- TTX targets $0.30 as Justin Solar’s daring declare sparks comparisons with XRP’s current 400% surge.

- TRX exhibits bullish patterns with technical indicators signaling a potential breakout above $0.225.

- XRP evokes TRX’s momentum as parallels emerge in market developments and investor sentiment.

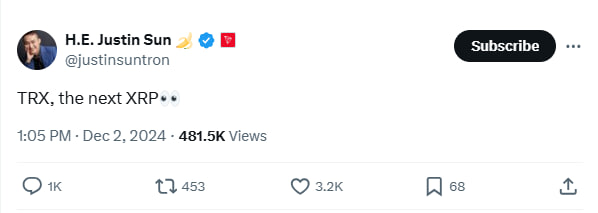

Justin Solar, founding father of TRON, hinted at a vibrant future for TRX, evaluating it to XRP’s market efficiency. His assertion, “TRX, the subsequent XRP,” grew to become a trending matter amongst crypto buyers on X.

Supporters marked this off as a constructive long-term prediction. Skeptics, nevertheless, really feel it could be a transfer to spice up TRX’s visibility. X person PC PR1NCIPAL argued that TRX lacks the shopping for conviction for sustained rallies.

The person identified the absence of a serious investor with sufficient liquidity to execute constant high-volume trades. This comes as XRP experiences renewed curiosity, pushed by authorized victories and rising adoption in cross-border funds.

Parallels Between XRP and TRX Market Developments

TradingView information exhibits XRP, presently buying and selling at $2.55, has surged over 400% up to now month, marking a decisive upward momentum just like its 2017-2018 bull run. Following this surge, the cryptocurrency broke above its 2021 excessive of $1.96 and is now eyeing its all-time excessive of $3.84 because the bull market continues.

This resurgence follows years of consolidation pushed by the prolonged Ripple-SEC lawsuit, which capped its value trajectory till now. In the meantime, TRX, buying and selling at $0.209, has proven regular progress over time, surpassing its 2021 excessive of $0.184.

These technical breakout patterns align with Solar’s optimistic outlook, indicating that TRX could mirror XRP’s progress trajectory. TRX is now setting its sights on its all-time excessive of $0.30, a milestone that might validate its long-term bullish risk.

TRX Market Technical Evaluation

A more in-depth take a look at TRX’s every day chart reveals a pennant flag sample, usually signalling a continuation of a bullish development. TRX is now consolidating above the 50% Fibonacci degree at $0.205, a key assist zone. This degree aligns with a consolidation section following a powerful rally earlier within the month.

Technically, the Relative Power Index at 65.67 signifies bullish momentum, though it’s approaching overbought territory. This implies that whereas shopping for stress stays potent, merchants ought to stay cautious of possible short-term pullbacks or profit-taking.

The Directional Motion Index reinforces the bullish narrative, with the +DI line at 27.8762 positioned above the -DI line at 10.5865, indicating patrons dominate the market. Furthermore, the Common Directional Index at 47 underscores the present development’s power, suggesting a breakout might be imminent.

Key Ranges to Look ahead to TRX

TRX could attain $0.225 within the coming days. Nonetheless, for this state of affairs to unfold, it should shut the day above $0.217, which coincides with the 78.6% Fibonacci retracement degree.

Conversely, a breakdown under the 38.2% Fib at $0.201 might expose the coin to retesting decrease assist areas, together with $0.195 on the 23.6% Fib. A breach under this zone would possibly invalidate the uptrend setup, driving the token towards $0.185 and threatening to derail its bull run.

Disclaimer: The knowledge offered on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any form. Coin Version shouldn’t be liable for any losses incurred on account of the utilization of content material, merchandise, or companies talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.