Runes launched on April 20, the day of Bitcoin’s fourth halving. Fueled by the hype surrounding the much-anticipated halving, they had been launched to the market with a bang, garnering an unbelievable quantity of consideration and exercise.

Their launch precipitated fairly a stir within the crypto trade, particularly within the Bitcoin market, the place it sparked a fierce debate on Bitcoin’s future and utility, not in contrast to the one we noticed with the launch of Bitcoin Ordinals.

It’s now been a month since Runes launched — a protracted sufficient interval that allows us to get a strong understanding of how they affected the market and permits us to make some predictions about their future.

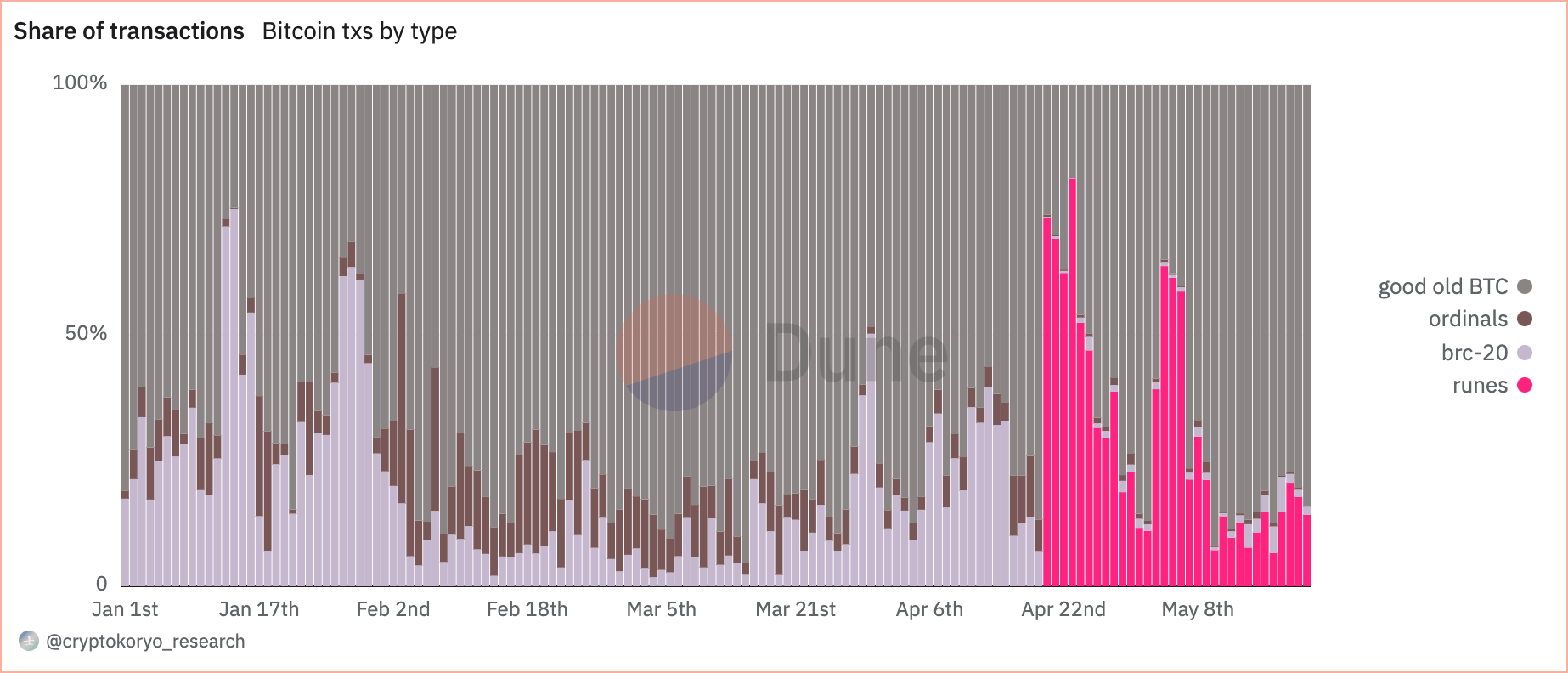

StarCrypto’s preliminary evaluation confirmed that Runes’s preliminary influence available on the market was substantial. On the day of the halving, Runes transactions made up 57.7% of all Bitcoin transactions that day, in comparison with simply 0.5% for Ordinals and 0.2% for BRC-20 tokens.

