Bitcoin and different risk-on property are below short-term strain because the macro narrative flips from recession to sticky, entrenched inflation.

Sticky inflation

Markets are braced for an imminent recession. Nevertheless, present macro evaluation suggests a recession will not be coming, not less than not within the quick time period. As an alternative, analysts count on a interval of sticky, entrenched inflation.

On Feb. 24, the U.S. Bureau of Financial Evaluation (BEA) launched Private Consumption Expenditure (PCE) information for January, exhibiting an precise fee of 4.7%, a lot increased than the anticipated fee of 4.3%.

PCE measures the value of products and companies, much like the Shopper Worth Index (CPI), however differs by sourcing information from companies versus customers, as is the case with CPI.

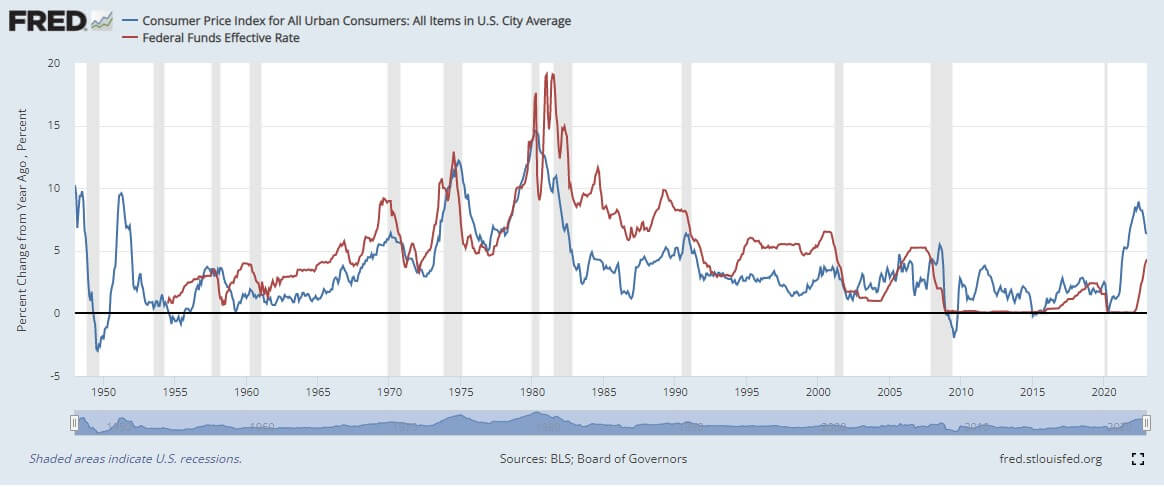

Though Yr-on-Yr CPI information reveals inflation coming down, thus conflicting with PCE information, the U.S. labor market stays sizzling with a 50-year low in unemployment and spiking wage progress – suggesting inflationary pressures stay.

The upshot of that is possible additional hawkishness from the Fed, which said that its main objective is to deliver inflation right down to 2%.

In flip, ought to increased inflation turn out to be the dominant narrative, the impact may see value strain on Bitcoin, and different risk-on property, as disposable revenue will get squeezed to maintain tempo with the value of necessities.

