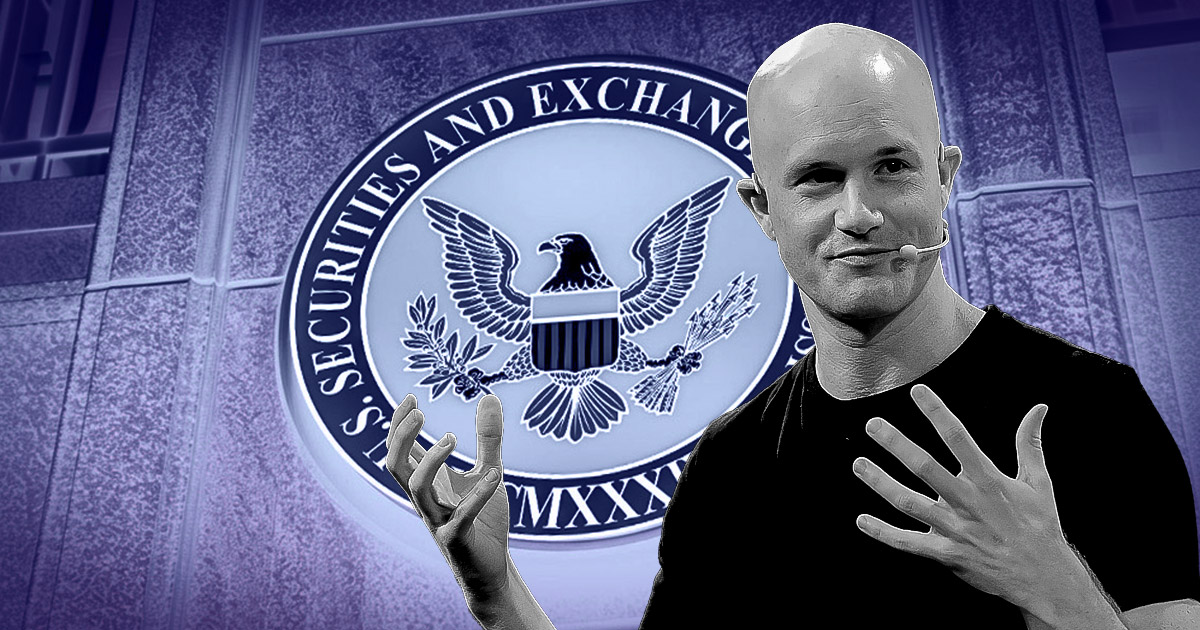

Coinbase CEO Brian Armstrong has referred to as on the subsequent Chair of the US Securities and Change Fee (SEC) to dismiss the company’s “frivolous” instances towards crypto companies and publicly apologize to the American folks.

In an Oct. 29 put up on X, Armstrong highlighted inconsistencies within the SEC’s strategy to the crypto sector, which he argues have resulted in pointless lawsuits towards corporations corresponding to Coinbase. He acknowledged that whereas an apology could not reverse the injury, it may very well be a step towards rebuilding public belief within the SEC.

He acknowledged:

“It could not undue the injury executed to the nation, however it could begin the method of restoring belief within the SEC as an establishment.”

Conflicting SEC place

Underneath Gary Gensler‘s management, the SEC has issued conflicting statements on important points, together with whether or not digital property qualify as securities and the company’s regulatory authority over digital asset exchanges.

Armstrong identified that in 2018, the SEC acknowledged digital property weren’t securities, solely to contradict itself in 2021 by classifying them as funding contracts. By 2024, the company had once more shifted its place, stating that digital property are “not securities.”

The SEC has additionally flip-flopped on Bitcoin’s standing. Initially deemed a non-security in 2023, the SEC indicated uncertainty, ultimately reaffirming its non-security classification in 2024.

Armstrong raised additional issues concerning the SEC’s authority over crypto exchanges. In 2021, the SEC claimed no regulatory physique existed for these exchanges. A yr later, nonetheless, it asserted that it held Congressional authority to supervise digital asset exchanges.

The SEC’s stance on securities legislation readability has additionally been inconsistent. Though it beforehand claimed uncertainty about digital property as securities, the company argued in 2023 that its regulatory framework, established over the previous 90 years, was clear.

These conflicting positions have led to industry-wide confusion and amplified requires regulatory transparency. Many within the crypto house have advocated for SEC Chair Gensler’s elimination, a transfer Republican presidential candidate Donald Trump has pledged to pursue if elected.