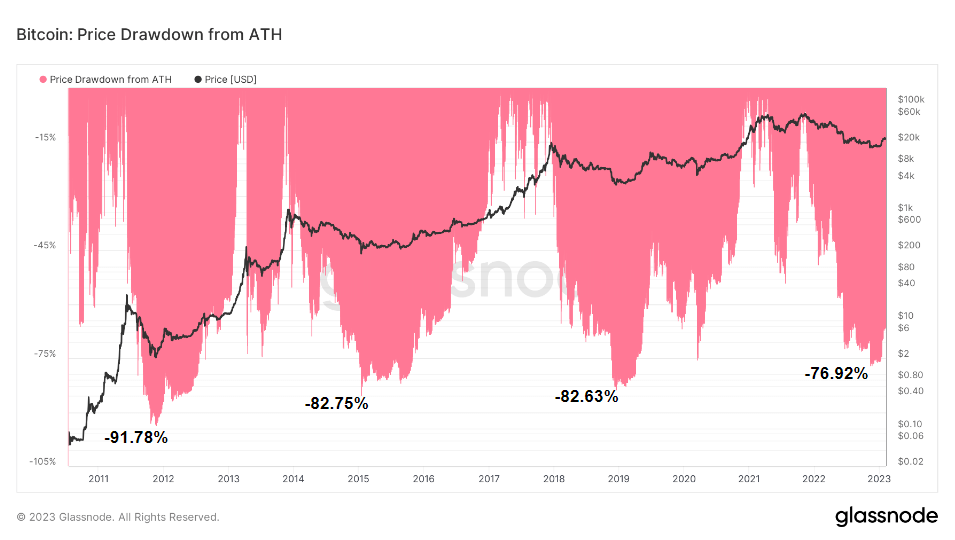

Analyzing Bitcoin’s market cap reveals that the 2022 bear market introduced the fourth worse drawdown from the all-time excessive in its historical past. Bitcoin’s drop to $15,500 represents a 76.92% drawdown from its ATH.

Market capitalization is likely one of the most generally used metrics when estimating the dimensions and worth of an asset. Outlined because the mixed worth of all items of an asset, market capitalization is calculated by multiplying the value by the circulating provide.

Relating to Bitcoin, market capitalization and its fluctuation is commonly used to find out the energy and adoption of the community. It’s additionally particularly helpful when evaluating Bitcoin to different property and markets.

Probably the most vital worth drawdown from ATH occurred on the finish of 2011 when an aggressive bear market worn out 91.78% of Bitcoin’s market cap. Crypto winters in 2015 and 2018/2019 noticed drawdowns of 82.75% and 82.63%, respectively.

That is according to StarCrypto’s earlier evaluation, which discovered that every market cycle posted greater lows.

Nonetheless, market capitalization fails to characterize the precise state of the community. On account of a lot of misplaced and inactive cash, market capitalization is commonly greater than the realized worth of the community.

That is the place realized cap is available in, because it reveals the worth of the Bitcoin community primarily based on lively cash.

Not like market cap, which values cash primarily based on their present worth, realized cap values every UTXO primarily based on the value at which it final moved. This strategy is a a lot better proxy for the worth saved in Bitcoin and can be utilized as an estimate of the mixture value foundation of the community.

Realized cap drastically reduces dormant and misplaced cash’ impression on the community. These cash are seen as having low financial worth, as they had been final moved at a worth a lot decrease than its realized worth that they’ve little impression on it. Nonetheless, if these cash had been moved after being dormant for years, their impression on the realized worth can be correspondingly vital.

The magnitude of change in realized cap reveals the distinction in worth between the value at which a coin was final spent and the value at which it beforehand moved.

