- Stablecoins are growing demand for U.S. Treasuries, with $120 billion in collateral invested.

- Blockchain initiatives, like JPMorgan’s Onyx Platform, are revolutionizing Treasury operations and post-trade processes.

- Most central banks are exploring CBDCs to handle rising challenges within the digital asset panorama.

Digital property, notably stablecoins and blockchain initiatives, are reshaping the monetary panorama. A report from the U.S. Division of Treasury exhibits that digital currencies are driving demand for U.S. Treasuries as buyers and establishments discover blockchain’s potential to reinforce the effectivity of economic transactions.

Stablecoins Improve Treasury Demand

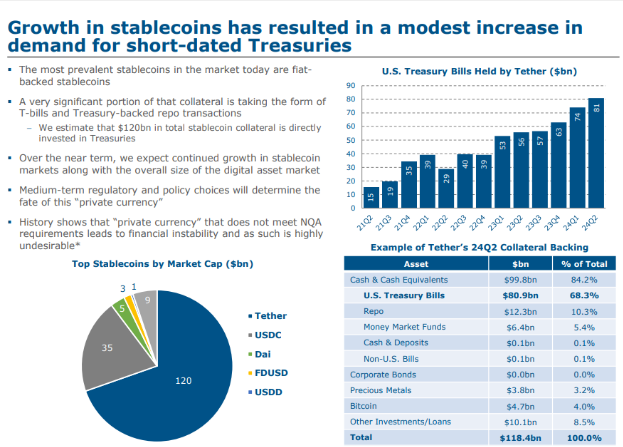

Stablecoins, digital currencies pegged to fiat property, play an important function in boosting Treasury demand. An estimated $120 billion in stablecoin collateral is invested in Treasuries. Tether, the most important stablecoin by market capitalization, allocates 68.3% of its $118.4 billion reserves to Treasury payments.

Different main stablecoins, reminiscent of USDC, additionally enhance this demand. Stablecoins act as collateral in decentralized finance (DeFi) markets and supply liquidity in digital transactions. Over 80% of crypto transactions use stablecoins as one leg of the transaction.

Fiat-backed stablecoins have been widespread due to their potential to keep up a steady worth, making them appropriate collateral in monetary markets. This integration of stablecoins into the Treasury market highlights their important function within the digital asset ecosystem. Furthermore, stablecoins are engaging in DeFi markets due to their cash-like traits, which makes them interesting for lending and borrowing.

Blockchain Initiatives Modernize Treasury Operations

As well as, each personal and public initiatives are selling the combination of blockchain into Treasury operations. The SIFMA Multi-Asset Ledger Settlement Pilot and the DTCC’s Digital Asset Treasury Tokenization Challenge intention to enhance post-trade processes utilizing shared, immutable ledgers.

As an illustration, JPMorgan’s Onyx Platform, which launched in 2020, now permits real-time repo transactions via tokenized Treasuries, serving to establishments to handle collateral extra effectively.

Within the public sector, initiatives like Challenge Cedar—a collaboration between the New York Federal Reserve and the Financial Authority of Singapore—are utilizing distributed ledger know-how (DLT) to enhance cross-border funds.

The European Funding Financial institution additionally made information final yr by issuing £50 billion in digital bonds on a non-public blockchain. These initiatives spotlight the rising curiosity in blockchain’s potential to modernize monetary infrastructure.

Shifting ahead, regulatory choices might be key in shaping the function and oversight of digital property. A 2021 BIS survey confirmed that 86% of central banks are actively researching the creation and implementation of Central Financial institution Digital Currencies (CBDCs) to handle these rising challenges.

Disclaimer: The data offered on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any type. Coin Version is just not accountable for any losses incurred because of the utilization of content material, merchandise, or providers talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.