Whereas this sudden dominance mirrored the huge curiosity in Runes, it was evident that such a pointy spike within the share of transactions was unsustainable in the long term.

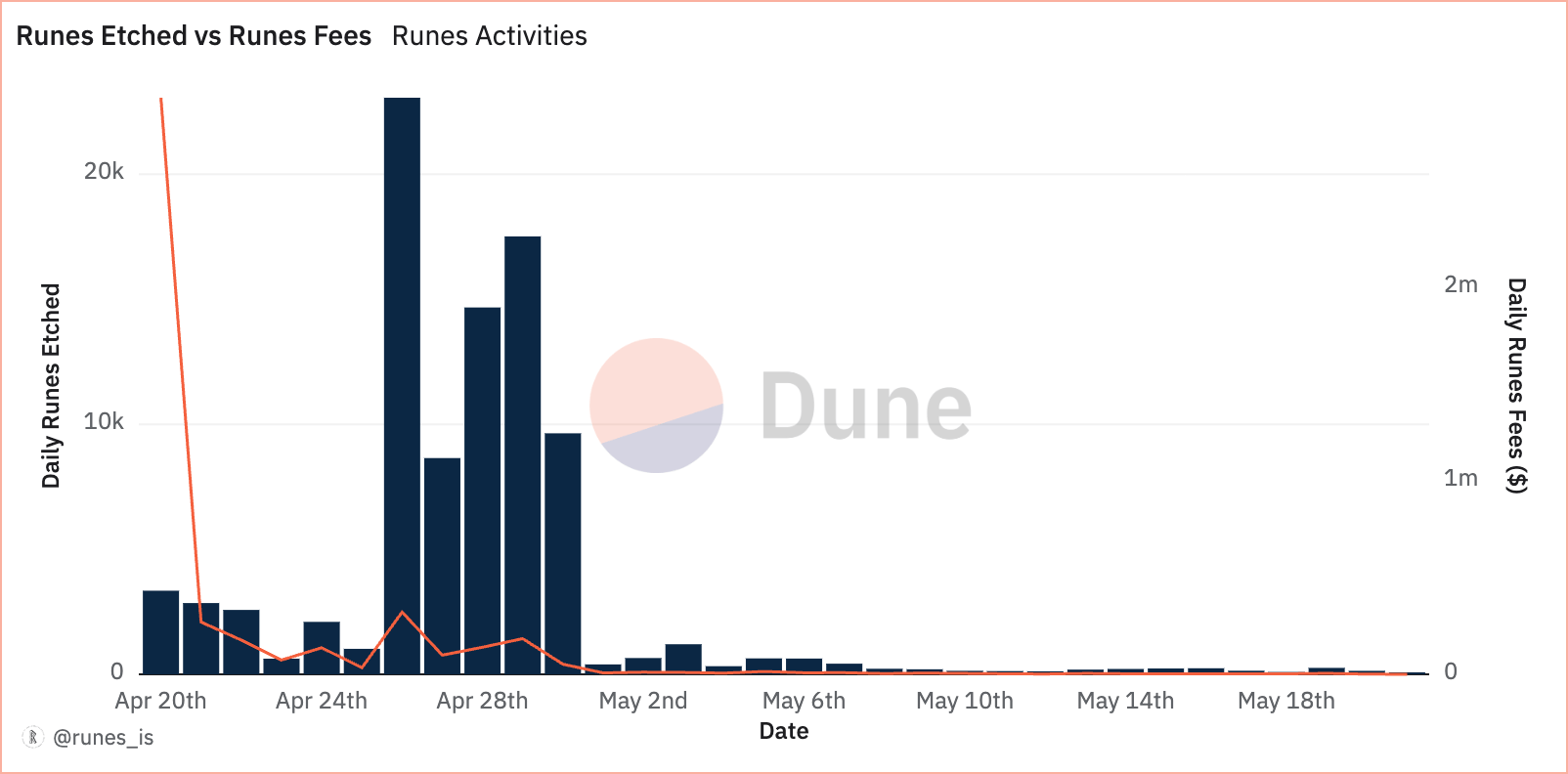

Every day knowledge from Dune Analytics confirmed a fluctuating sample in Runes exercise within the days following the launch. On April 20, 3,344 Runes had been etched, producing $2.997 million in charges. This excessive exercise stage was short-lived, with a pointy decline noticed within the following days.

By April 23, solely 625 Runes had been etched, with charges dropping to $73,793. The height occurred on April 26, with 23,061 Runes etched, however this momentum didn’t maintain, with figures dropping to 139 Runes by Could 20.

