Asset administration and danger administration are essential elements of any funding technique, and the digital asset house isn’t any exception. With the volatility and complexity of the crypto market, it’s important for traders to watch their investments and assess their danger publicity fastidiously.

CryptoCompare, a number one digital asset knowledge supplier, has launched its month-to-month Digital Asset Administration Assessment, which offers an summary of the worldwide digital asset funding product panorama.

Methodology

The report tracks the adoption of digital asset merchandise by analyzing belongings beneath administration, buying and selling volumes, and value efficiency. The assessment drew knowledge from numerous sources, together with Monetary Occasions, 21Shares, Coinshares, XBT Supplier, Grayscale, OTC Markets, HanETF, Yahoo Finance, 3iQ, Function, VanEck, ByteTree, Nordic Progress Market, Bloomberg, and CryptoCompare.

Key Findings

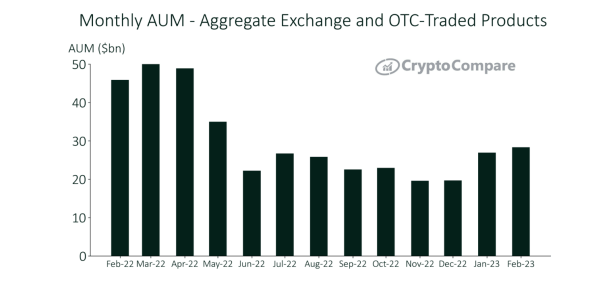

Digital asset investments continued their upward pattern in February, with the overall belongings beneath administration (AUM) for digital asset funding merchandise reaching a brand new excessive of $28.3 billion.

This represents a 5.25% improve from January, the third consecutive month-to-month improve in AUM. The AUM surge alerts traders’ bullish sentiment and a rising urge for food for digital belongings.

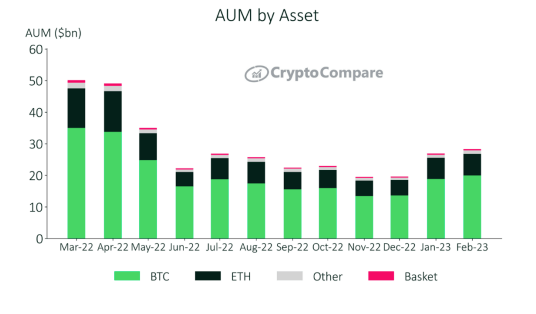

Bitcoin and Ethereum-based merchandise skilled elevated belongings beneath administration (AUM) in February. BTC-based merchandise noticed an increase of 6.06%, bringing the overall AUM to $20.0 billion, whereas ETH-based merchandise noticed a 1.72% improve, bringing the overall AUM to $6.80 billion. Consequently, BTC and ETH merchandise now account for 70.5% and 24.0% of the overall AUM market share, respectively.

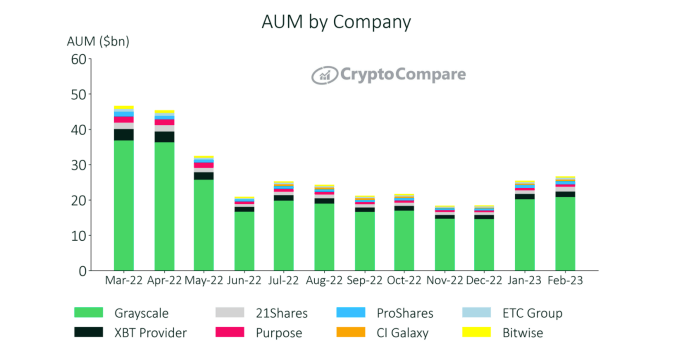

Throughout February, CI Galaxy had the best improve in belongings beneath administration (AUM), with an increase of 37.7% to $460 million. Following intently was 21Shares, which noticed a 33.4% improve to $1.38 billion. Regardless of these good points, Grayscale continued to carry the dominant place, with merchandise recording a complete AUM of $20.8 billion, representing a 3.02% improve in comparison with the earlier month. XBT Supplier ($1.54 billion) and 21Shares ($1.38 billion) adopted Grayscale because the market’s second and third-largest gamers.

In response to the newest report for February 2023, the common day by day combination product volumes throughout all digital asset funding merchandise noticed a slight decline of 9.39% to $73.3 million.

In comparison with December 2022, volumes have elevated by 21.5%. Regardless of this enchancment, volumes are nonetheless down by 80.1% in comparison with February 2022, indicating the risky nature of the market.

BTC-based merchandise remained dominant by way of weekly internet flows, with each BTC-based merchandise and Quick BTC merchandise recording constructive flows of $5.3 million and $4.6 million, respectively.

DCG’s resolution to promote its positions in Grayscale Belief Merchandise was pushed by its want to lift funds. One of the crucial important gross sales was roughly 25% of its Ethereum Belief (ETHE) at a reduction of round 50% of the belief’s value, in line with a report from the Monetary Occasions cited within the report.

The total CryptoCompare’s Digital Asset Administration Assessment report could be discovered right here.