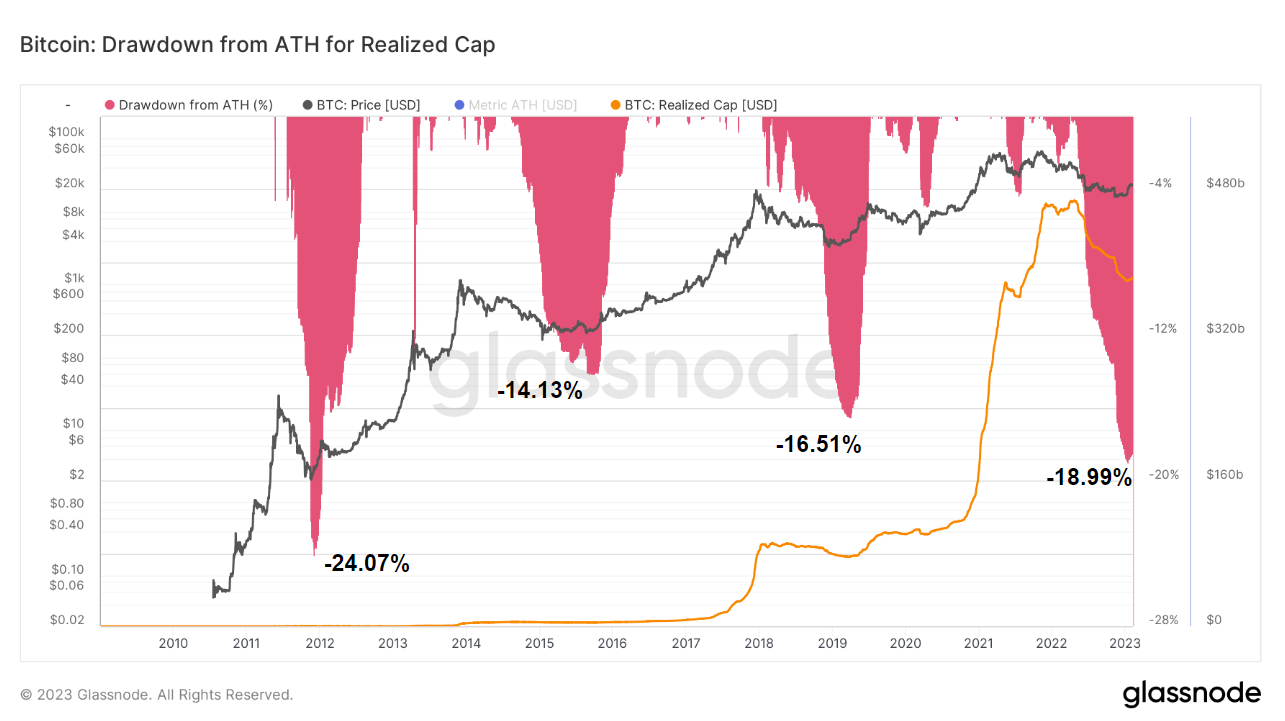

Bitcoin’s worth via the realized cap reveals that the 2022 drawdown was the second worse in its historical past. In November 2022, Bitcoin noticed its realized cap drop by 18.8% from the all-time excessive recorded in November 2021.

Graph exhibiting Bitcoin’s realized worth drawdown from ATH from 2011 to 2023 (Supply: Glassnode)

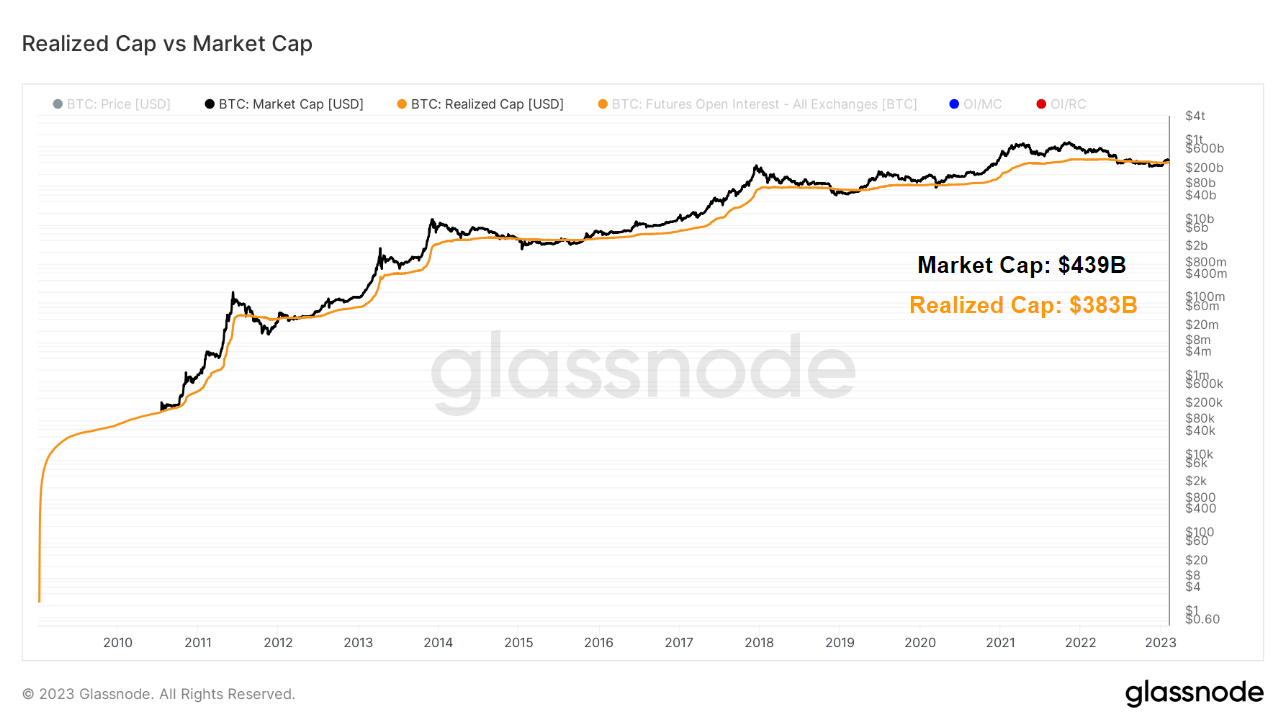

The continuing bear market put Bitcoin’s realized cap at $383 billion. That is $56 billion decrease than Bitcoin’s present market cap, which stands at $439 billion.

Evaluating Bitcoin’s market cap to its realized cap is believed to be a superb indicator of market phases. Particularly, when the market cap is greater than the realized cap, the market is in combination revenue.

Put merely, the realized cap reveals the worth at which the cash had been purchased, whereas the market cap reveals the worth at which they are often offered.

Conversely, when the realized cap is greater than the market cap, the market is in combination loss, as the worth at which most cash had been purchased is greater than the worth at which they are often offered.

Information analyzed by StarCrypto confirmed that the market is at present in combination revenue. And whereas that revenue isn’t as excessive because the crypto market is used to, it signifies a gradual and regular restoration from the second-worst worth downturn in Bitcoin’s historical past.