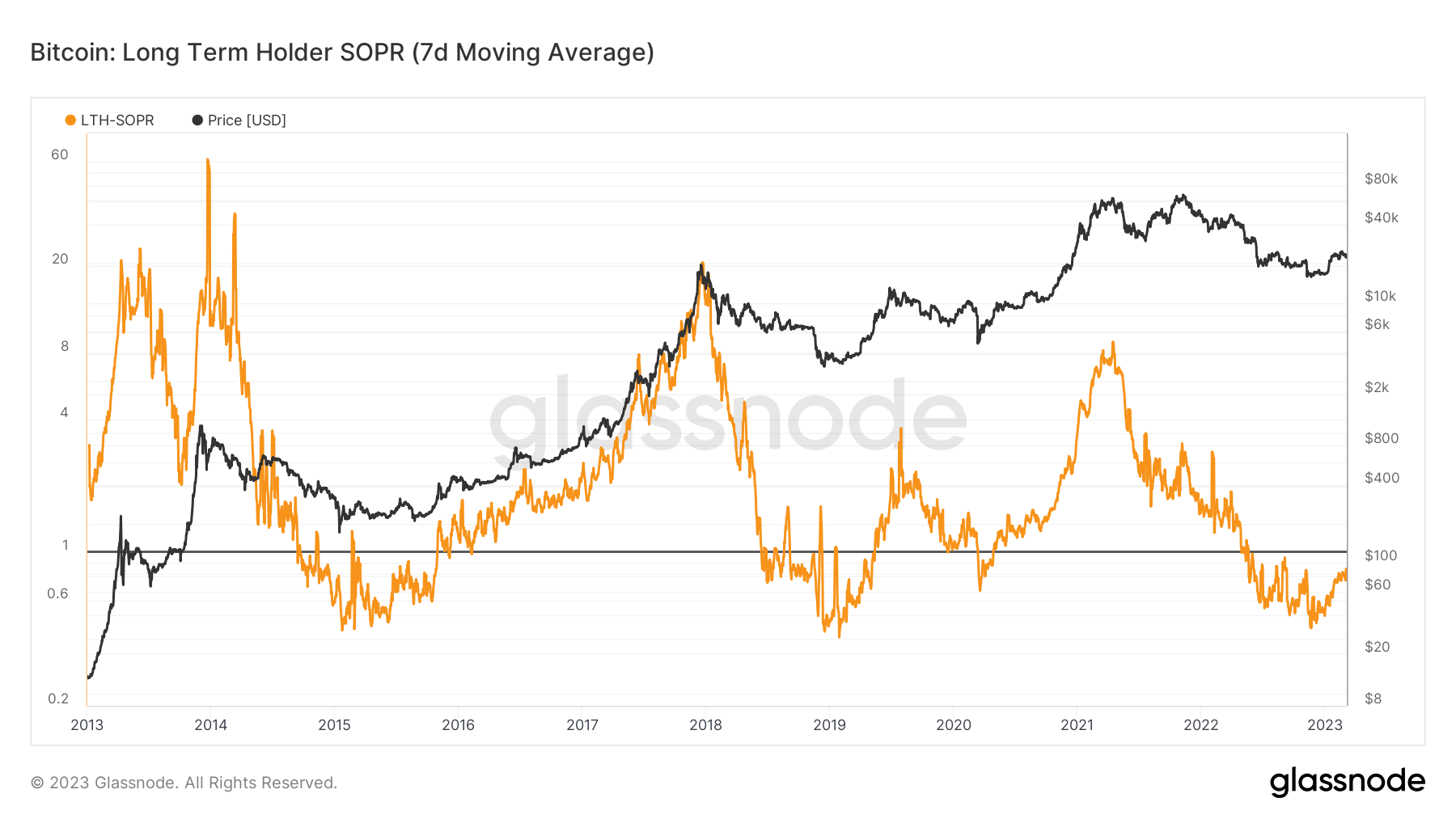

Spent Output Revenue Ratio (LTH SOPR) is a metric that gives a transparent perception into the conduct of Bitcoin holders. When utilized to LTHs, it reveals the diploma of realized revenue for all cash LTHs moved over a specific time-frame.

A SOPR worth larger than 1 implies that the cash have been promoting at a revenue, whereas a SOPR worth lower than 1 reveals the cash are promoting at a loss. A SOPR trending increased reveals revenue is being realized, whereas a downward trending SOPR signifies losses.

Knowledge analyzed by StarCrypto confirmed that the LTH SOPR has been trending upward for the reason that starting of the 12 months after bottoming to a three-year low in December 2022.

