- Goldman Sachs ranked BTC above US Treasury, Gold, and 22 different belongings.

- CoinGecko believes Bitcoin was the worst-performing funding in 2022.

- Litecoin outperformed DeFi tokens with a landslide margin of 79% development from 2022.

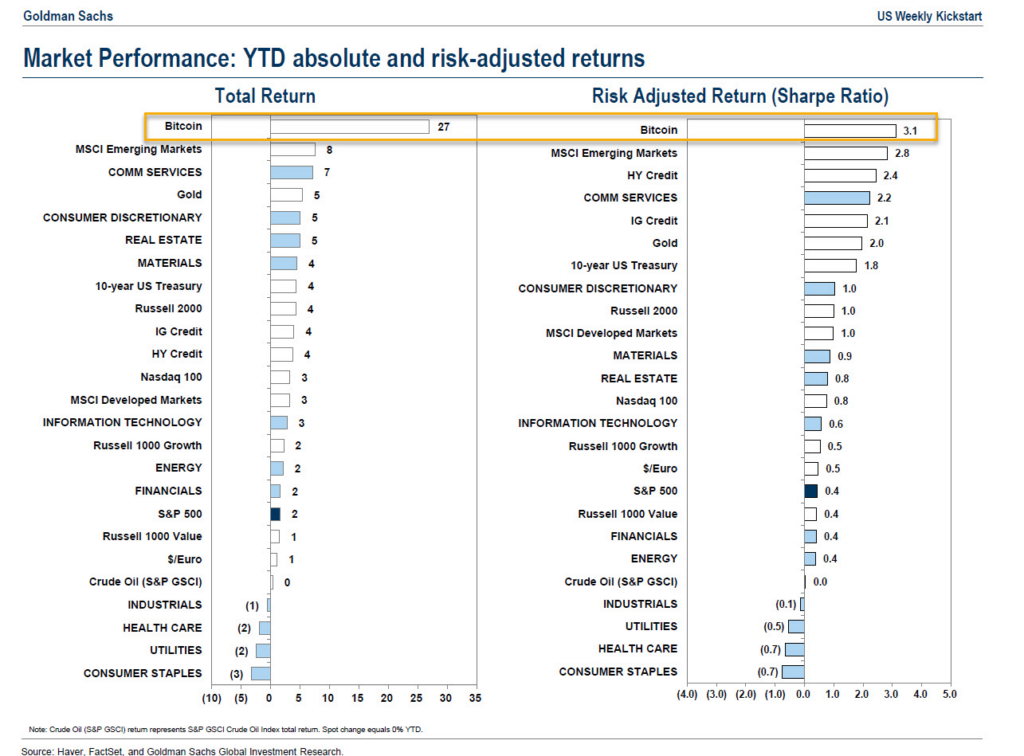

Based on the year-to-date asset return of Goldman Sachs, probably the most distinguished monetary establishments in the US, Bitcoin (BTC) was the best-performing asset on the earth.

Goldman Sachs ranked Bitcoin above gold, actual property, 10-year US Treasury, power, Nasdaq 100, and twenty different funding devices. Notably, Goldman Sachs added Bitcoin to its rating of belongings barely two years in the past.

Curiously, the market monitoring platform, CoinGecko, believes Bitcoin was the worst-performing funding within the 2022 calendar 12 months. In its current annual crypto trade report revealed final week, CoinGecko highlighted important belongings which carried out poorly throughout the board, besides Crude Oil and the US Greenback. Nonetheless, BTC carried out worst with a 64.2% drop.

Lately, Tom Dunleavy, a researcher at Messari, an information analytic agency, highlighted that the Litecoin token LTC outperformed BTC and its closest rival, Ethereum (ETH), over the previous three months and one-year timeframes.

Dunleavy shared a chart illustrating that LTC buyers noticed over 31.% and 23.2% return on funding (ROI) greater than BTC and ETH buyers, respectively, from January 2022. Beneath the three-month window, the figures had been greater than double the one-year worth. Litecoin additionally outperformed DeFi tokens with a landslide margin of 73% development from 2022.

Nonetheless, Bitcoin traded at $48,086.84, 52 weeks in the past, and its lowest value throughout the identical interval was $15,599. Over the past 30 days, BTC has grown by over 27%, as per CoinMarketCap. It at present trades at $22,918.78, with a market share of over $441 billion.