Amidst the fast evolution of the high-tech and ever-evolving panorama of Bitcoin mining, an intriguing discovery has emerged from one of many trade’s main Bitcoin power researchers.

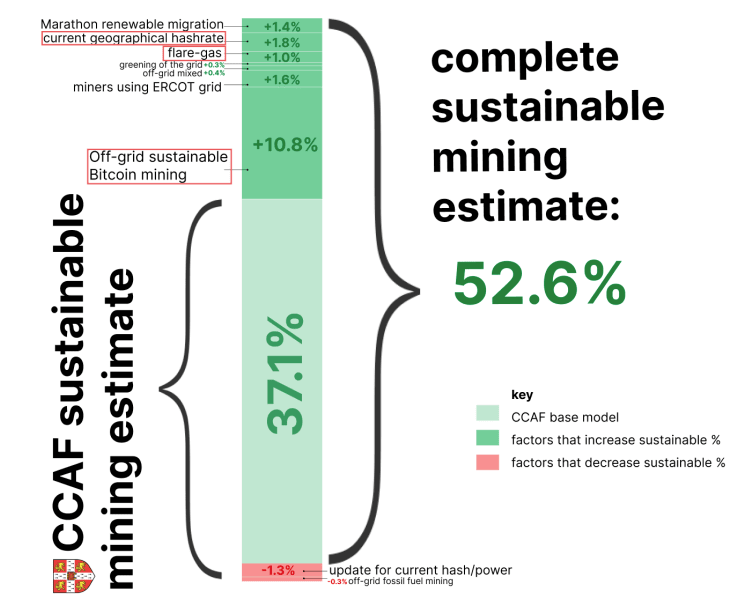

In line with Daniel Batten, creator of the Cambridge Bitcoin Electrical energy Consumption Index (CBECI), three exclusions talked about on its web site have understated Bitcoin’s sustainable power share by 13.6%.

When all is correctly tallied, the creator of the unique examine says, Bitcoin’s power sustainability trickles over the 50% mark, with 52.6% of Bitcoin mining being carried out sustainably.

The analysis carried out by the CBECI was launched to deploy a data-based evaluation of Bitcoin’s electrical energy utilization and, previously, was met with mounting public concern in regards to the situation.

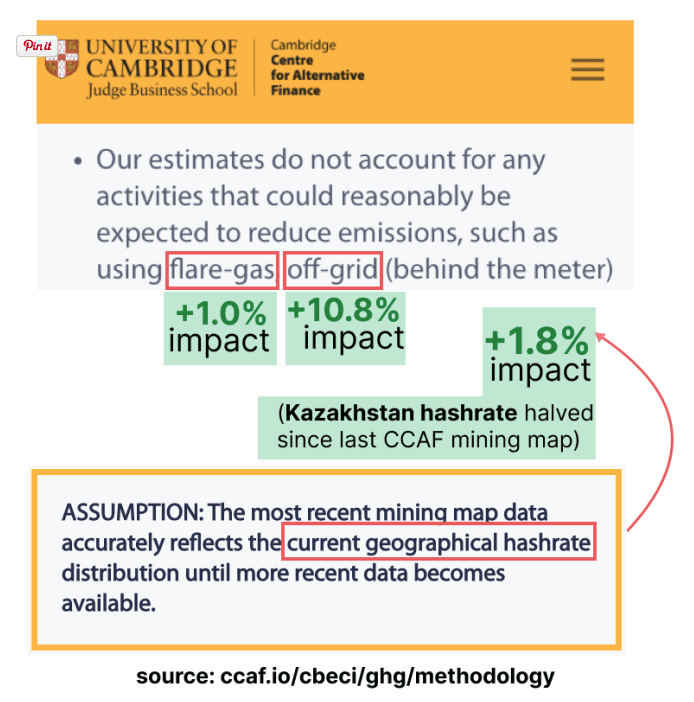

In abstract, the CCAF mannequin didn’t issue within the following:

- Off-grid mining (impression: plus 10.8%)

- Flare-gas mining (impression: plus 1.0%)

- Up to date geographical hash charge (Kazakhstan miner exodus, impression: plus 1.8%)

With all exclusions factored in, the sustainable power combine calculation is 52.6%.

Since 2019, the CCAF’s efforts to broaden the scope of the Index has aimed to offer the foundational components required for a complete understanding of Bitcoin’s impression on the setting.

How can we make certain that the info is correct?

The reply to this query may be simulated utilizing a revised mannequin, in line with researchers.

For Bitcoin’s true sustainable power use to be under 50%, a minimum of one of many following situations must be true:

- 4 giant Bitcoin mining operations secretly run off 100% coal-based power.

- ERCOT (The operator of Texas’s electrical energy grid) has over-reported its true renewable power numbers by an element of 4.

- Regardless of the widely-reported exodus of miners from Kazakhstan, its declare on Bitcoin mining elevated its share of the worldwide hash charge from 13.2% to twenty%.

Researchers say these are primarily based on findings from the unique CCAF findings — which return to 2019 and now have to be revised.

What this implies for sustainable mining

With the emergence of a authentic, data-driven strategy to handle the issues raised by the CCAF examine, Bitcoin advocates could lastly be capable to take away the roadblock inhibiting Bitcoin’s adoption amongst Environmental, Social, and Governance (ESG) buyers.

“For the primary time, Bitcoin advocates have a authentic, data-based method to take away the roadblock that the CCAF examine has for a while created within the minds of ESG buyers.”

The creator argues that this will likely additionally impression policymakers who have a look at the report.

“Previous the primary hurdle, proponents of Bitcoin can ask the following two huge questions that ESG buyers and the White Home have: Is Bitcoin’s macro-trend quantifiably transferring towards sustainable power? And is Bitcoin quantifiably a web optimistic to the setting and society?”

With the Cambridge report’s revised findings into the sustainability of Bitcoin mining, Bitcoin advocates and ESG buyers can argue that unique proof-of-work cryptocurrency is primarily sustainable, probably positioning it as a frontrunner in sustainable power adoption throughout all industries.