Fed funds fee on the rise

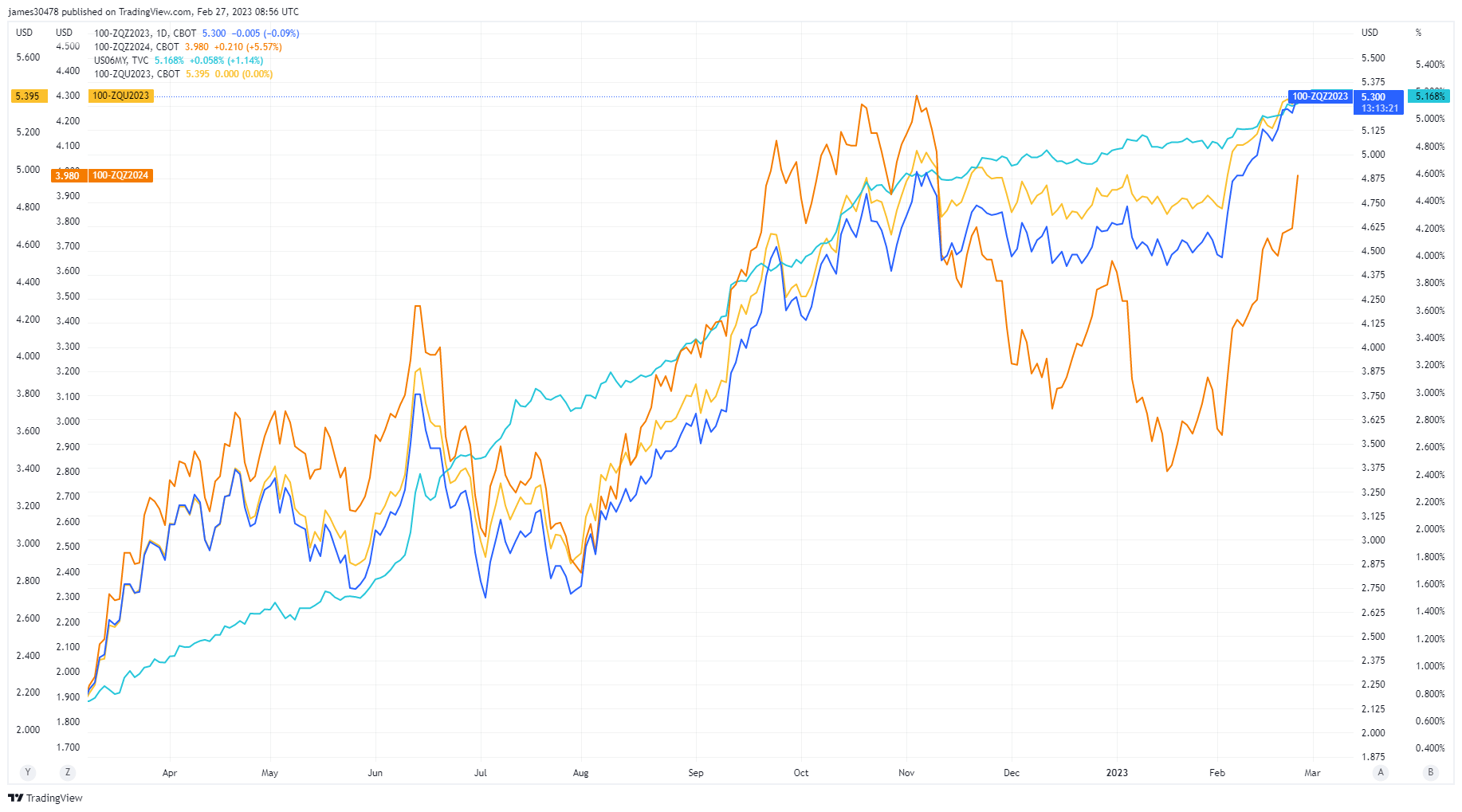

Fed funds futures information beforehand pointed to rising confidence inside the interbank lending market. Nevertheless, current actions present this narrative has flipped.

Fed funds futures discuss with derivatives based mostly on the federal funds fee – the lending fee charged by banks (to different banks) for in a single day lending.

The chart beneath reveals Fed funds futures for September 2023, December 2023, and December 2024 have adjusted increased. The next fee throughout the board suggests banks lack confidence in lending to different banks – that means interbank borrowing turns into costlier.

Like persistent inflation, a better Fed funds fee will create downward strain on risk-on property as banks clamp down on borrowing to restrict their publicity.