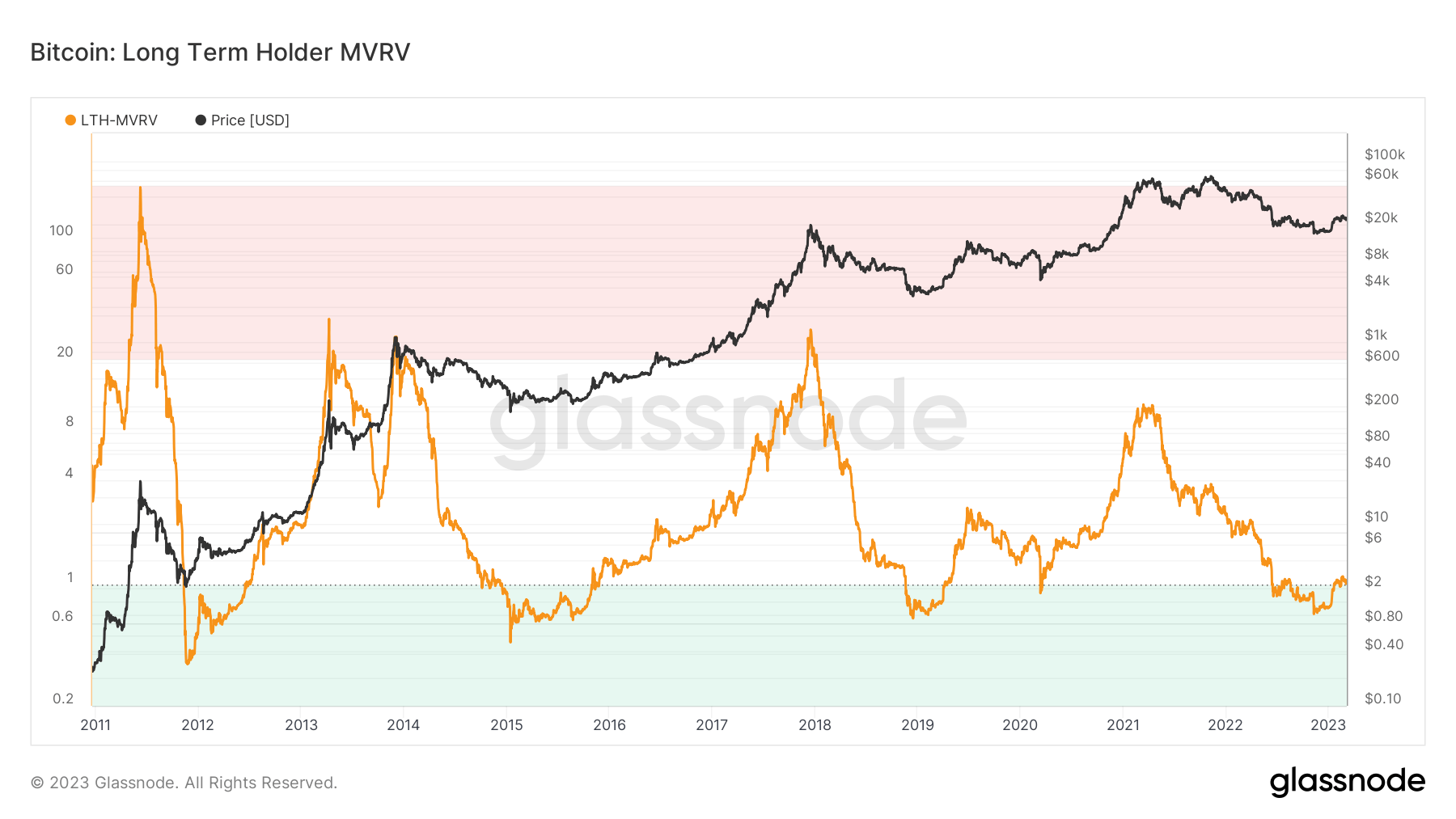

Not like SOPR, which takes under consideration solely spent outputs with a lifespan of greater than 155 days, LTH MVRV takes under consideration solely unspent outputs (UTXO).

The MVRV ratio reveals the ratio of Bitcoin’s market cap and its realized cap to find out whether or not it’s buying and selling above or under truthful worth. Like SOPR, it offers a strong evaluation of market profitability as excessive deviations between market worth and realized worth can be utilized to determine market tops and bottoms.

A rising MVRV ratio signifies a bigger diploma of unrealized revenue and the potential for distribution as traders race to lock in earnings. A lowering or low MVRV reveals a smaller diploma of unrealized earnings that would sign undervaluation and poor demand.

When the MVRV ratio drops under 1, a big portion of the provision is held both at break-even costs or at a loss. That is often an indication of market capitulation and signifies that the bear accumulation part is perhaps coming to an finish.

