- Ethereum is at the moment holding under an necessary resistance degree.

- Solana and Polkadot await a bullish breakout.

- Arbitrum’s worth has dropped from an important degree.

The altcoin market is exhibiting indicators of progress and bouncing again, with sure developments pointing to the potential of a rally.

Whereas the broader market, together with altcoins like Dogecoin and XRP, is gaining momentum, it’s not but clear when an enormous altseason will happen. Traditionally, February has been a robust month for crypto, particularly for Ethereum, and this yr could comply with the identical sample.

Analyst Miles Deutscher has listed prime altcoins for the February:

Ethereum (ETH)

The analyst mentioned that Ethereum stays a foundational asset for a lot of portfolios. Even with its volatility, its massive ecosystem, sensible contract capabilities, and robust developer group make it vital for long-term publicity to the crypto area.

Ethereum is at the moment buying and selling under an necessary resistance of $3,350 and is down 4% within the final week. The value chart reveals some attention-grabbing worth motion and it stays to be seen if ETH will quickly rise above $3400.

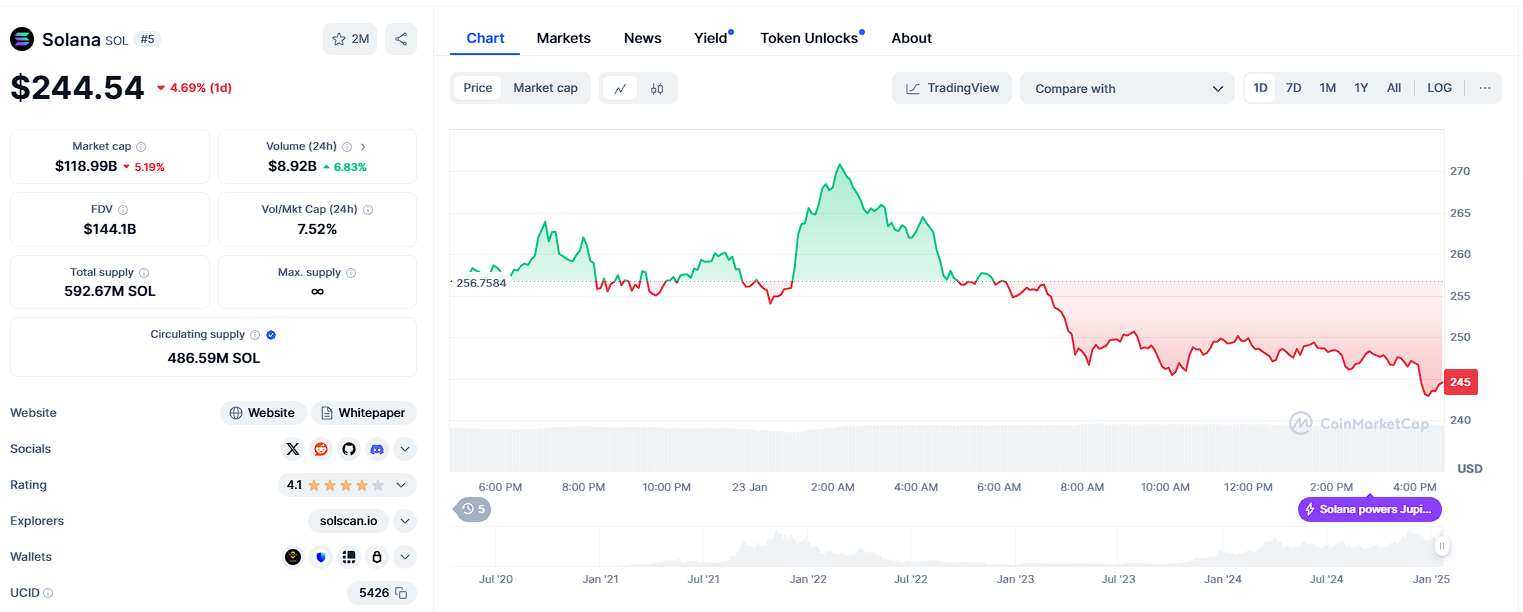

Solana (SOL)

Solana has emerged as a quick and scalable various to Ethereum, providing low transaction charges and a quickly rising ecosystem.

Whereas it has confronted challenges like community downtimes, its technological enhancements and rising adoption make it a robust candidate for long-term progress.

Solana is up over 22% within the final seven days. The coin is now seeking to break via $294 and hit new all-time highs.

Polkadot (DOT)

Polkadot’s interoperability-focused strategy units it aside within the blockchain area, in keeping with the analyst. Its tech-heavy basis offers it numerous potential within the medium to long run.

Whereas Polkadot has dropped by over 9% prior to now week, it’s anticipated to expertise a robust bullish breakout, with a goal of $11.65, the best level reached on December 4.

Chainlink (LINK)

Chainlink leads the way in which in decentralized oracle options, offering real-world information to blockchains to be used in sensible contracts. Because the bridge between off-chain and on-chain information, it’s a robust long-term play.

Chainlink’s worth surged by 50% after January fifteenth, reaching as excessive as $27.14 earlier than encountering resistance. The $32 degree is now an necessary space to look at for LINK.

Avalanche (AVAX)

Avalanche is one other high-speed blockchain that competes with Ethereum and Solana. With a rising ecosystem and robust developer help, AVAX is one to look at for medium-term progress.

Avalanche’s worth has fallen under the $48 resistance, exhibiting indicators of bearish strain, and is down 8% this week. A transfer above $40 is being intently monitored

Arbitrum (ARB)

As a layer-2 scaling answer for Ethereum, Arbitrum helps alleviate congestion on the Ethereum community by offering sooner and cheaper transactions. With Ethereum’s excessive fuel charges, Arbitrum stands out as a sensible answer.

Arbitrum’s worth dropped from $0.82 over the weekend to $0.67 on Monday, exhibiting bearish motion. If it strikes up, the following resistance to look at is $0.78.

Disclaimer: The knowledge offered on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any type. Coin Version will not be answerable for any losses incurred because of the utilization of content material, merchandise, or companies talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.