The crypto market has recorded its highest weekly influx this 12 months, reaching a powerful $2.2 billion.

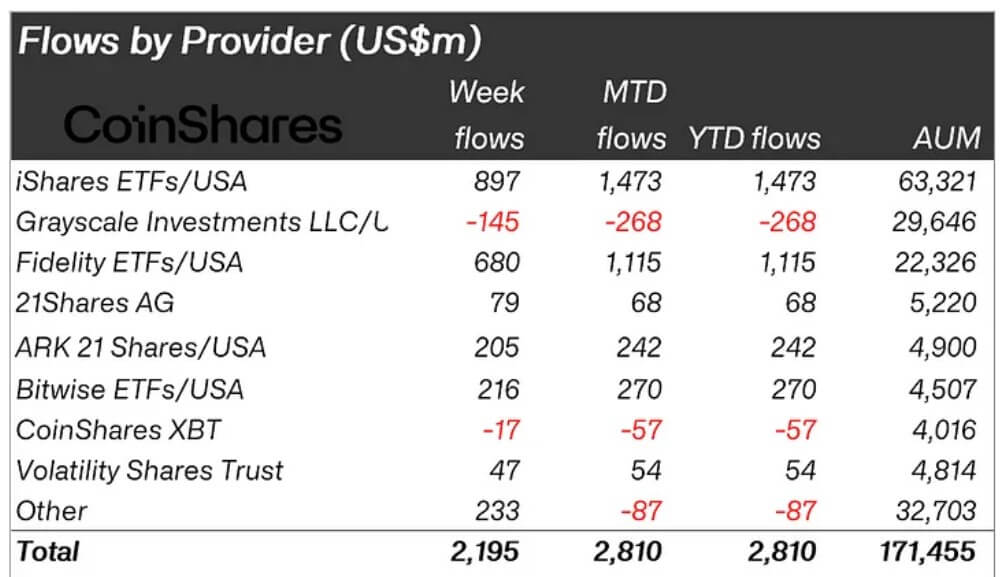

In response to the most recent CoinShares report, this inflow of capital was fueled by rising pleasure round Donald Trump’s Jan. 20 inauguration. The agency famous that the surge pushed complete year-to-date inflows to $2.8 billion.

This inflow has additionally pushed property beneath administration (AUM) to a file excessive of $171 billion. The surge coincided with Bitcoin’s spectacular efficiency, with the flagship crypto climbing almost 20% over the previous week to hit an all-time excessive close to the $110,000 mark.

In the meantime, the market additionally skilled a corresponding spike in exchange-traded product (ETP) buying and selling volumes, which reached $21 billion final week.

James Butterfill, CoinShares head of analysis, identified that this quantity accounted for 34% of Bitcoin’s buying and selling exercise on main exchanges. This strong quantity highlights rising institutional curiosity and the growing mainstream adoption of crypto.

Bitcoin and XRP shine

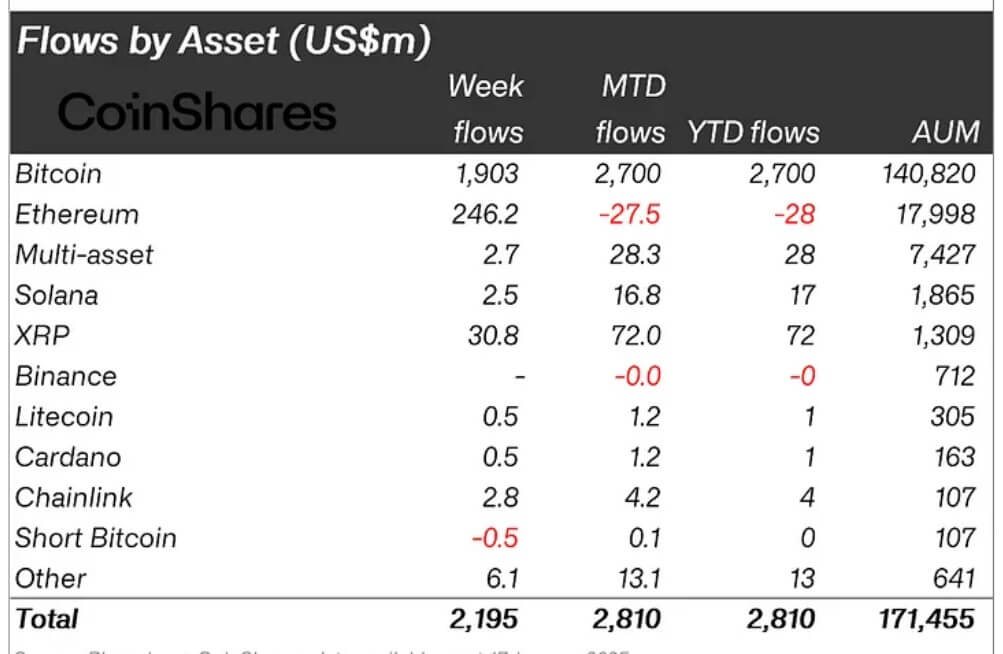

Bitcoin continued its dominance, securing $1.9 billion in inflows final week and bringing its complete for the 12 months to $2.7 billion.

The report highlighted that spot Bitcoin ETFs, supplied by key gamers like BlackRock, Constancy, Ark Make investments, and Bitwise, collectively attracted over $2.1 billion in inflows. The inflows are seen as a constructive response to market optimism about supportive regulatory insurance policies anticipated beneath the incoming administration.

Curiously, short-Bitcoin merchandise registered modest inflows of $500,000, a shocking deviation from typical bearish conduct throughout bullish traits.

In the meantime, Ethereum drew $246 million in inflows, marking a reversal of its earlier outflows this 12 months. Nevertheless, the second-largest crypto continues to underperform compared to its friends.

Butterfill famous that Ethereum stays the weakest performer this 12 months from an influx perspective regardless of considerably outpacing Solana, which introduced in $2.5 million final week.

However, XRP has confirmed to be a standout performer, attracting $31 million in inflows final week. Since mid-November 2024, XRP’s complete inflows have reached a powerful $484 million, underscoring its rising enchantment to buyers.

Stellar adopted with smaller inflows of $2.1 million, whereas different altcoins confirmed little exercise in the course of the interval.