- Degen Spartan states no new know-how found for everlasting greater returns.

- The Twitter thread got here amid revelations made by analytics agency, Glassnode.

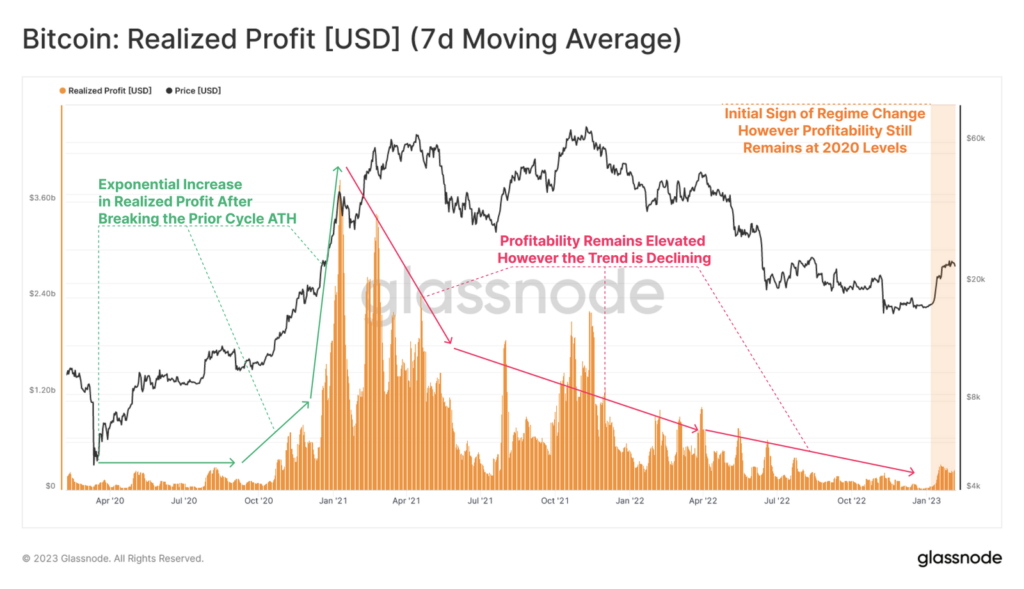

- Glassnode identifies structural adjustments utilizing the ratio of realized income and losses.

Well-liked Crypto Fund Supervisor DegenSpartan tweeted “no new secret know-how for completely greater returns has been found right here but”. Moreover, he defined that the one apparent cycle-to-cycle pattern change was the discount of profitability with subsequent cycles.

Giving extra in-depth perception to those behaviors, DegenSpartan said that the discount of profitability was reciprocated by the bigger market cap and broader participation and “maturing” of the asset.

Notably, Degen Spartan’s statements got here amid current revelations by the on-chain market intelligence platform, Glassnode. In line with Glassnode, a number of on-chain oscillators have reached a degree of equilibrium and are usually trending once more.

Moreover, that is in keeping with findings made throughout earlier bear markets, throughout which a shift within the route of market tides came about. The present consolidation allegedly places the standard BTC holder right into a regime of unrealized revenue, displaying {that a} attainable turning of the macro market tides is imminent.

Notably, utilizing the ratio of realized income to realized losses, Glassnode identifies structural adjustments within the relative dominance of the 2 classes.

It is very important keep in mind that a capitulation in value motion occurred after the Nov 2021 ATH resulting in a regime presided over by losses, in keeping with Glassnode. This regime drove the Realized Revenue/loss Ratio beneath 1, with the extent of the state of affairs turning into extra extreme with every succeeding capitulation in value motion.

Nonetheless, in keeping with specialists, the neighborhood has seen the primary prolonged interval of profitability for the reason that exit liquidity occasion in April 2022, which is a robust indicator of the start phases of a shift within the profitability regime.