- BTC has been exhibiting indicators of exhaustion after its current rally.

- The token’s short-term retracement may very well be seen as bearish.

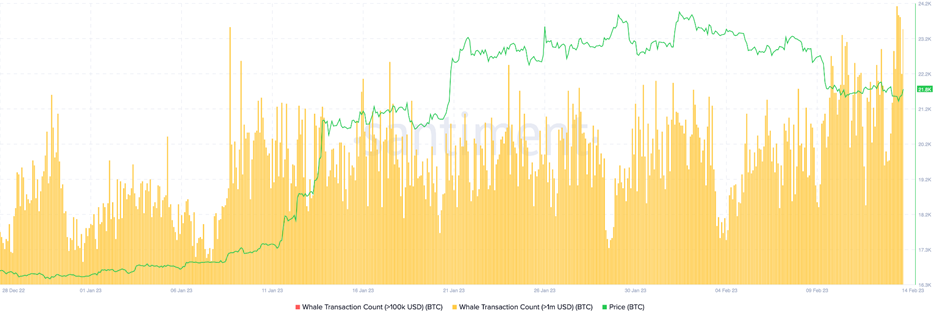

- The Whale Transaction Rely metric signifies a substantial spike regardless of BTC’s value tanking.

The worth of Bitcoin (BTC) has been exhibiting indicators of exhaustion after its quite profitable transfer in 2023. Regardless of this, nonetheless, it looks as if whales have been shopping for the dip.

BTC’s short-term retracement may very well be seen as bearish, however the opinion of the whales differs. The 2023 bull rally was capable of produce the next excessive above the November 5 swing excessive at $21,480, which brought on a shift in market construction on the every day timeframe. This transfer might trigger the beginning of an uptrend, and BTC’s present bearish case might thus be seen as only a retracement.

The whales appear to agree with this idea because the Whale Transaction Rely metric signifies a substantial spike regardless of BTC’s value tanking. If this metric signifies a spike after a sell-off, it might point out that the whales try to purchase the dip, which is perhaps the case for the time being. This huge transaction metric noticed a rise from 150 to 280 during the last 5 days.

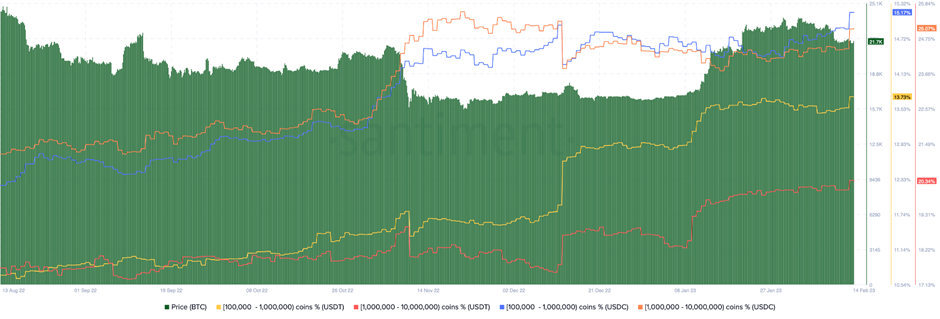

So as to add extra advantage to the whales’ idea is the variety of stablecoins they maintain. The final time whales holding stablecoins spiked was in late December 2022, earlier than BTC kick-started a 49% upswing within the following month.

For the time being, the quantity of Tether (USDT) and Circle (USDC) whales holding between 100,000 to 10,000,000 stablecoins noticed a spike during the last two days. This additionally helps the concept that the whales are shopping for the dip.

BTC is presently buying and selling palms at $21,748.48 after a 0.40% drop in value during the last 24 hours. The crypto king can be nonetheless within the purple by greater than 5% during the last week.

Disclaimer: The views and opinions, in addition to all the data shared on this value evaluation, are printed in good religion. Readers should do their very own analysis and due diligence. Any motion taken by the reader is strictly at their very own danger. Coin Version and its associates won’t be held answerable for any direct or oblique harm or loss.