Conserving charges increased for longer

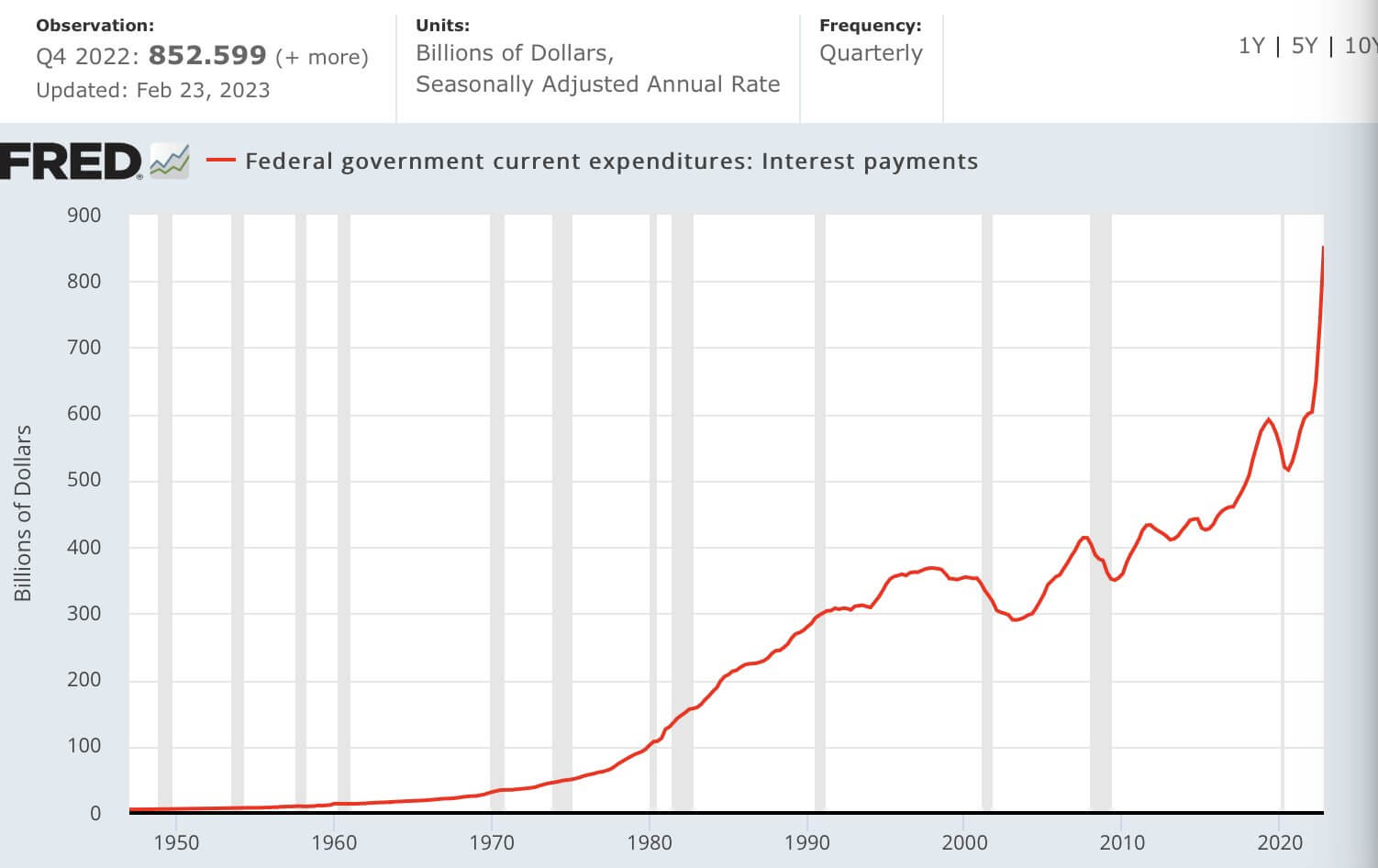

The curiosity paid on federal authorities debt is approaching $1 trillion. The chart beneath reveals curiosity funds nearly doubling since 2020.

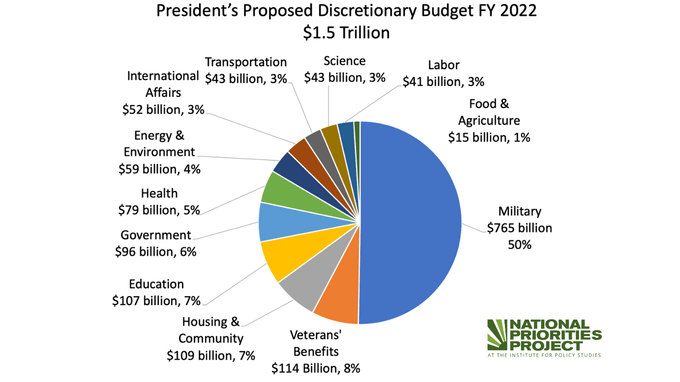

50% of 2022’s $1.5 trillion discretionary price range was spent on the navy, with the subsequent most vital slice, at 8%, allotted to Veterans’ Advantages totaling $115 billion.

Conserving rates of interest increased for longer would make it tougher to service present money owed – this places the Fed in a troublesome spot relating to seeing issues via to a 2% inflation fee.

The up to date predicted terminal rate of interest now is available in at 5.25% -5.50%, giving leeway of 75 foundation factors from the present fee.

The following FOMC assembly is scheduled to conclude on March 22. Presently, economists are 70% in favor of a 25 foundation level hike, with the remaining 30% anticipating a 50 foundation level hike.

In the meantime, risk-on property, together with Bitcoin, now face short-term downward strain as inflation and dwindling danger urge for food amongst banks present headwinds towards value appreciation.