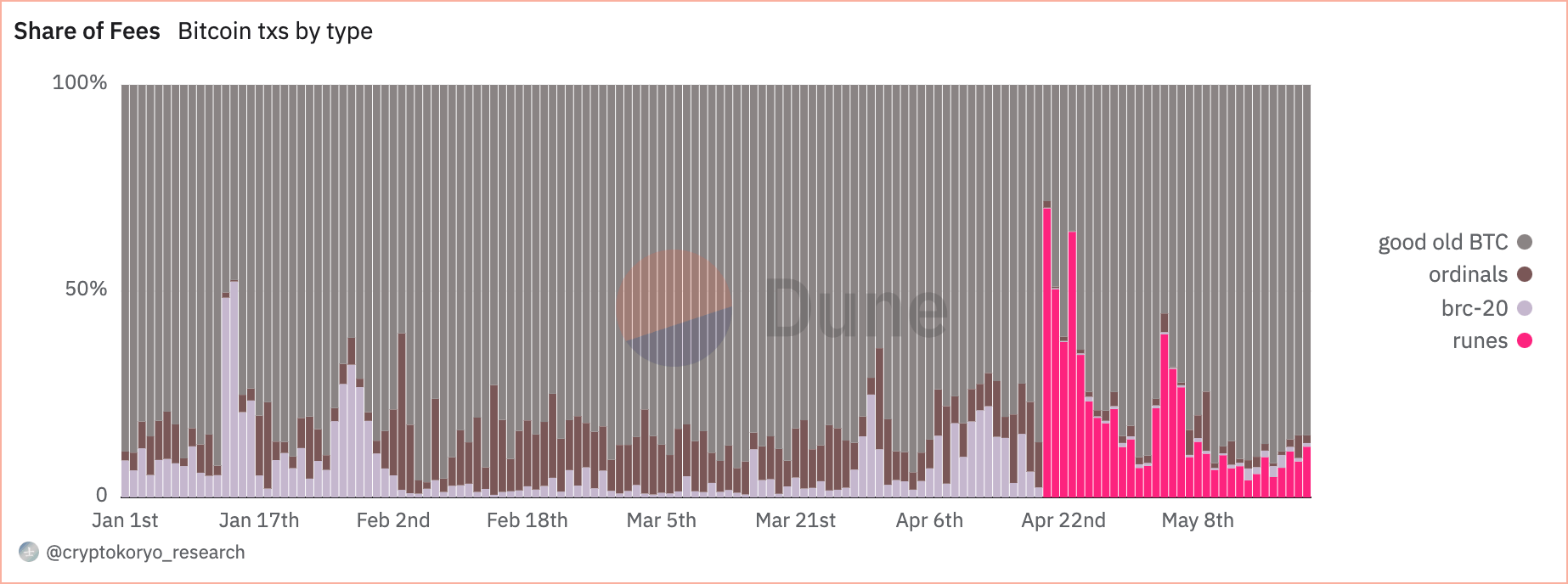

The share of Runes in whole Bitcoin charges was additionally unsustainable. On April 20, they accounted for 70.1% of charges. These figures fluctuated considerably over the month, with transaction shares reaching 81.3% on April 23 and charges hitting 64.4%. By Could 20, Runes transactions constituted 17.8% of the whole, and charges dropped to eight.7%.

Regardless of the drastic decline in recognition and utilization, Runes nonetheless managed to depart fairly a mark within the Bitcoin market. Of their first 30 days, a complete of 92,713 Runes had been created by 7.150 million transactions, with mint transactions accounting for 3.861 million of those.

All of this exercise generated a major quantity of transaction charges, totaling 2,299 BTC, with 1,282 BTC derived from mint transactions alone.

The info means that Runes are settling right into a extra secure, albeit much less dominant, position inside the Bitcoin ecosystem. This sample mirrors that of Ordinals, which confronted related preliminary enthusiasm that was adopted by stabilization.

As Runes turn out to be a extra everlasting fixture within the Bitcoin market, their affect on charges and transactions is anticipated to scale back considerably. Even only a month after their launch, the preliminary surge of exercise and charges has tapered off, resulting in a extra secure and predictable integration into the Bitcoin transaction panorama. Whereas we are able to count on a short-lived spike in exercise throughout well-liked mints, this stability is prone to proceed within the coming months.

The publish 30 days of Runes: Curiosity fizzles after spectacular launch appeared first on StarCrypto.