StarCrypto evaluation discovered that the LTH MVRV ratio has simply damaged above 1, indicating a possible finish to the bear market.

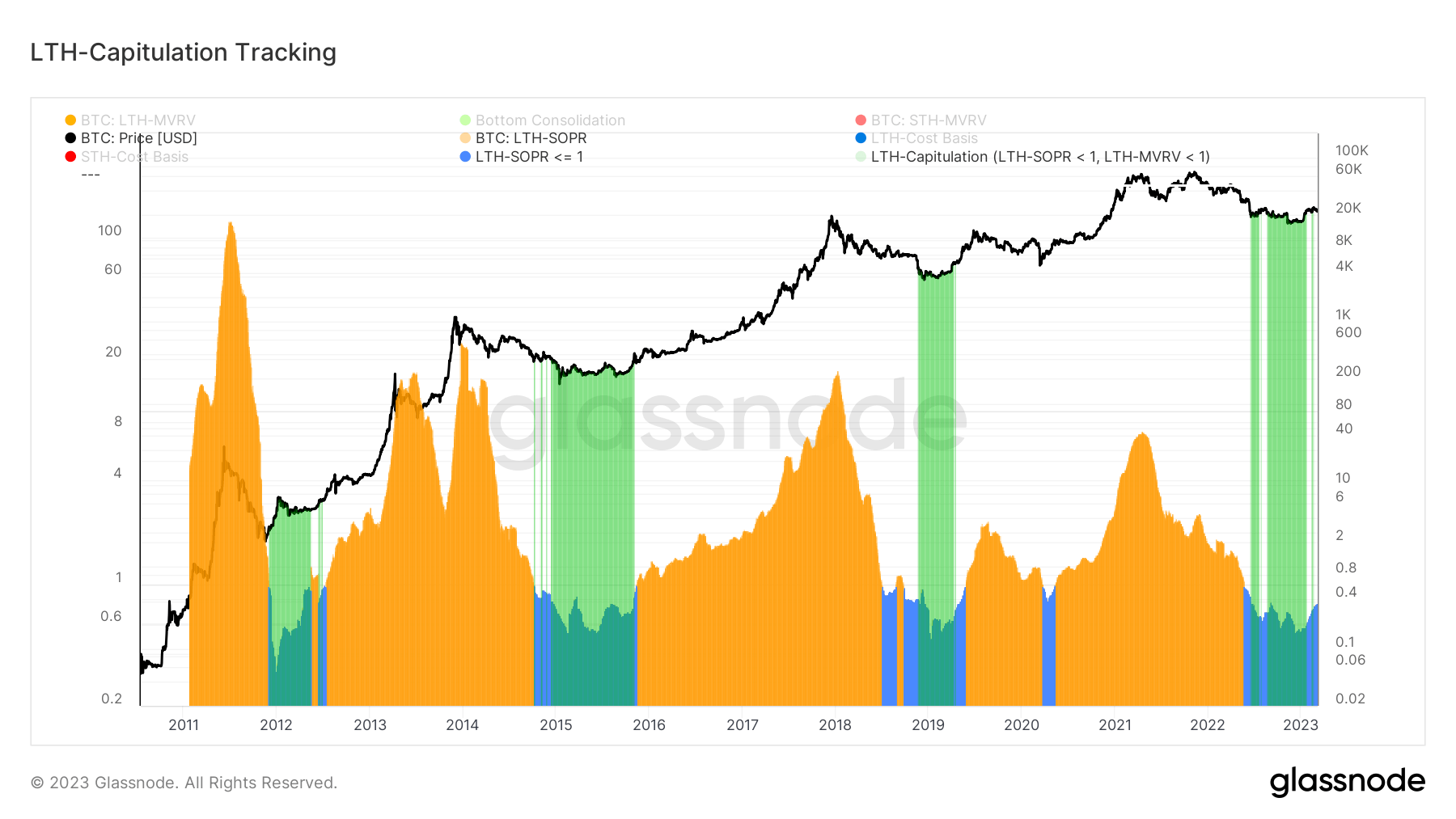

Compiling each SOPR and the MVRV ratio reveals a considerably hesitant finish to the bear market.

Inexperienced highlights on the graph under present intervals when each the LTH SOPR and the LTH MVRV ratios trended at or under 1. When the 2 ratios drop under 1, it reveals market capitulation as each spent cash are being bought at a loss and a big portion of the circulating provide is being held at an unrealized loss.

StarCrypto evaluation confirms that the market is firmly out of capitulation. Nevertheless, because the LTH SOPR remains to be trending at slightly below 1, the market nonetheless lacks the arrogance to enter right into a full-blown rally.