Bitcoin’s perpetual futures funding charge represents the price merchants incur to keep up lengthy or quick positions within the perpetual swaps market, with charges shifting between consumers and sellers primarily based on market situations.

Constructive funding charges recommend that lengthy positions dominate, reflecting bullish sentiment, whereas destructive charges point out bearish sentiment as quick positions dominate.

Adjustments in funding charges present perception into dealer positioning and market threat. Spikes in funding charges typically precede corrections, signaling heightened hypothesis and overleveraging. Conversely, destructive or impartial funding charges throughout consolidations can sign potential entry factors for strategic traders.

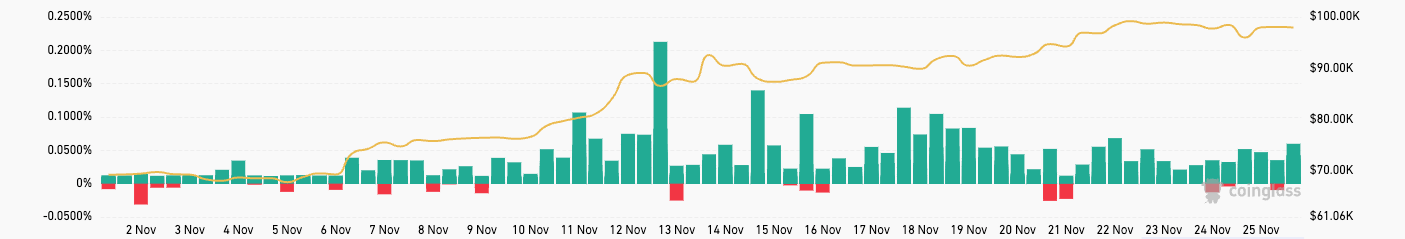

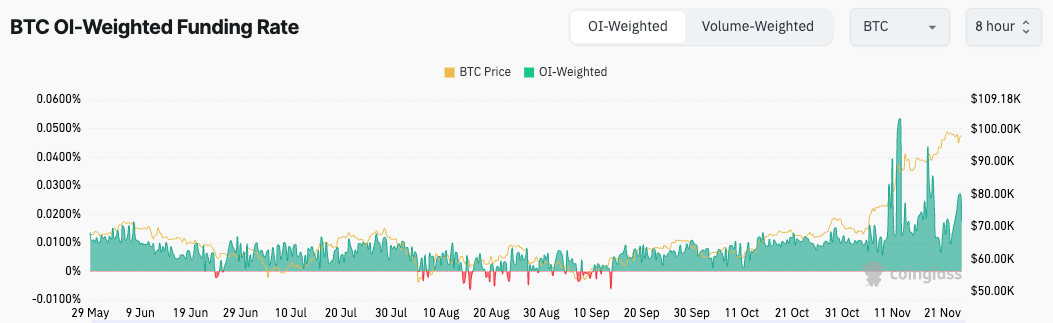

Bitcoin’s present funding charge tracks the robust rally we’ve seen in November. For the reason that starting of the month, each volume-weighted and open curiosity (OI)-weighted funding charges have remained constantly constructive, reaching the best ranges in over a yr. This sustained positivity reveals the dominance of lengthy positions, with merchants paying a premium to keep up these positions.

The market sentiment has been decisively bullish, as evidenced by merchants’ willingness to incur increased funding prices in anticipation of continued worth will increase. The heightened funding charges present that leveraged lengthy positions have contributed to the rally.

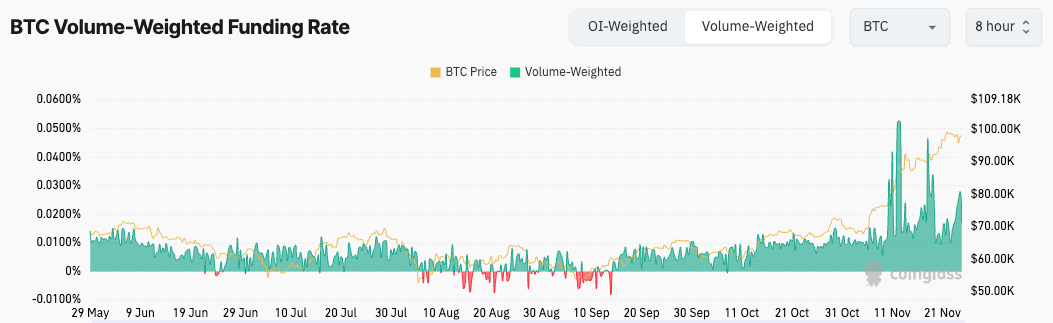

The quantity-weighted funding charge confirmed better volatility than the OI-weighted charge, suggesting that buying and selling volumes had a pronounced affect throughout these fast worth will increase. This volatility displays speculative exercise, with merchants aggressively opening positions to capitalize on Bitcoin’s momentum.

Nevertheless, earlier within the yr, the state of affairs was markedly totally different. From late June to mid-September, the market noticed a number of situations of destructive funding charges, notably within the volume-weighted metric. This mirrored bearish sentiment as Bitcoin’s worth struggled to interrupt out of a range-bound section.

Throughout these months, merchants closely favored quick positions, a cautious outlook that aligned with subdued worth motion. The shift to constantly constructive funding charges in late Q3 marked a turning level, signaling a broader transition to bullish sentiment as Bitcoin’s worth recovered.

The quantity-weighted funding charge demonstrated better sensitivity to market hypothesis than the OI-weighted charge. This distinction grew to become notably obvious throughout high-activity durations. Whereas the OI-weighted metric, being smoother, displays broader market leverage developments, the volume-weighted charge captures short-term fluctuations pushed by speculative merchants.

The rise in each metrics from late September via October revealed a gradual build-up of bullish sentiment. This development means that Bitcoin’s rally was not purely pushed by spot market exercise but in addition by the rising affect of leverage in derivatives markets. The alignment of constructive funding charges with sustained worth good points highlights the position of leveraged merchants in reinforcing bullish developments.

Regardless of this bullish momentum, the persistently excessive funding charges in November raises issues about market overheating. When funding charges stay elevated for prolonged durations, it typically alerts extreme leverage, making a fragile market atmosphere. Overleveraging heightens the chance of cascading liquidations if costs immediately reverse. Durations of excessive funding charges typically precede sharp corrections as overextended merchants are pressured to exit positions.

Conversely, the destructive funding charges noticed in July and September offered contrarian purchase alerts. Throughout these durations, extreme bearish sentiment set the stage for worth rebounds, highlighting the worth of funding charges as a predictive instrument.

The submit Sky-high Bitcoin funding charges present a leveraged but bullish market appeared first on StarCrypto.